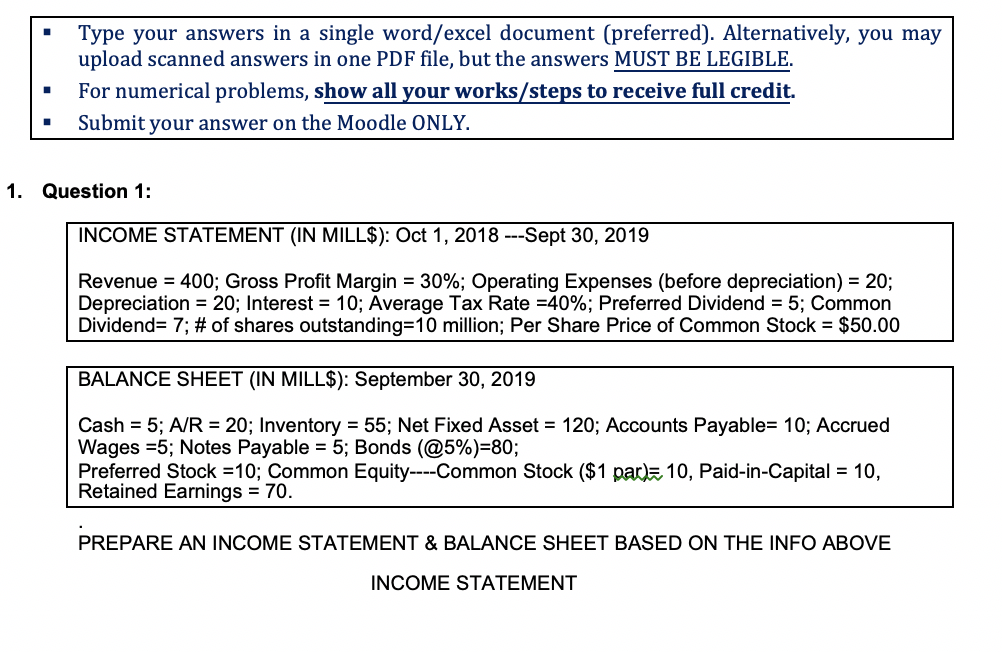

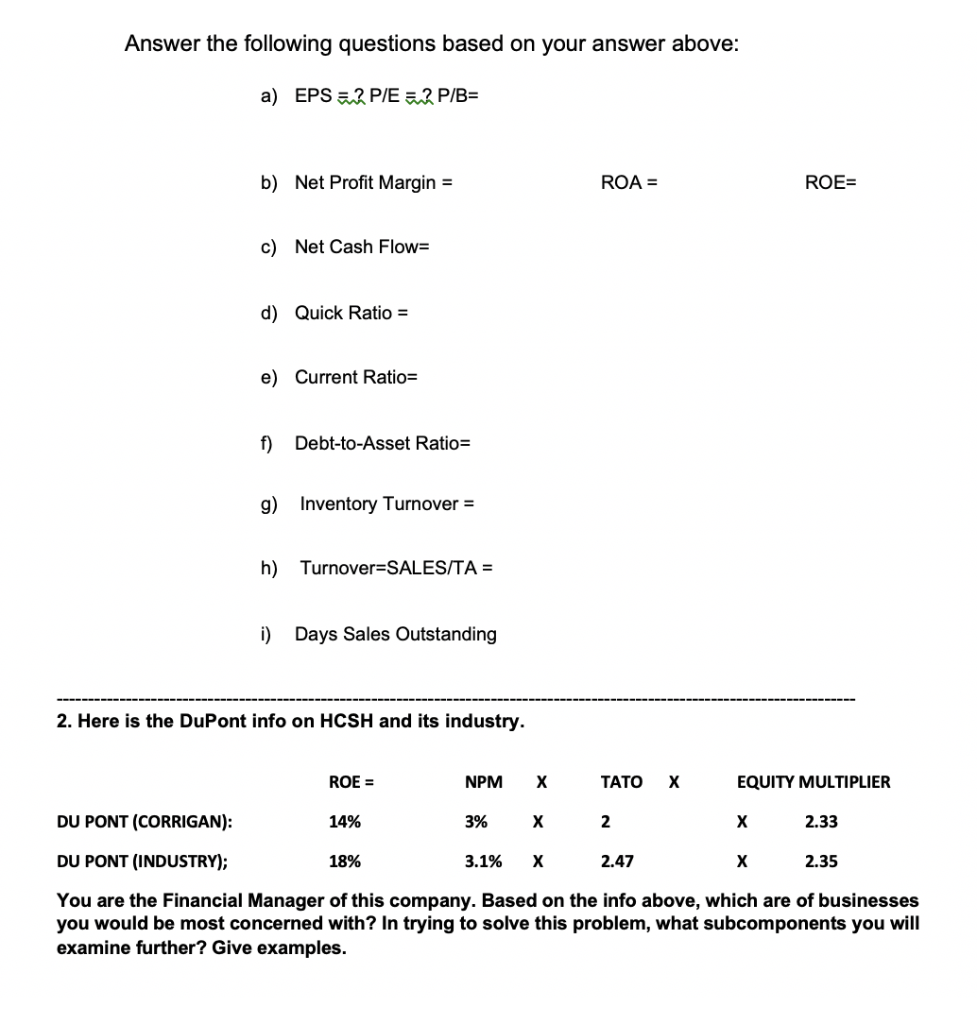

Type your answers in a single word/excel document (preferred). Alternatively, you may upload scanned answers in one PDF file, but the answers MUST BE LEGIBLE. For numerical problems, show all your works/steps to receive full credit. Submit your answer on the Moodle ONLY. 1. Question 1: INCOME STATEMENT (IN MILL$): Oct 1, 2018 ---Sept 30, 2019 Revenue = 400; Gross Profit Margin = 30%; Operating Expenses (before depreciation) = 20; Depreciation = 20; Interest = 10; Average Tax Rate =40%; Preferred Dividend = 5; Common Dividend= 7; # of shares outstanding=10 million; Per Share Price of Common Stock = $50.00 BALANCE SHEET (IN MILL$): September 30, 2019 Cash = 5; A/R = 20; Inventory = 55; Net Fixed Asset = 120; Accounts Payable= 10; Accrued Wages =5; Notes Payable = 5; Bonds (@5%)=80; Preferred Stock =10; Common Equity----Common Stock ($1 par = 10, Paid-in-Capital = 10, Retained Earnings = 70. PREPARE AN INCOME STATEMENT & BALANCE SHEET BASED ON THE INFO ABOVE INCOME STATEMENT Answer the following questions based on your answer above: a) EPS ? P/ E P /B= b) Net Profit Margin = ROA = ROE= c) Net Cash Flow= d) Quick Ratio = e) Current Ratio= f) Debt-to-Asset Ratio= g) Inventory Turnover = h) Turnover=SALES/TA = i) Days Sales Outstanding 2. Here is the DuPont info on HCSH and its industry. ROE = NPM X . EQUITY MULTIPLIER DU PONT (CORRIGAN): 14% X 2 2.47 3% 3.1% 2.33 X X DU PONT (INDUSTRY); 18% X 2.35 You are the Financial Manager of this company. Based on the info above, which are of businesses you would be most concerned with? In trying to solve this problem, what subcomponents you will examine further? Give examples. Type your answers in a single word/excel document (preferred). Alternatively, you may upload scanned answers in one PDF file, but the answers MUST BE LEGIBLE. For numerical problems, show all your works/steps to receive full credit. Submit your answer on the Moodle ONLY. 1. Question 1: INCOME STATEMENT (IN MILL$): Oct 1, 2018 ---Sept 30, 2019 Revenue = 400; Gross Profit Margin = 30%; Operating Expenses (before depreciation) = 20; Depreciation = 20; Interest = 10; Average Tax Rate =40%; Preferred Dividend = 5; Common Dividend= 7; # of shares outstanding=10 million; Per Share Price of Common Stock = $50.00 BALANCE SHEET (IN MILL$): September 30, 2019 Cash = 5; A/R = 20; Inventory = 55; Net Fixed Asset = 120; Accounts Payable= 10; Accrued Wages =5; Notes Payable = 5; Bonds (@5%)=80; Preferred Stock =10; Common Equity----Common Stock ($1 par = 10, Paid-in-Capital = 10, Retained Earnings = 70. PREPARE AN INCOME STATEMENT & BALANCE SHEET BASED ON THE INFO ABOVE INCOME STATEMENT Answer the following questions based on your answer above: a) EPS ? P/ E P /B= b) Net Profit Margin = ROA = ROE= c) Net Cash Flow= d) Quick Ratio = e) Current Ratio= f) Debt-to-Asset Ratio= g) Inventory Turnover = h) Turnover=SALES/TA = i) Days Sales Outstanding 2. Here is the DuPont info on HCSH and its industry. ROE = NPM X . EQUITY MULTIPLIER DU PONT (CORRIGAN): 14% X 2 2.47 3% 3.1% 2.33 X X DU PONT (INDUSTRY); 18% X 2.35 You are the Financial Manager of this company. Based on the info above, which are of businesses you would be most concerned with? In trying to solve this problem, what subcomponents you will examine further? Give examples