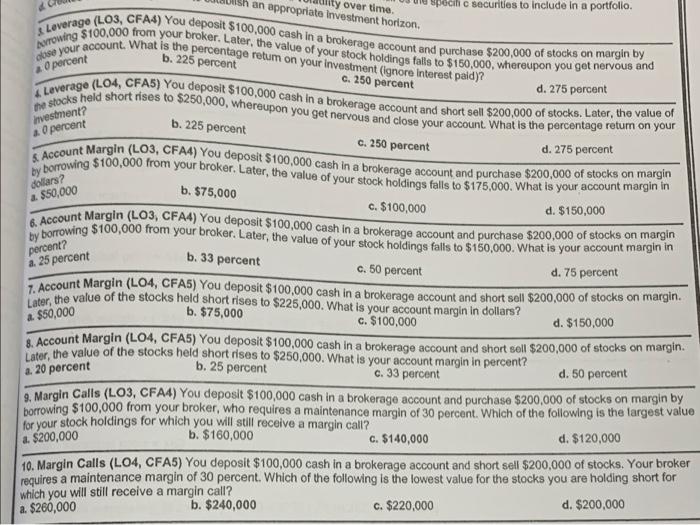

ty over time. an appropriate Investment horizon. b. 225 percent 40 percent C. 250 percent investment? 10 percent b. 225 percent C. 250 percent dollars? $50,000 b. $75,000 Specific securities to include in a portfolio Avrowing $100,000 from your broker. Later, the value of your stock holdings falls to $150,000, whereupon you get nervous and Loverage (LO3, CFA4) You deposit $100,000 cash in a brokerage account and purchase $200,000 of stocks on margin by abse your account. What is the percentage retum on your investment (ignore interest paid)? d. 275 percent the stocks held short rises to $250,000, whereupon you get nervous and close your account. What is the percentage return on your 4 Leverage ( L04, CFA5) You deposit $100,000 cash in a brokerage account and short sell $200,000 of stocks. Later, the value of d. 275 percent by borrowing $100,000 from your broker. Later, the value of your stock holdings falls to $175,000. What is your account margin in & Account Margin (LO3, CFA4) You deposit $100,000 cash in a brokerage account and purchase $200,000 of stocks on margin c. $100,000 d. $150,000 6. Account Margin (LO3, CFA4) You deposit $100,000 cash in a brokerage account and purchase $200,000 of stocks on margin by borrowing $100,000 from your broker. Later, the value of your stock holdings falls to $150,000. What is your account margin in c. 50 percent d. 75 percent 7. Account Margin (LO4, CFAS) You deposit $100.000 cash in a brokerage account and short soll $200,000 of stocks on margin. Later, the value of the stocks held short cises to $225,000. What is your account margin in dollars? $75,000 c. $100,000 d. $150,000 8. Account Margin (LO4, CFAS) You deposit $100,000 cash in a brokerage account and short soll $200,000 of stocks on margin. Later, the value of the stocks held short rises to $250,000. What is your account margin in percent? b. 25 percent c. 33 percent d. 50 percent 9. Margin Calls (LO3, CFA4) You deposit $100,000 cash in a brokerage account and purchase $200,000 of stocks on margin by borrowing $100,000 from your broker, who requires a maintenance margin of 30 percent. Which of the following is the largest value for your stock holdings for which you will still receive a margin call? b. $160,000 C. $140,000 d. $120,000 percent? a. 25 percent b. 33 percent a $50,000 a. 20 percent a. $200,000 10. Margin Calls (L04, CFA5) You deposit $100,000 cash in a brokerage account and short sell $200,000 of stocks. Your broker requires a maintenance margin of 30 percent. Which of the following is the lowest value for the stocks you are holding short for which you will still receive a margin call? a $260,000 b. $240,000 c. $220,000 d. $200,000