Question

Tyler Corporation is a diversified company that provides goods and services through three major operating subsidiaries; (1) a retailer of auto parts and supplies; (2)

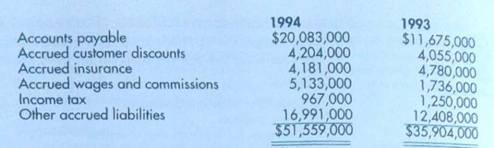

Tyler Corporation is a diversified company that provides goods and services through three major operating subsidiaries; (1) a retailer of auto parts and supplies; (2) a marketer of products for fund-raising programs in schools; and (3) a manufacturer of cast iron pipe and fittings for waterworks applications. Its 1994 financial statements include the following current liabilities on the next page.

Required:

a. Describe each of the liabilities shown on Tyler’s balance sheet. Describe the business purpose of each liability.

b. Why is Tyler accruing customer discounts?

c. Tyler’s total current assets were $ 102,878,000 and $75,395,000 for 1994 and 1993, respectively. Included in these amounts are inventories, prepaid, and deferred taxes totaling $61,761,000 and $39,424,000 for 1994 and 1993, respectively. Calculate current and quick ratios and comment on your results

d. At the end of 1994, Tyler accrued an estimated contingent liability of $3,953,000 for environmental contamination. This amount is included in other accrued liabilities. As an investor, is this disclosure adequate on the balance sheet? Why haven’t they separately disclosed this obligation? What concerns would an investor have and what other information would an investor want to see?

Accounts payable Accrued customer discounts Accrued insurance Accrued wages and commissions Income tax Other accrued liabilities 1994 $20,083,000 4,204,000 4,181,000 5,133,000 967,000 16,991,000 $51,559,000 1993 $11,675,000 4,055,000 4,780,000 1,736,000 1,250,000 12,408,000 $35,904,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part a Accounts Payable Description These are amounts owed to suppliers by Tyler Purpose Delaying payments to suppliers means the business is taking up the suppliers credit facility and it helps the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started