Type or paste question here

Type or paste question here

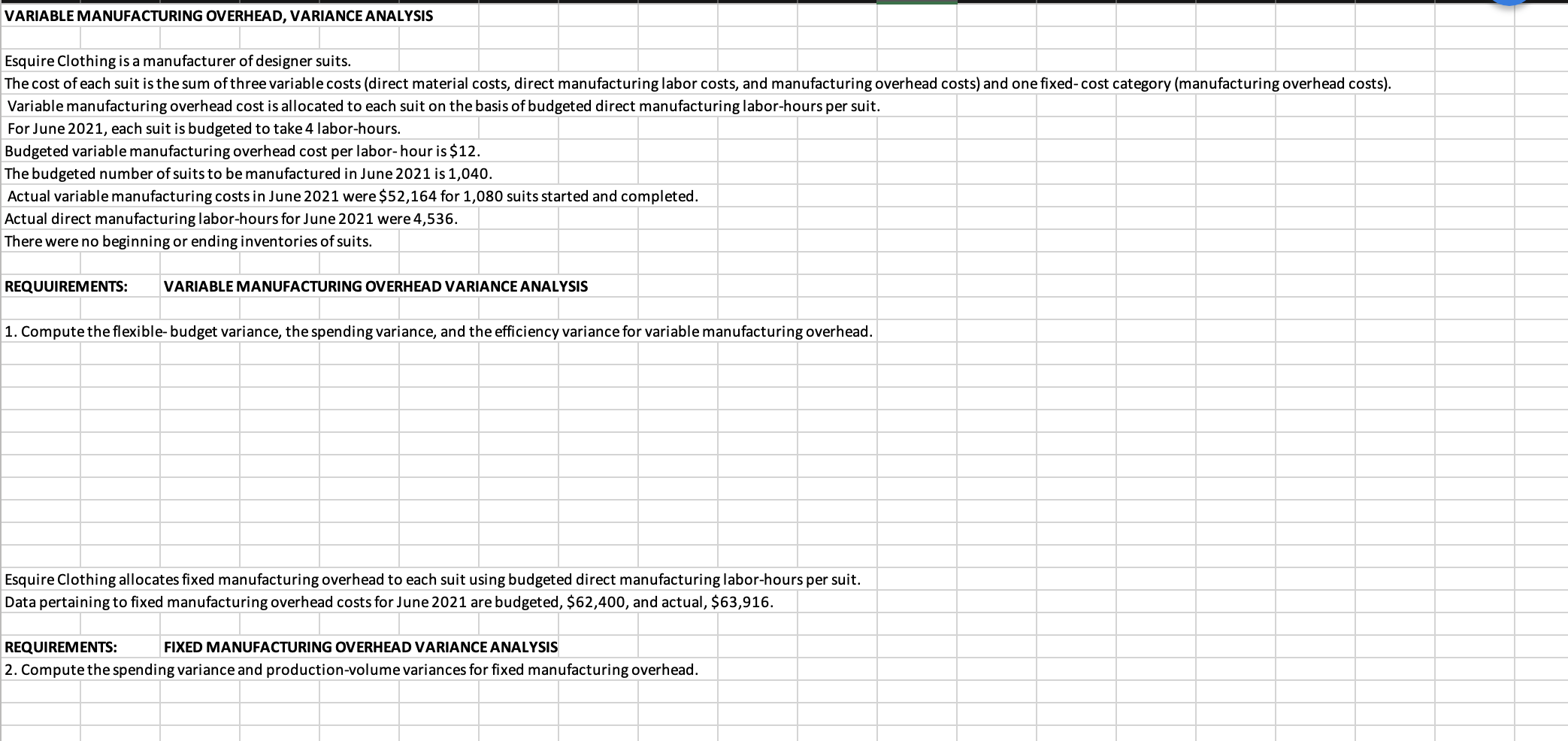

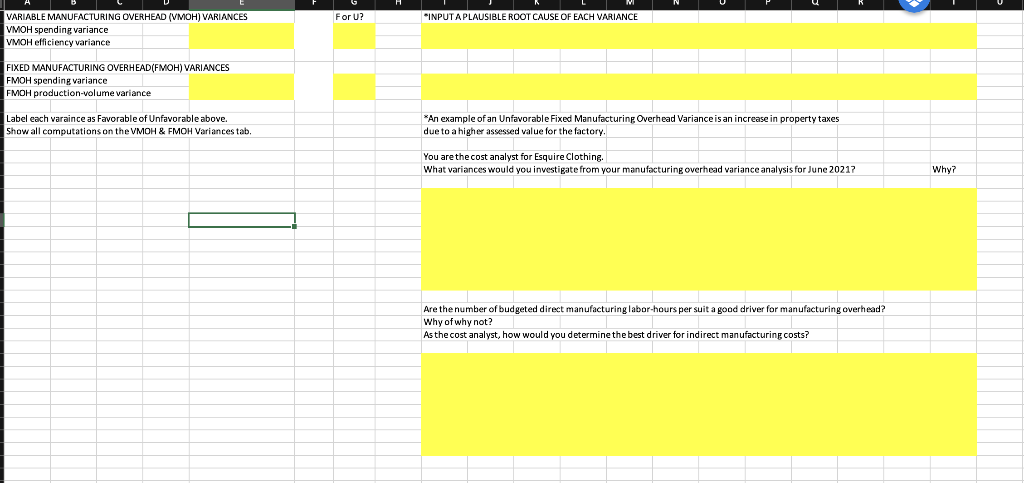

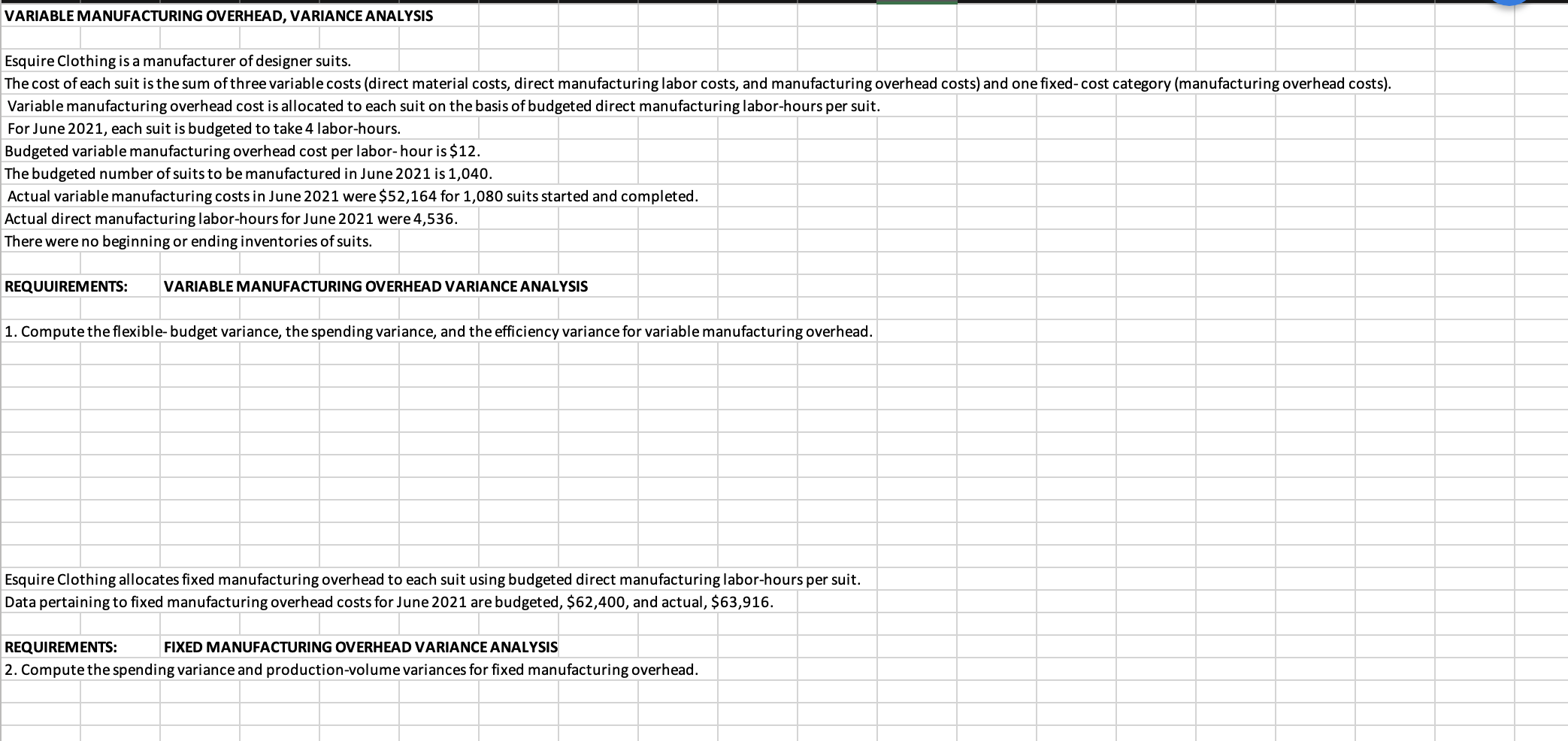

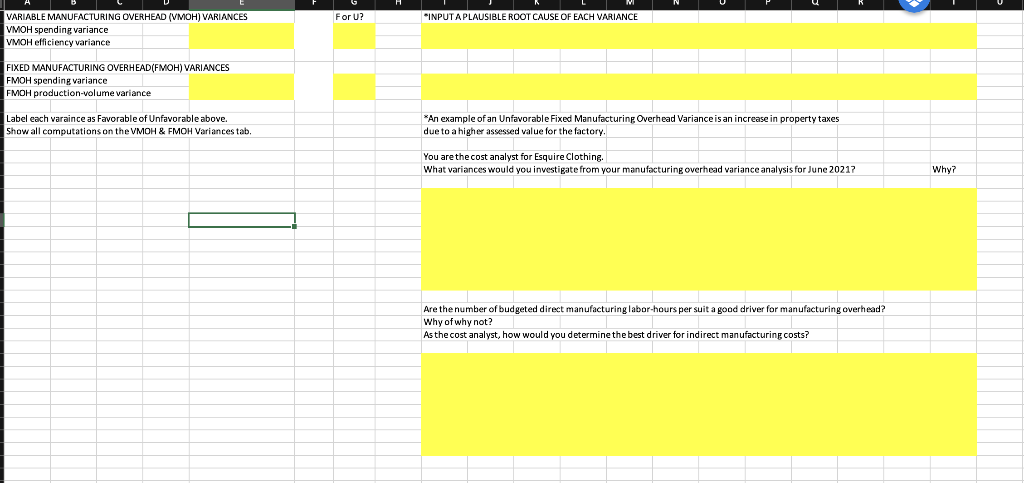

VARIABLE MANUFACTURING OVERHEAD, VARIANCE ANALYSIS Esquire Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturing labor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2021, each suit is budgeted to take 4 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $12. The budgeted number of suits to be manufactured in June 2021 is 1,040. Actual variable manufacturing costs in June 2021 were $52,164 for 1,080 suits started and completed. Actual direct manufacturing labor-hours for June 2021 were 4,536. There were no beginning or ending inventories of suits. REQUUIREMENTS: VARIABLE MANUFACTURING OVERHEAD VARIANCE ANALYSIS 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Esquire Clothing allocates fixed manufacturing overhead to each suit using budgeted direct manufacturing labor-hours per suit. Data pertaining to fixed manufacturing overhead costs for June 2021 are budgeted, $62,400, and actual, $63,916. REQUIREMENTS: FIXED MANUFACTURING OVERHEAD VARIANCE ANALYSIS 2. Compute the spending variance and production-volume variances for fixed manufacturing overhead. For U? "INPUT APLAUSIBLE ROOT CAUSE OF EACH VARIANCE VARIABLE MANUFACTURING OVERHEAD (VMOH) VARIANCES VMOH spending variance VMOH efficiency variance FIXED MANUFACTURING OVERHEAD(FMOH) VARIANCES FMOH spending variance FMOH production-volume variance Label each varaince as Favorable of Unfavorable above. Show all computations on the VMOH & FMOH Variances tab. *An example of an Unfavorable Fixed Manufacturing Overhead Variance is an increase in property taxes due to a higher assessed value for the factory, You are the cost analyst for Esquire Clothing What variances would you investigate from your manufacturing overhead variance analysis for June 20217 Why? Are the number of budgeted direct manufacturing labor-hours per suit a good driver for manufacturing overhead? Why of why not? As the cost analyst, how would you determine the best driver for indirect manufacturing costs

Type or paste question here

Type or paste question here