Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Type True or False. If you answer False, then explain why the statement is false (1 line). If you answer True do NOT explain. The

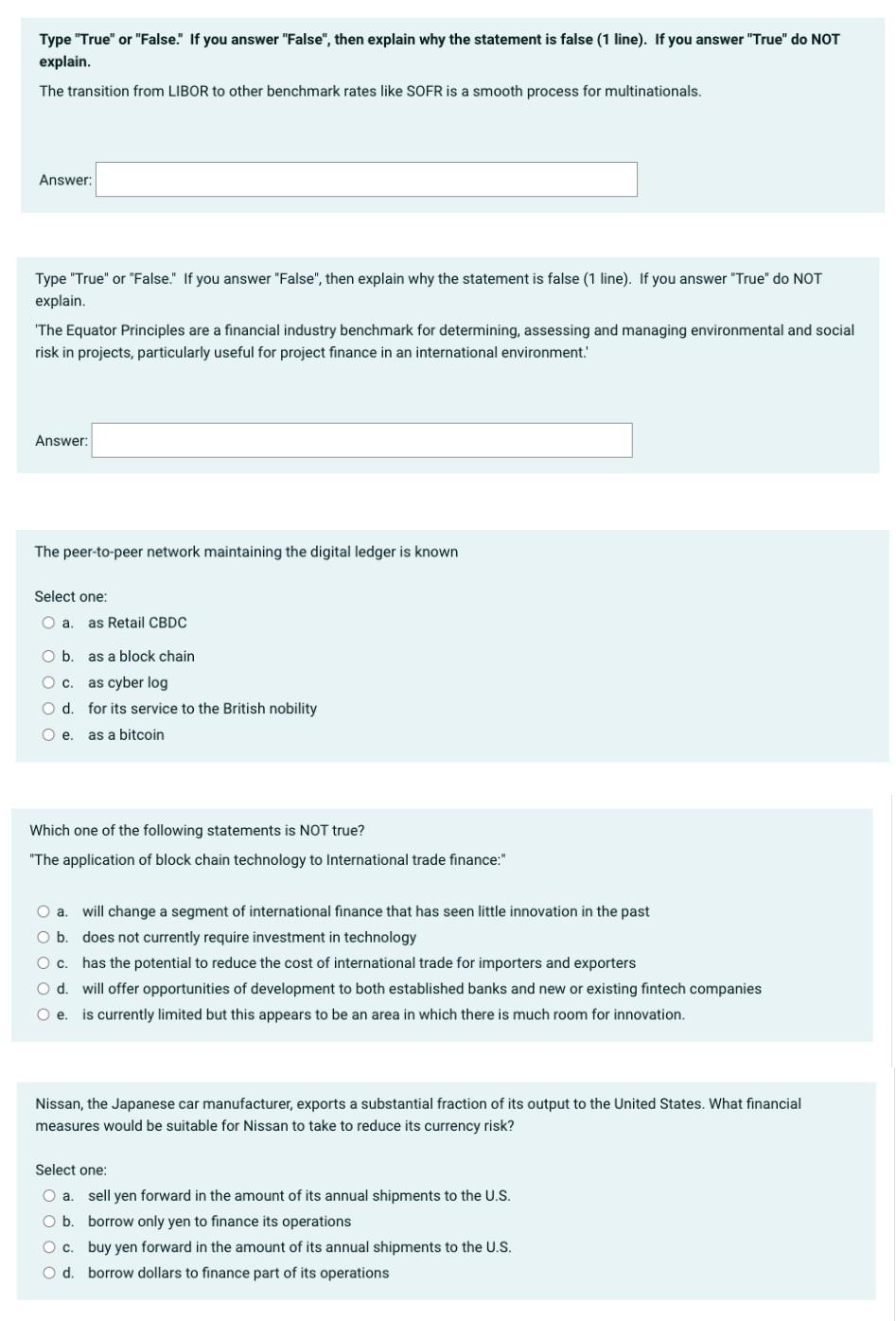

Type "True" or "False." If you answer "False", then explain why the statement is false (1 line). If you answer "True" do NOT explain. The transition from LIBOR to other benchmark rates like SOFR is a smooth process for multinationals. Answer: Type "True" or "False." If you answer "False", then explain why the statement is false (1 line). If you answer "True" do NOT explain. 'The Equator Principles are a financial industry benchmark for determining, assessing and managing environmental and social risk in projects, particularly useful for project finance in an international environment.' Answer: The peer-to-peer network maintaining the digital ledger is known Select one: O a. as Retail CBDC O b. as a block chain O c. as cyber log O d. for its service to the British nobility O e. as a bitcoin Which one of the following statements is NOT true? "The application of block chain technology to International trade finance:" O a. will change a segment of international finance that has seen little innovation in the past O b. does not currently require investment in technology O c. has the potential to reduce the cost of international trade for importers and exporters O d. will offer opportunities of development to both established banks and new or existing fintech companies O e. is currently limited but this appears to be an area in which there is much room for innovation. Nissan, the Japanese car manufacturer, exports a substantial fraction of its output to the United States. What financial measures would be suitable for Nissan to take to reduce its currency risk? Select one: O a. sell yen forward in the amount of its annual shipments to the U.S. O b. borrow only yen to finance its operations O c. buy yen forward in the amount of its annual shipments to the U.S. O d. borrow dollars to finance part of its operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started