Type or paste question here

Type or paste question here

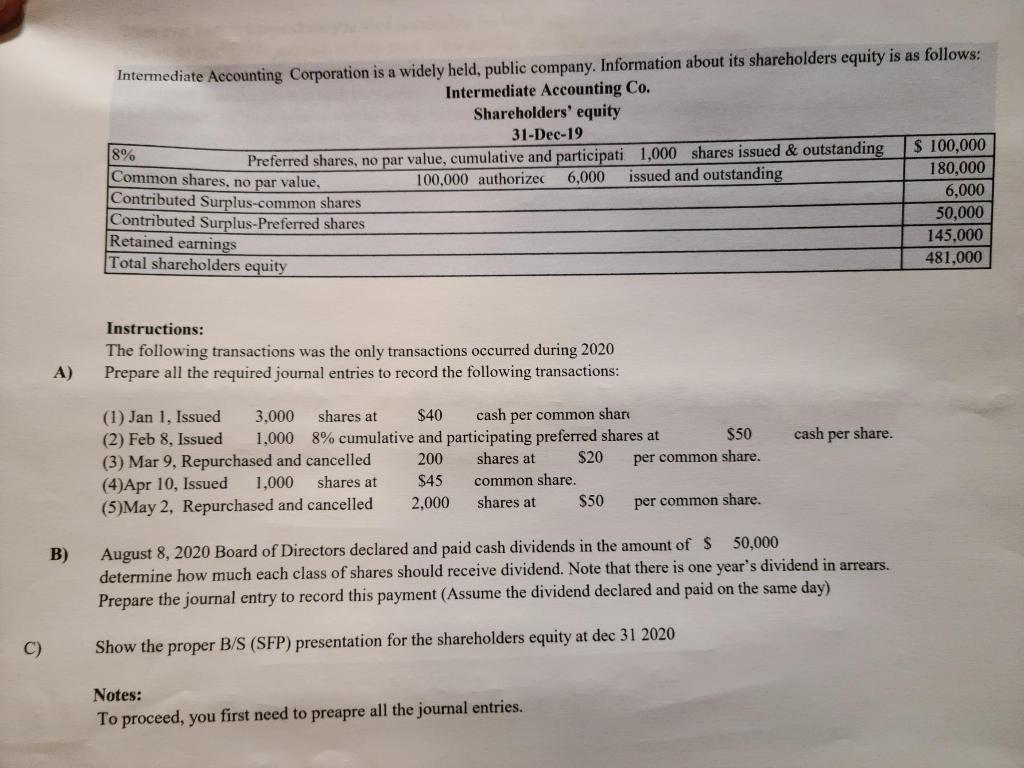

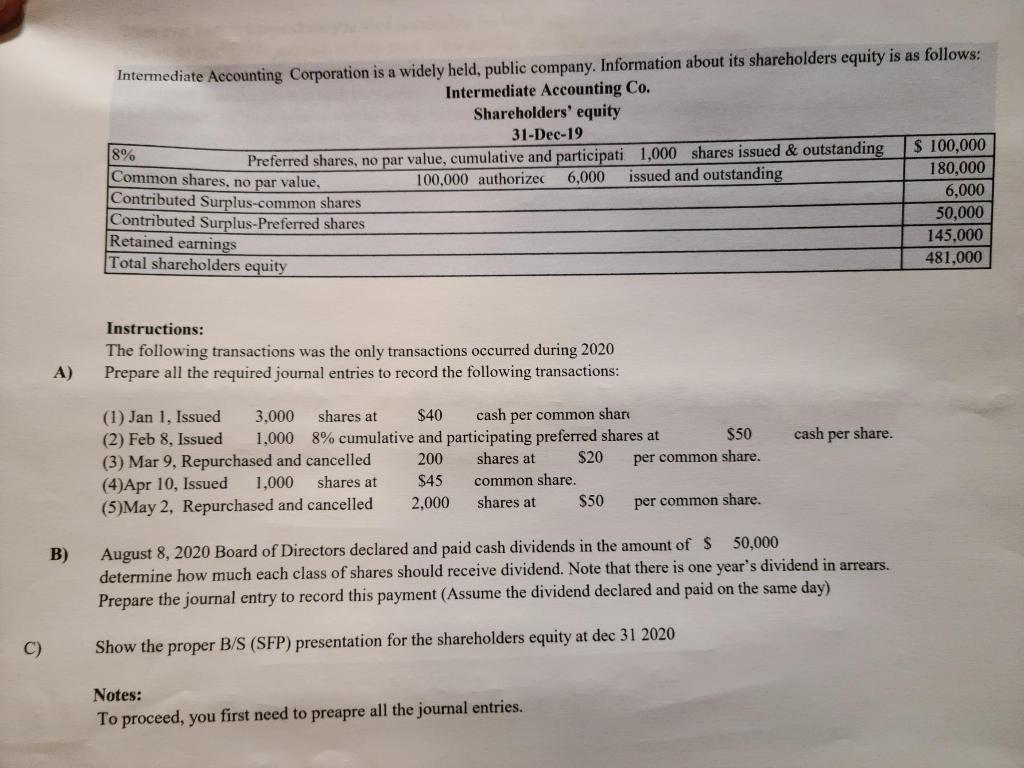

Intermediate Accounting Corporation is a widely held, public company. Information about its shareholders equity is as follows: Intermediate Accounting Co. Shareholders' equity 31-Dec-19 8% Preferred shares, no par value, cumulative and participati 1,000 shares issued & outstanding $ 100,000 100,000 authorized 6,000 issued and outstanding 180,000 Contributed Surplus-common shares 6.000 Contributed Surplus-Preferred shares 50,000 145,000 Total shareholders equity 481,000 Common shares, no par value, Retained earnings Instructions: The following transactions was the only transactions occurred during 2020 Prepare all the required journal entries to record the following transactions: A) cash per share. (1) Jan 1, Issued 3.000 shares at $40 cash per common shart (2) Feb 8, Issued 1,000 8% cumulative and participating preferred shares at $50 (3) Mar 9, Repu sed and cancelled 200 shares at $20 per common share. (4)Apr 10, Issued 1,000 shares at $45 common share. (5)May 2, Repurchased and cancelled 2.000 shares at $50 per common share. B) August 8, 2020 Board of Directors declared and paid cash dividends in the amount of $ 50,000 determine how much each class of shares should receive dividend. Note that there is one year's dividend in arrears. Prepare the journal entry to record this payment (Assume the dividend declared and paid on the same day) C) Show the proper B/S (SFP) presentation for the shareholders equity at dec 31 2020 Notes: To proceed, you first need to preapre all the journal entries. Intermediate Accounting Corporation is a widely held, public company. Information about its shareholders equity is as follows: Intermediate Accounting Co. Shareholders' equity 31-Dec-19 8% Preferred shares, no par value, cumulative and participati 1,000 shares issued & outstanding $ 100,000 100,000 authorized 6,000 issued and outstanding 180,000 Contributed Surplus-common shares 6.000 Contributed Surplus-Preferred shares 50,000 145,000 Total shareholders equity 481,000 Common shares, no par value, Retained earnings Instructions: The following transactions was the only transactions occurred during 2020 Prepare all the required journal entries to record the following transactions: A) cash per share. (1) Jan 1, Issued 3.000 shares at $40 cash per common shart (2) Feb 8, Issued 1,000 8% cumulative and participating preferred shares at $50 (3) Mar 9, Repu sed and cancelled 200 shares at $20 per common share. (4)Apr 10, Issued 1,000 shares at $45 common share. (5)May 2, Repurchased and cancelled 2.000 shares at $50 per common share. B) August 8, 2020 Board of Directors declared and paid cash dividends in the amount of $ 50,000 determine how much each class of shares should receive dividend. Note that there is one year's dividend in arrears. Prepare the journal entry to record this payment (Assume the dividend declared and paid on the same day) C) Show the proper B/S (SFP) presentation for the shareholders equity at dec 31 2020 Notes: To proceed, you first need to preapre all the journal entries

Type or paste question here

Type or paste question here