Types describes four dimensions of innovation: Product vs Process, Radical vs Incremental, Architectural vs Component, and Competence Enhancing or not. An innovative product or process can be described, for example, as a combination of incremental, architectural, and competence enhancing. The view of any pattern may be different for the user than for the producer.

Pattern of innovation can be described by an S shaped curve for production by innovator and a different S curve for adoption of innovation by user. These S curves provide a time frame for innovation but not exact predictions.

According to WSJ article which I provide and apply the four type concepts from producers and users view of innovations of each product in the case. Describe the pattern of adoption implication of your analysis for the innovative product or process in your two-page paper(Microsoft Word). (Please use the keyboard)

WSJ article:Daimler to Separate Its Trucks Business From Mercedes-Benz Cars

Auto maker hopes truck-making spinoff will boost valuation of its businesses

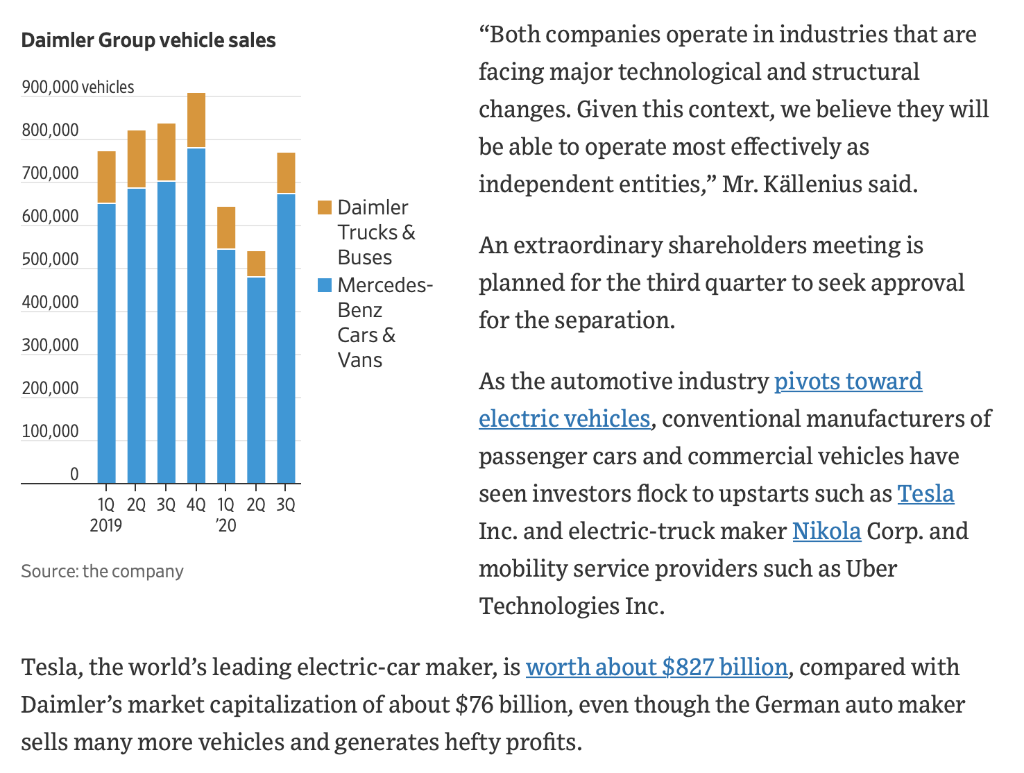

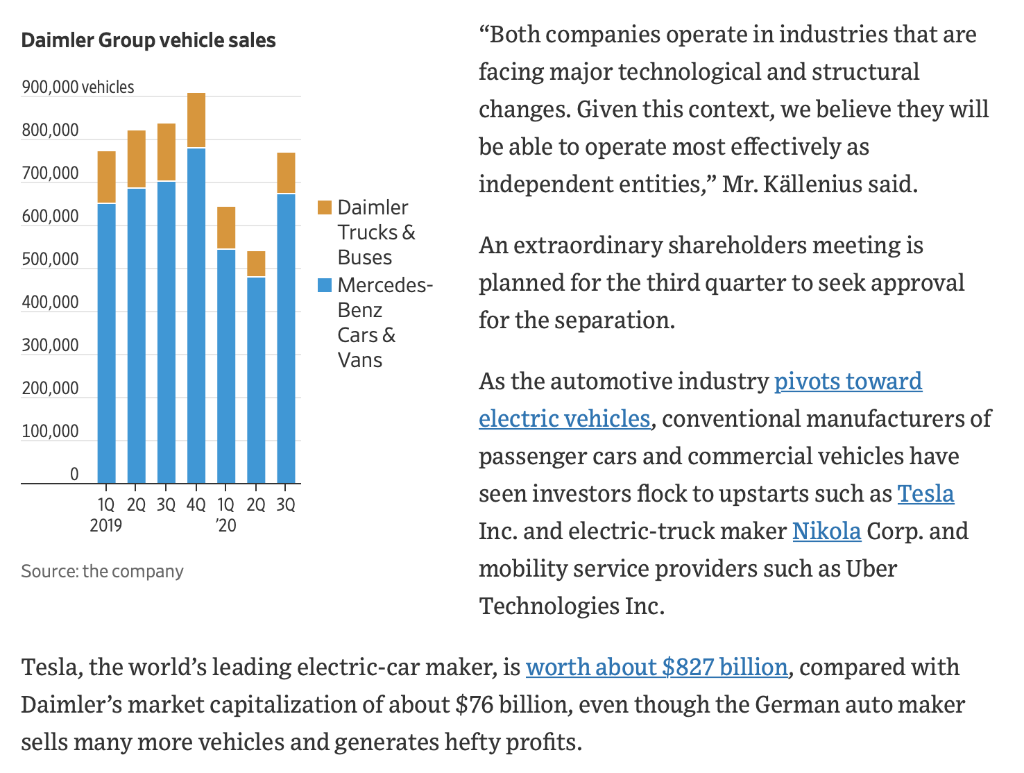

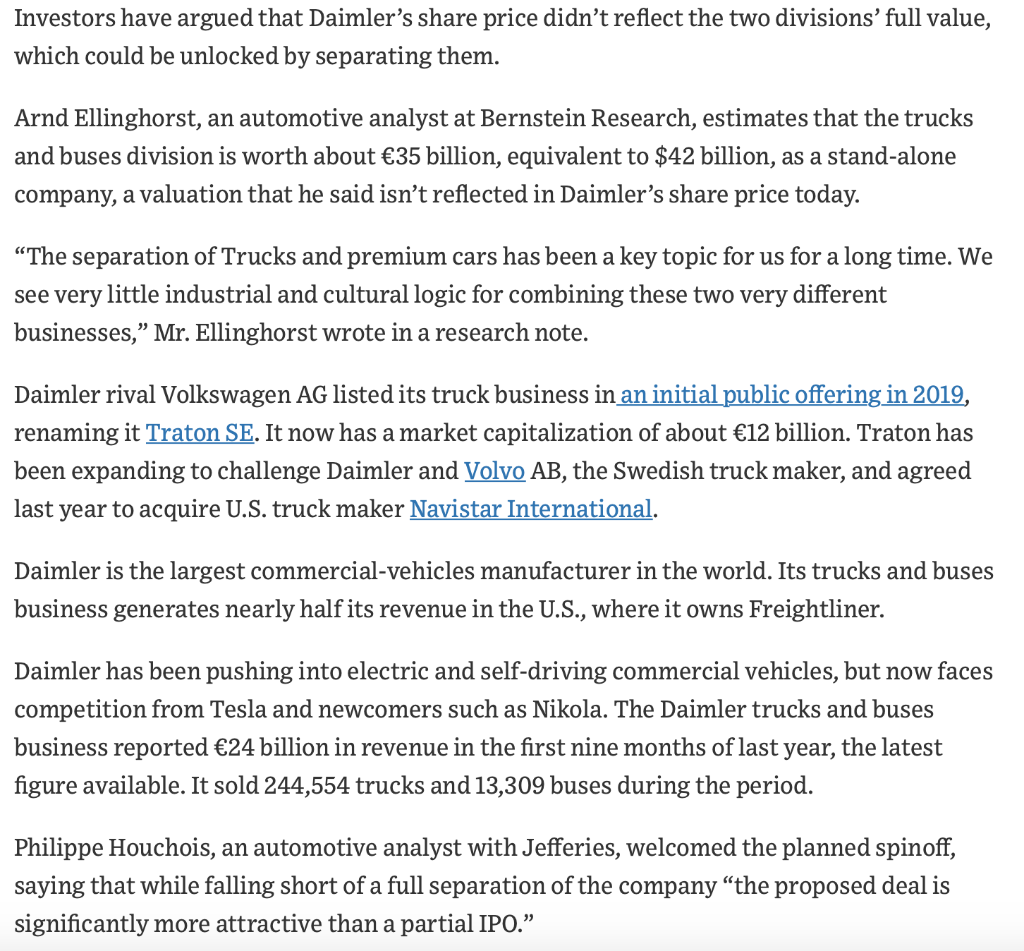

BERLIN, Daimler AG DMLRY 0.85% A plans to spin off its trucks business, in a move highlighting how conventional auto makers are under pressure to boost their stock-market value. Daimler said Wednesday it would hand over a "significant majority of shares in its business that makes trucks and buses to company shareholders by the end of the year. It also plans to eventually make Mercedes-Benz the name of the car-making business, which in future would focus on developing luxury electric cars and automotive software. Investors applauded the news, driving Daimler's shares up nearly 9% in trading in Frankfurt. Echoing arguments that investors have made for years, Daimler's top executive, Ola Kllenius, said the two vehicle businesses were quite distinct, with different customers, technologies and financial requirements. Daimler Group vehicle sales 900,000 vehicles Both companies operate in industries that are facing major technological and structural changes. Given this context, we believe they will be able to operate most effectively as independent entities, Mr. Kllenius said. 800,000 700,000 600,000 500,000 Daimler Trucks & Buses Mercedes- Benz Cars & Vans An extraordinary shareholders meeting is planned for the third quarter to seek approval for the separation. 400,000 300,000 200,000 100,000 0 10 20 30 40 10 20 30 2019 20 As the automotive industry pivots toward electric vehicles, conventional manufacturers of passenger cars and commercial vehicles have seen investors flock to upstarts such as Tesla Inc. and electric-truck maker Nikola Corp. and mobility service providers such as Uber Technologies Inc. Source: the company Tesla, the world's leading electric-car maker, is worth about $827 billion, compared with Daimler's market capitalization of about $76 billion, even though the German auto maker sells many more vehicles and generates hefty profits. Investors have argued that Daimler's share price didn't reflect the two divisions' full value, which could be unlocked by separating them. Arnd Ellinghorst, an automotive analyst at Bernstein Research, estimates that the trucks and buses division is worth about 35 billion, equivalent to $42 billion, as a stand-alone company, a valuation that he said isn't reflected in Daimler's share price today. "The separation of Trucks and premium cars has been a key topic for us for a long time. We see very little industrial and cultural logic for combining these two very different businesses, Mr. Ellinghorst wrote in a research note. Daimler rival Volkswagen AG listed its truck business in an initial public offering in 2019, renaming it Traton SE. It now has a market capitalization of about 12 billion. Traton has been expanding to challenge Daimler and Volvo AB, the Swedish truck maker, and agreed last year to acquire U.S. truck maker Navistar International. Daimler is the largest commercial-vehicles manufacturer in the world. Its trucks and buses business generates nearly half its revenue in the U.S., where it owns Freightliner. Daimler has been pushing into electric and self-driving commercial vehicles, but now faces competition from Tesla and newcomers such as Nikola. The Daimler trucks and buses business reported 24 billion in revenue in the first nine months of last year, the latest figure available. It sold 244,554 trucks and 13,309 buses during the period. Philippe Houchois, an automotive analyst with Jefferies, welcomed the planned spinoff, saying that while falling short of a full separation of the company the proposed deal is significantly more attractive than a partial IPO. Corrections & Amplifications Daimler's trucks and buses business recorded 24 billion in revenue and sold 244,554 trucks and 13,309 buses in the first nine months of last year. An earlier version of this article incorrectly attributed those results to the first three months of last year. (Corrected on Feb. 3.)