Answered step by step

Verified Expert Solution

Question

1 Approved Answer

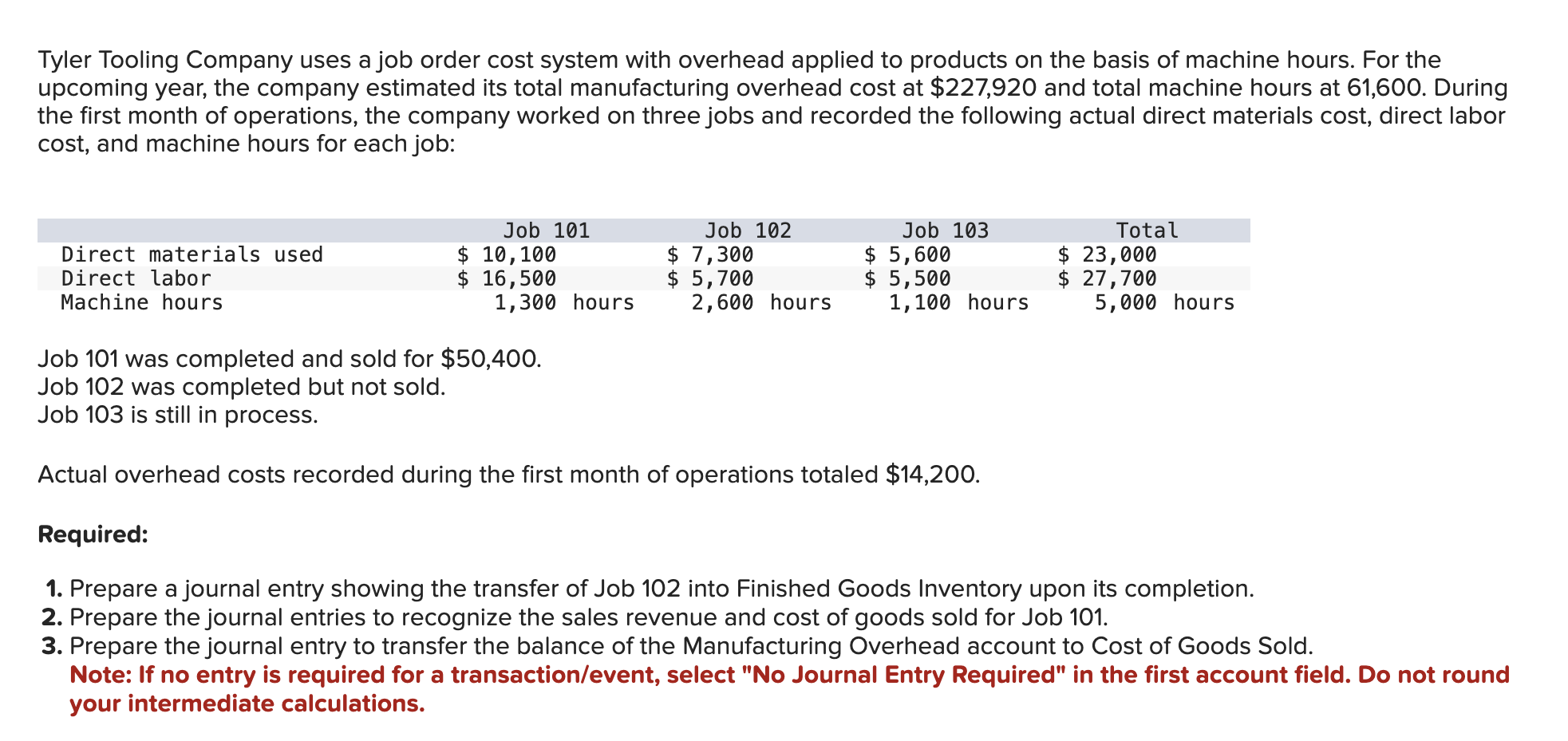

Tyler Tooling Company uses a job order cost system with overhead applied to products on the basis of machine hours. For the upcoming year, the

Tyler Tooling Company uses a job order cost system with overhead applied to products on the basis of machine hours. For the

upcoming year, the company estimated its total manufacturing overhead cost at $ and total machine hours at During

the first month of operations, the company worked on three jobs and recorded the following actual direct materials cost, direct labor

cost and machine hours for each job:

Job was completed and sold for $

Job was completed but not sold.

Job is still in process.

Actual overhead costs recorded during the first month of operations totaled $

Required:

Prepare a journal entry showing the transfer of Job into Finished Goods Inventory upon its completion.

Prepare the journal entries to recognize the sales revenue and cost of goods sold for Job

Prepare the journal entry to transfer the balance of the Manufacturing Overhead account to Cost of Goods Sold.

Note: If no entry is required for a transactionevent select No Journal Entry Required" in the first account field. Do not round

your intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started