Type or paste question here

Type or paste question here

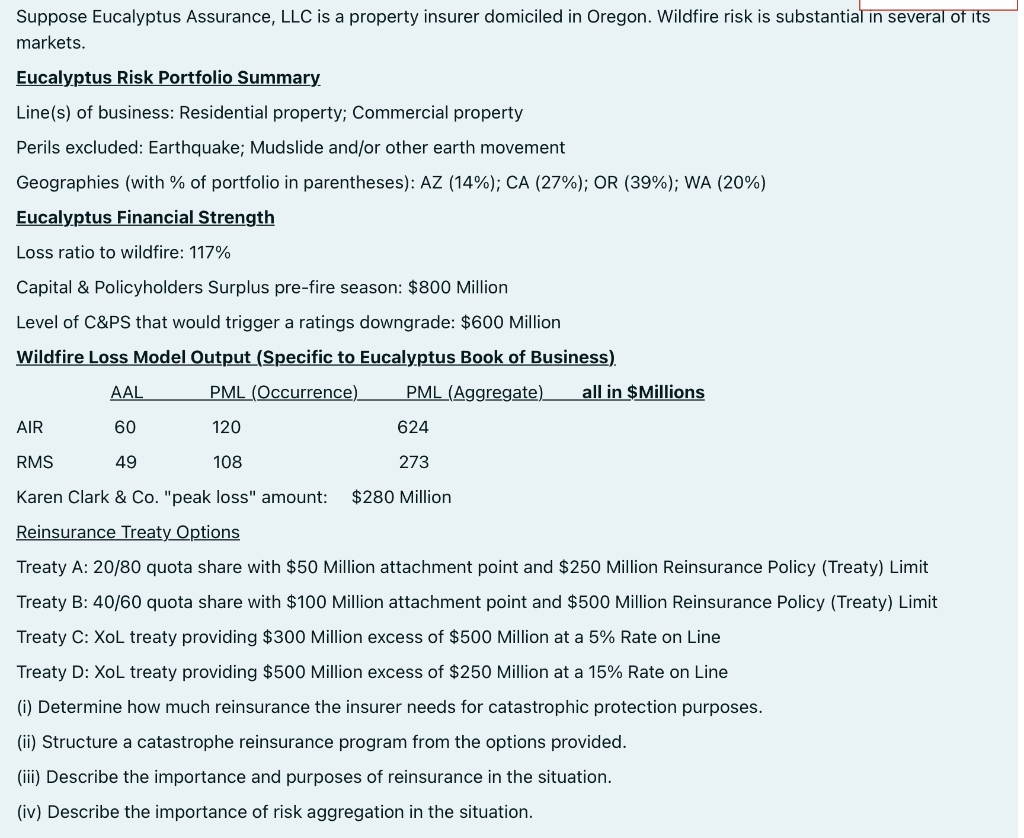

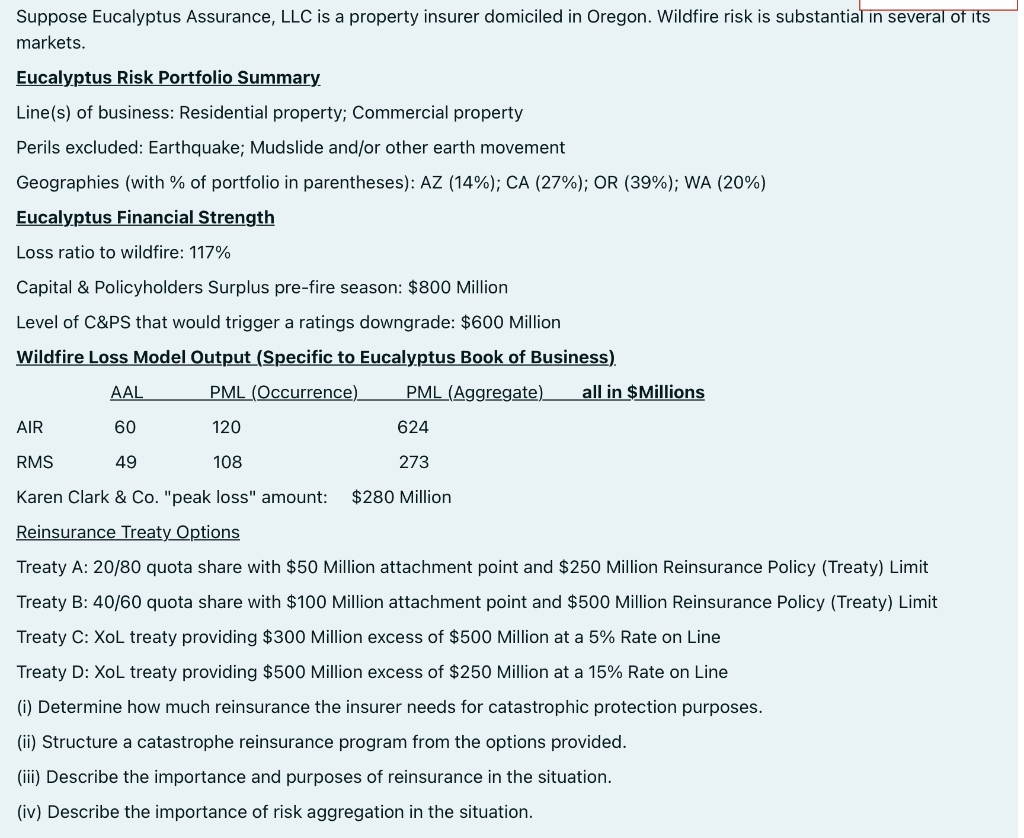

Suppose Eucalyptus Assurance, LLC is a property insurer domiciled in Oregon. Wildfire risk is substantial in several of its markets. Eucalyptus Risk Portfolio Summary Line(s) of business: Residential property; Commercial property Perils excluded: Earthquake; Mudslide and/or other earth movement Geographies (with % of portfolio in parentheses): AZ (14%); CA (27%); OR (39%); WA (20%) Eucalyptus Financial Strength Loss ratio to wildfire: 117% Capital & Policyholders Surplus pre-fire season: $800 Million Level of C&PS that would trigger a ratings downgrade: $600 Million Wildfire Loss Model Output (Specific to Eucalyptus Book of Business) AAL PML (Occurrence) PML (Aggregate) all in $Millions AIR 60 120 624 RMS 49 108 273 Karen Clark & Co. "peak loss" amount: $280 Million Reinsurance Treaty Options Treaty A: 20/80 quota share with $50 Million attachment point and $250 Million Reinsurance Policy (Treaty) Limit Treaty B: 40/60 quota share with $100 Million attachment point and $500 Million Reinsurance Policy (Treaty) Limit Treaty C: XoL treaty providing $300 Million excess of $500 Million at a 5% Rate on Line Treaty D: XOL treaty providing $500 Million excess of $250 Million at a 15% Rate on Line (i) Determine how much reinsurance the insurer needs for catastrophic protection purposes. (ii) Structure a catastrophe reinsurance program from the options provided. (iii) Describe the importance and purposes of reinsurance in the situation. (iv) Describe the importance of risk aggregation in the situation. Suppose Eucalyptus Assurance, LLC is a property insurer domiciled in Oregon. Wildfire risk is substantial in several of its markets. Eucalyptus Risk Portfolio Summary Line(s) of business: Residential property; Commercial property Perils excluded: Earthquake; Mudslide and/or other earth movement Geographies (with % of portfolio in parentheses): AZ (14%); CA (27%); OR (39%); WA (20%) Eucalyptus Financial Strength Loss ratio to wildfire: 117% Capital & Policyholders Surplus pre-fire season: $800 Million Level of C&PS that would trigger a ratings downgrade: $600 Million Wildfire Loss Model Output (Specific to Eucalyptus Book of Business) AAL PML (Occurrence) PML (Aggregate) all in $Millions AIR 60 120 624 RMS 49 108 273 Karen Clark & Co. "peak loss" amount: $280 Million Reinsurance Treaty Options Treaty A: 20/80 quota share with $50 Million attachment point and $250 Million Reinsurance Policy (Treaty) Limit Treaty B: 40/60 quota share with $100 Million attachment point and $500 Million Reinsurance Policy (Treaty) Limit Treaty C: XoL treaty providing $300 Million excess of $500 Million at a 5% Rate on Line Treaty D: XOL treaty providing $500 Million excess of $250 Million at a 15% Rate on Line (i) Determine how much reinsurance the insurer needs for catastrophic protection purposes. (ii) Structure a catastrophe reinsurance program from the options provided. (iii) Describe the importance and purposes of reinsurance in the situation. (iv) Describe the importance of risk aggregation in the situation

Type or paste question here

Type or paste question here