Type or paste question here

Type or paste question here

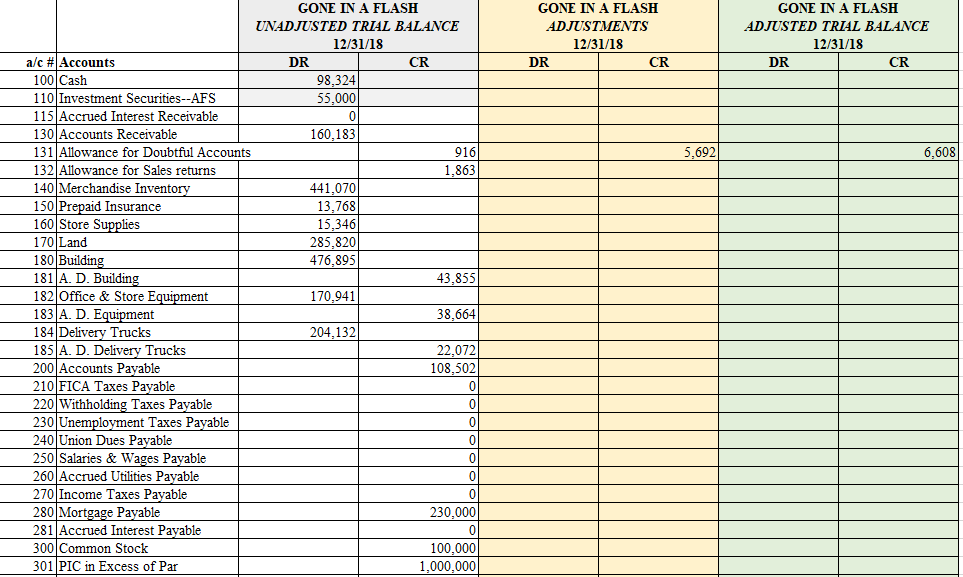

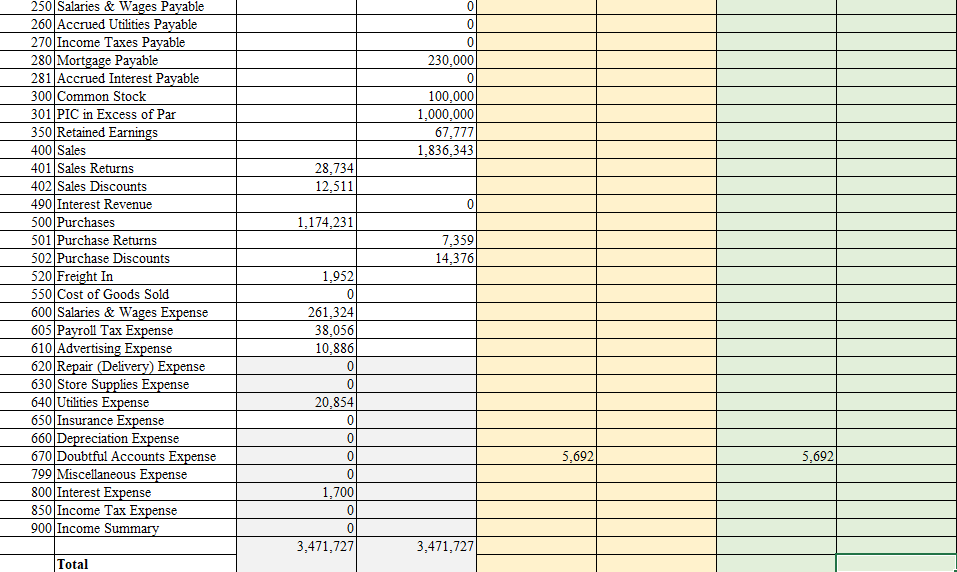

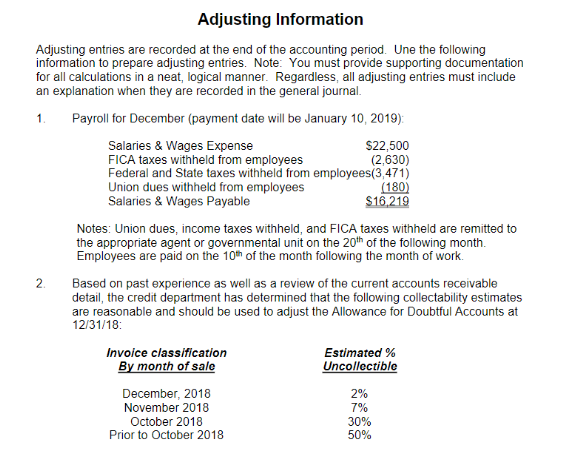

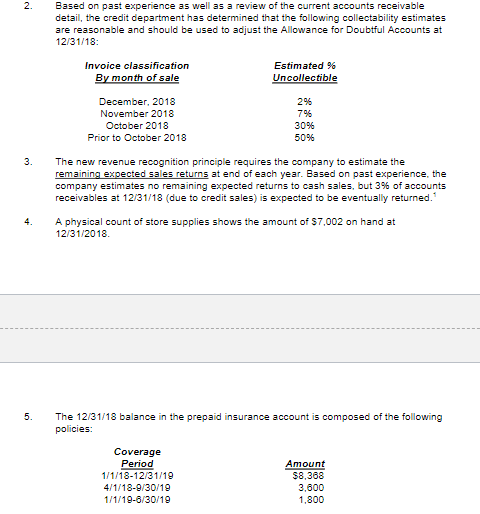

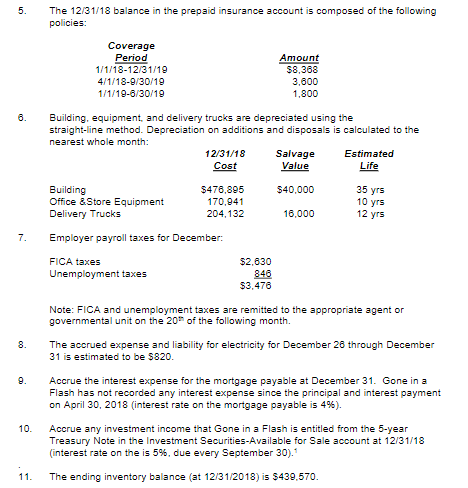

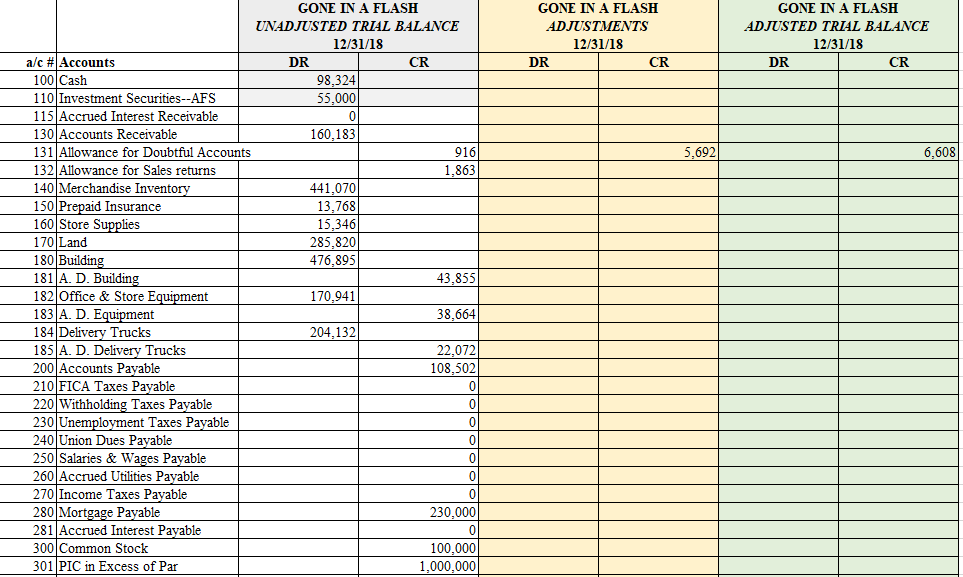

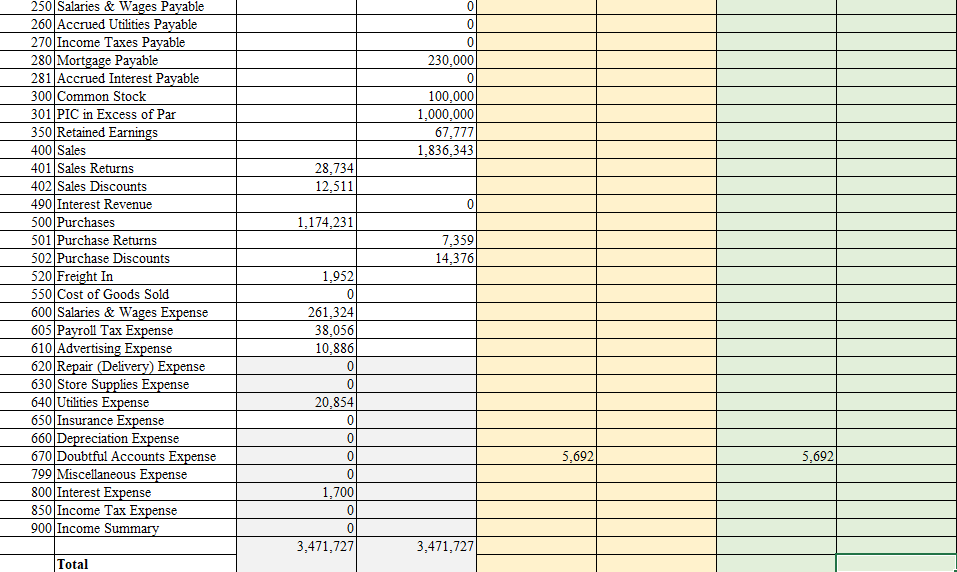

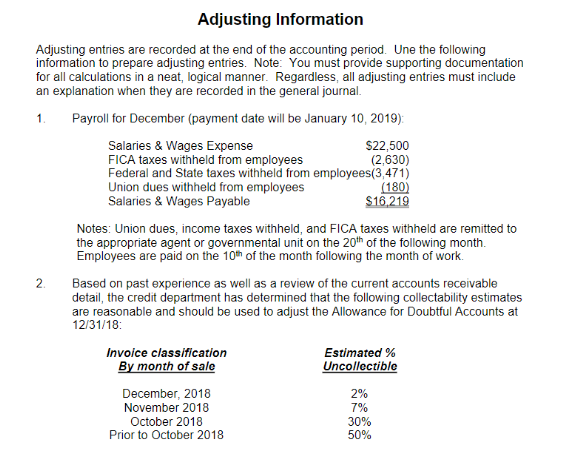

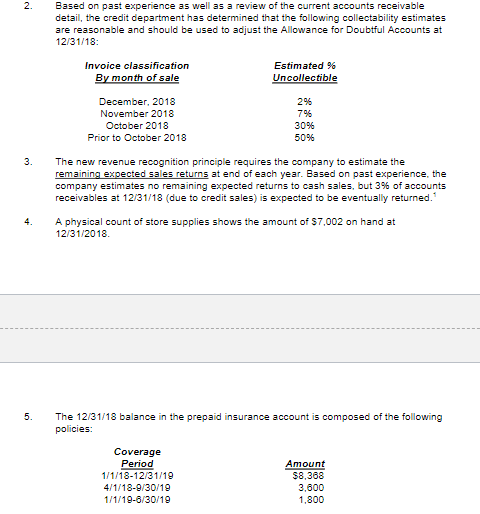

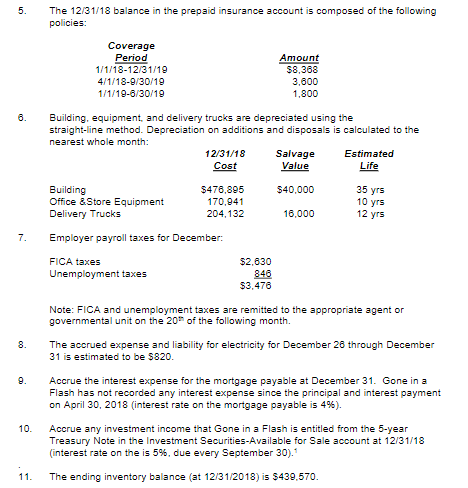

GONE IN A FLASH ADJUSTMENTS 12/31/18 DR CR GONE IN A FLASH ADJUSTED TRIAL BALANCE 12/31/18 DR CR 5,692 6,6087 GONE IN A FLASH UNADJUSTED TRIAL BALANCE 12/31/18 a/c # Accounts DR CR 100 Cash 98,324 110 Investment Securities--AFS 55,000 115 Accrued Interest Receivable 0 130 Accounts Receivable 160.183 131 Allowance for Doubtful Accounts 916 132 Allowance for Sales returns 1,8631 140 Merchandise Inventory 441,070 150 Prepaid Insurance 13,768 160 Store Supplies 15,346 170 Land 285,8201 180 Building 476.895 181 A. D. Building 43.8551 182 Office & Store Equipment 170,941 183 A. D. Equipment 38,664 184 Delivery Trucks 204.132 185 A. D. Delivery Trucks 22,072 200 Accounts Payable 108,502 210 FICA Taxes Payable 0 220 Withholding Taxes Payable 0 230 Unemployment Taxes Payable 0 240 Union Dues Payable 0 250 Salaries & Wages Payable 01 260 Accrued Utilities Payable 0 270 Income Taxes Payable 0 280 Mortgage Payable 230,000 281 Accrued Interest Payable 01 300 Common Stock 100,000 301 PIC in Excess of Par 1,000,000 0 0 230,000 0 100,000 1,000,000 67,777 1,836,343 28,734 12,511 1,174,231 7,359 14,376 250 Salaries & Wages Payable 260 Accrued Utilities Payable 270 Income Taxes Payable 280 Mortgage Payable 281 Accrued Interest Payable 300 Common Stock 301 PIC in Excess of Par 350 Retained Earnings 400 Sales 401 Sales Returns 402 Sales Discounts 490 Interest Revenue 500 Purchases 501 Purchase Returns 502 Purchase Discounts 520 Freight In 550 Cost of Goods Sold 600 Salaries & Wages Expense 605 Payroll Tax Expense 610 Advertising Expense 620 Repair (Delivery) Expense 630 Store Supplies Expense 640 Utilities Expense 650 Insurance Expense 660 Depreciation Expense 670 Doubtful Accounts Expense 799 Miscellaneous Expense 800 Interest Expense 850 Income Tax Expense 900 Income Summary 1,952 261,324 38,056 10,886 0 0 20,854 0 ololololo 5,692 5,692 1,700 0 0 3,471,727 3,471,727 Total Adjusting Information Adjusting entries are recorded at the end of the accounting period. Une the following information to prepare adjusting entries. Note: You must provide supporting documentation for all calculations in a neat, logical manner. Regardless, all adjusting entries must include an explanation when they are recorded in the general journal. 1 Payroll for December (payment date will be January 10, 2019) Salaries & Wages Expense $22,500 FICA taxes withheld from employees (2,630) Federal and State taxes withheld from employees(3,471) Union dues withheld from employees (180) Salaries & Wages Payable S16,219 Notes: Union dues, income taxes withheld, and FICA taxes withheld are remitted to the appropriate agent or governmental unit on the 20th of the following month. Employees are paid on the 10th of the month following the month of work. 2 Based on past experience as well as a review of the current accounts receivable detail, the credit department has determined that the following collectability estimates are reasonable and should be used to adjust the Allowance for Doubtful Accounts at 12/31/18 Invoice classification Estimated % By month of sale Uncollectible December, 2018 2% November 2018 7% October 2018 30% Prior to October 2018 50% 2. Based on past experience as well as a review of the current accounts receivable detail, the credit department has determined that the following collectability estimates are reasonable and should be used to adjust the Allowance for Doubtful Accounts at 12/31/18 Invoice classification By month of sale Estimated % Uncollectible December, 2018 November 2018 October 2018 Prior to October 2018 2% 7% 30% 50% 3. The new revenue recognition principle requires the company to estimate the remaining expected sales returns at end of each year. Based on past experience, the company estimates no remaining expected returns to cash sales, but 3% of accounts receivables at 12/31/18 (due to credit sales) is expected to be eventually returned. A physical count of store supplies shows the amount of $7,002 on hand at 12/31/2018 4. 5. The 12/31/18 balance in the prepaid insurance account is composed of the following policies: Coverage Period 1/1/18-12/31/19 4/1/18-9/30/19 1/1/19-8/30/19 Amount $8.368 3.600 1.800 5. The 12/31/18 balance in the prepaid insurance account is composed of the following policies: Coverage Period 1/1/18-12/31/19 4/1/18-9/30/19 1/1/19-8/30/19 Amount $8,368 3.600 1.800 3. 6 Building, equipment and delivery trucks are depreciated using the straight-line method. Depreciation on additions and disposals is calculated to the nearest whole month: 12/31/18 Salvage Estimated Cost Value Life $40,000 Building Office & Store Equipment Delivery Trucks $478.895 170,941 204,132 35 yrs 10 yrs 12 yrs 16,000 7. Employer payroll taxes for December: FICA taxes Unemployment taxes $2,830 846 $3,478 Note: FICA and unemployment taxes are remitted to the appropriate agent or governmental unit on the 20 of the following month. The accrued expense and liability for electricity for December 26 through December 31 is estimated to be $820. 8. 9. Accrue the interest expense for the mortgage payable at December 31. Gone in a Flash has not recorded any interest expense since the principal and interest payment on April 30, 2018 (interest rate on the mortgage payable is 49). 10 Accrue any investment income that Gone in a Flash is entitled from the 5-year Treasury Note in the Investment Securities-Available for Sale account at 12/31/18 (interest rate on the is 5%, due every September 30). 11. The ending inventory balance (at 12/31/2018) is $439,570. GONE IN A FLASH ADJUSTMENTS 12/31/18 DR CR GONE IN A FLASH ADJUSTED TRIAL BALANCE 12/31/18 DR CR 5,692 6,6087 GONE IN A FLASH UNADJUSTED TRIAL BALANCE 12/31/18 a/c # Accounts DR CR 100 Cash 98,324 110 Investment Securities--AFS 55,000 115 Accrued Interest Receivable 0 130 Accounts Receivable 160.183 131 Allowance for Doubtful Accounts 916 132 Allowance for Sales returns 1,8631 140 Merchandise Inventory 441,070 150 Prepaid Insurance 13,768 160 Store Supplies 15,346 170 Land 285,8201 180 Building 476.895 181 A. D. Building 43.8551 182 Office & Store Equipment 170,941 183 A. D. Equipment 38,664 184 Delivery Trucks 204.132 185 A. D. Delivery Trucks 22,072 200 Accounts Payable 108,502 210 FICA Taxes Payable 0 220 Withholding Taxes Payable 0 230 Unemployment Taxes Payable 0 240 Union Dues Payable 0 250 Salaries & Wages Payable 01 260 Accrued Utilities Payable 0 270 Income Taxes Payable 0 280 Mortgage Payable 230,000 281 Accrued Interest Payable 01 300 Common Stock 100,000 301 PIC in Excess of Par 1,000,000 0 0 230,000 0 100,000 1,000,000 67,777 1,836,343 28,734 12,511 1,174,231 7,359 14,376 250 Salaries & Wages Payable 260 Accrued Utilities Payable 270 Income Taxes Payable 280 Mortgage Payable 281 Accrued Interest Payable 300 Common Stock 301 PIC in Excess of Par 350 Retained Earnings 400 Sales 401 Sales Returns 402 Sales Discounts 490 Interest Revenue 500 Purchases 501 Purchase Returns 502 Purchase Discounts 520 Freight In 550 Cost of Goods Sold 600 Salaries & Wages Expense 605 Payroll Tax Expense 610 Advertising Expense 620 Repair (Delivery) Expense 630 Store Supplies Expense 640 Utilities Expense 650 Insurance Expense 660 Depreciation Expense 670 Doubtful Accounts Expense 799 Miscellaneous Expense 800 Interest Expense 850 Income Tax Expense 900 Income Summary 1,952 261,324 38,056 10,886 0 0 20,854 0 ololololo 5,692 5,692 1,700 0 0 3,471,727 3,471,727 Total Adjusting Information Adjusting entries are recorded at the end of the accounting period. Une the following information to prepare adjusting entries. Note: You must provide supporting documentation for all calculations in a neat, logical manner. Regardless, all adjusting entries must include an explanation when they are recorded in the general journal. 1 Payroll for December (payment date will be January 10, 2019) Salaries & Wages Expense $22,500 FICA taxes withheld from employees (2,630) Federal and State taxes withheld from employees(3,471) Union dues withheld from employees (180) Salaries & Wages Payable S16,219 Notes: Union dues, income taxes withheld, and FICA taxes withheld are remitted to the appropriate agent or governmental unit on the 20th of the following month. Employees are paid on the 10th of the month following the month of work. 2 Based on past experience as well as a review of the current accounts receivable detail, the credit department has determined that the following collectability estimates are reasonable and should be used to adjust the Allowance for Doubtful Accounts at 12/31/18 Invoice classification Estimated % By month of sale Uncollectible December, 2018 2% November 2018 7% October 2018 30% Prior to October 2018 50% 2. Based on past experience as well as a review of the current accounts receivable detail, the credit department has determined that the following collectability estimates are reasonable and should be used to adjust the Allowance for Doubtful Accounts at 12/31/18 Invoice classification By month of sale Estimated % Uncollectible December, 2018 November 2018 October 2018 Prior to October 2018 2% 7% 30% 50% 3. The new revenue recognition principle requires the company to estimate the remaining expected sales returns at end of each year. Based on past experience, the company estimates no remaining expected returns to cash sales, but 3% of accounts receivables at 12/31/18 (due to credit sales) is expected to be eventually returned. A physical count of store supplies shows the amount of $7,002 on hand at 12/31/2018 4. 5. The 12/31/18 balance in the prepaid insurance account is composed of the following policies: Coverage Period 1/1/18-12/31/19 4/1/18-9/30/19 1/1/19-8/30/19 Amount $8.368 3.600 1.800 5. The 12/31/18 balance in the prepaid insurance account is composed of the following policies: Coverage Period 1/1/18-12/31/19 4/1/18-9/30/19 1/1/19-8/30/19 Amount $8,368 3.600 1.800 3. 6 Building, equipment and delivery trucks are depreciated using the straight-line method. Depreciation on additions and disposals is calculated to the nearest whole month: 12/31/18 Salvage Estimated Cost Value Life $40,000 Building Office & Store Equipment Delivery Trucks $478.895 170,941 204,132 35 yrs 10 yrs 12 yrs 16,000 7. Employer payroll taxes for December: FICA taxes Unemployment taxes $2,830 846 $3,478 Note: FICA and unemployment taxes are remitted to the appropriate agent or governmental unit on the 20 of the following month. The accrued expense and liability for electricity for December 26 through December 31 is estimated to be $820. 8. 9. Accrue the interest expense for the mortgage payable at December 31. Gone in a Flash has not recorded any interest expense since the principal and interest payment on April 30, 2018 (interest rate on the mortgage payable is 49). 10 Accrue any investment income that Gone in a Flash is entitled from the 5-year Treasury Note in the Investment Securities-Available for Sale account at 12/31/18 (interest rate on the is 5%, due every September 30). 11. The ending inventory balance (at 12/31/2018) is $439,570

Type or paste question here

Type or paste question here