Question

Tyler Company acquired all of Jasmine Companys outstanding stock on January 1, 2019, for $286,400 in cash. Jasmine had a book value of only $220,000

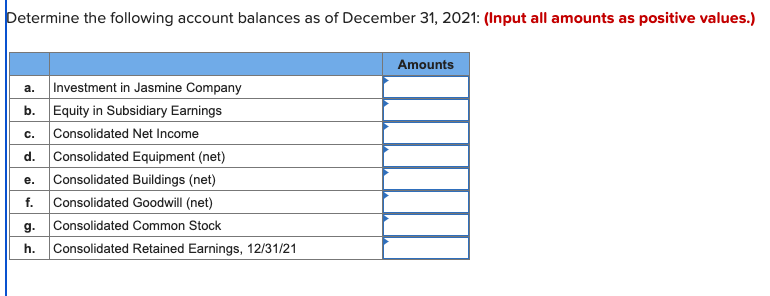

Tyler Company acquired all of Jasmine Companys outstanding stock on January 1, 2019, for $286,400 in cash. Jasmine had a book value of only $220,000 on that date. However, equipment (having an eight-year remaining life) was undervalued by $60,000 on Jasmines financial records. A building with a 20-year remaining life was overvalued by $15,700. Subsequent to the acquisition, Jasmine reported the following: Net Income Dividends Declared 2019 $ 74,400 $ 10,000 2020 62,500 40,000 2021 47,800 20,000 In accounting for this investment, Tyler has used the equity method. Selected accounts taken from the financial records of these two companies as of December 31, 2021, follow: Tyler Company Jasmine Company Revenuesoperating $ (312,000 ) $ (182,000 ) Expenses 233,000 134,200 Equipment (net) 406,000 98,500 Buildings (net) 404,000 71,400 Common stock (290,000 ) (53,400 ) Retained earnings, 12/31/21 (582,000 ) (245,000 ) Determine the following account balances as of December 31, 2021:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started