Answered step by step

Verified Expert Solution

Question

1 Approved Answer

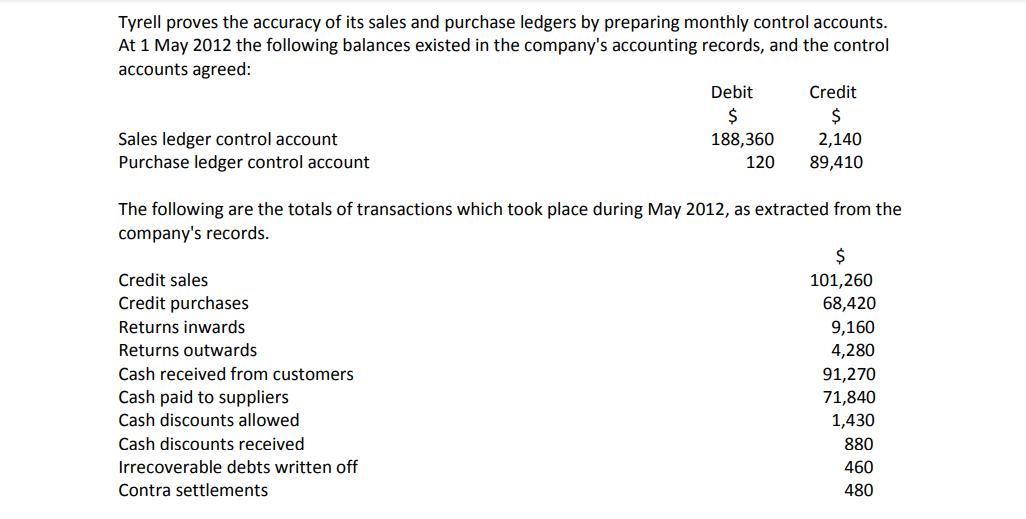

Tyrell proves the accuracy of its sales and purchase ledgers by preparing monthly control accounts. At 1 May 2012 the following balances existed in

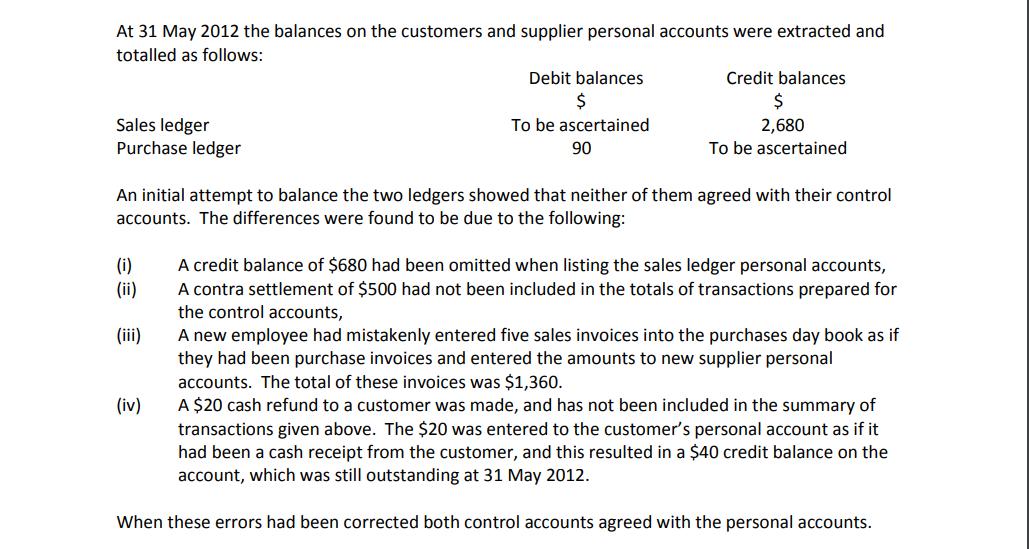

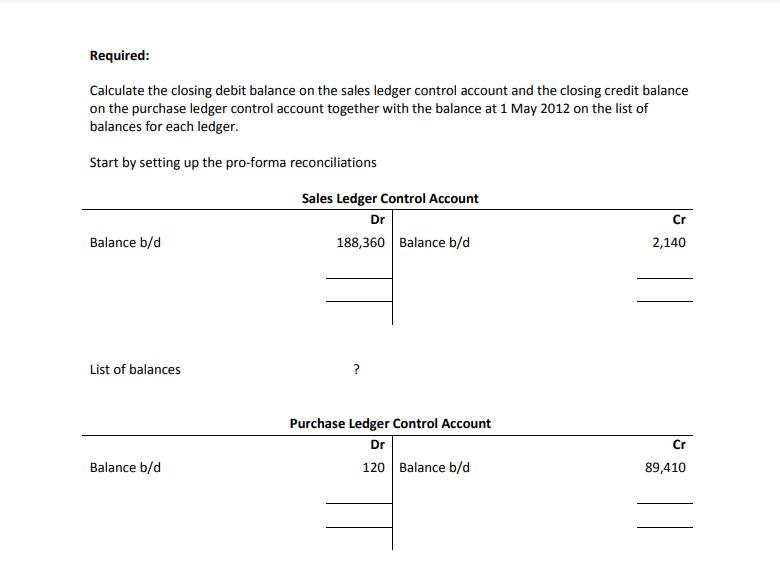

Tyrell proves the accuracy of its sales and purchase ledgers by preparing monthly control accounts. At 1 May 2012 the following balances existed in the company's accounting records, and the control accounts agreed: Credit Debit $ 188,360 $ 2,140 Sales ledger control account Purchase ledger control account 120 89,410 The following are the totals of transactions which took place during May 2012, as extracted from the company's records. $ Credit sales 101,260 Credit purchases 68,420 Returns inwards 9,160 Returns outwards 4,280 Cash received from customers 91,270 Cash paid to suppliers 71,840 Cash discounts allowed 1,430 Cash discounts received 880 Irrecoverable debts written off 460 Contra settlements 480 At 31 May 2012 the balances on the customers and supplier personal accounts were extracted and totalled as follows: Credit balances Debit balances $ $ 2,680 Sales ledger To be ascertained 90 Purchase ledger To be ascertained An initial attempt to balance the two ledgers showed that neither of them agreed with their control accounts. The differences were found to be due to the following: (i) (ii) A credit balance of $680 had been omitted when listing the sales ledger personal accounts, A contra settlement of $500 had not been included in the totals of transactions prepared for the control accounts, (iii) A new employee had mistakenly entered five sales invoices into the purchases day book as if they had been purchase invoices and entered the amounts to new supplier personal accounts. The total of these invoices was $1,360. (iv) A $20 cash refund to a customer was made, and has not been included in the summary of transactions given above. The $20 was entered to the customer's personal account as if it had been a cash receipt from the customer, and this resulted in a $40 credit balance on the account, which was still outstanding at 31 May 2012. When these errors had been corrected both control accounts agreed with the personal accounts. Required: Calculate the closing debit balance on the sales ledger control account and the closing credit balance on the purchase ledger control account together with the balance at 1 May 2012 on the list of balances for each ledger. Start by setting up the pro-forma reconciliations Sales Ledger Control Account Dr Cr Balance b/d. 188,360 Balance b/d 2,140 List of balances Purchase Ledger Control Account Dr Balance b/d 120 Balance b/d Cr 89,410

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Next enter the transaction from the list for May 2012 Cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started