Tyre Recycling Inc. (TRI) operates a tire recycling plant in Murdochville, QC. Three years ago it acquired all of the shares of Tyre Distributors

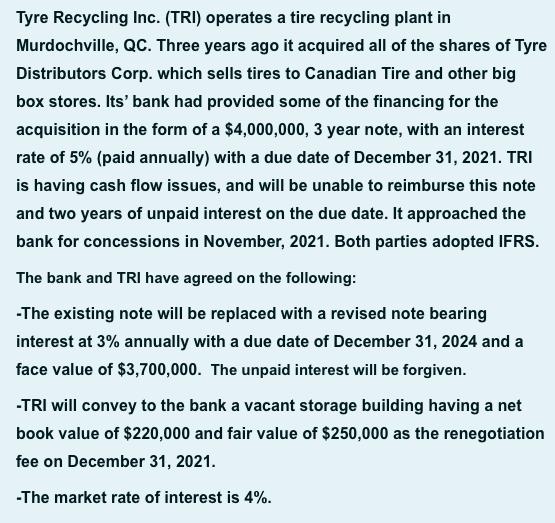

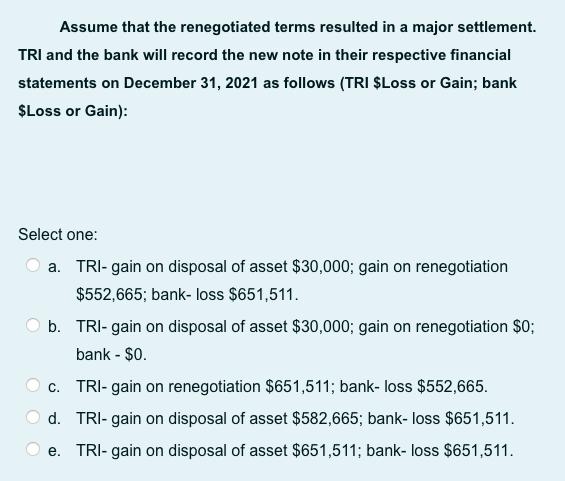

Tyre Recycling Inc. (TRI) operates a tire recycling plant in Murdochville, QC. Three years ago it acquired all of the shares of Tyre Distributors Corp. which sells tires to Canadian Tire and other big box stores. Its' bank had provided some of the financing for the acquisition in the form of a $4,000,000, 3 year note, with an interest rate of 5% (paid annually) with a due date of December 31, 2021. TRI is having cash flow issues, and will be unable to reimburse this note and two years of unpaid interest on the due date. It approached the bank for concessions in November, 2021. Both parties adopted IFRS. The bank and TRI have agreed on the following: -The existing note will be replaced with a revised note bearing interest at 3% annually with a due date of December 31, 2024 and a face value of $3,700,000. The unpaid interest will be forgiven. -TRI will convey to the bank a vacant storage building having a net book value of $220,000 and fair value of $250,000 as the renegotiation fee on December 31, 2021. -The market rate of interest is 4%. Assume that the renegotiated terms resulted in a major settlement. TRI and the bank will record the new note in their respective financial statements on December 31, 2021 as follows (TRI $Loss or Gain; bank $Loss or Gain): Select one: a. TRI- gain on disposal of asset $30,000; gain on renegotiation $552,665; bank- loss $651,511. b. TRI- gain on disposal of asset $30,000; gain on renegotiation $0; bank - $0. c. TRI- gain on renegotiation $651,511; bank- loss $552,665. d. TRI-gain on disposal of asset $582,665; bank-loss $651,511. e. TRI- gain on disposal of asset $651,511; bank- loss $651,511.

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer c TRI gain on renegotiation 651511 bankloss 552665 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started