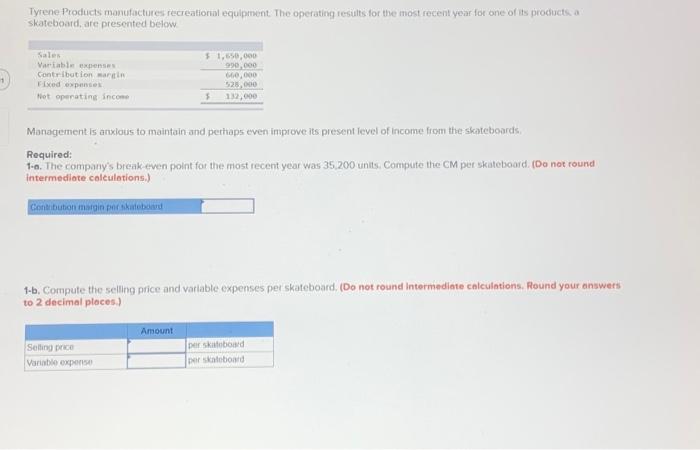

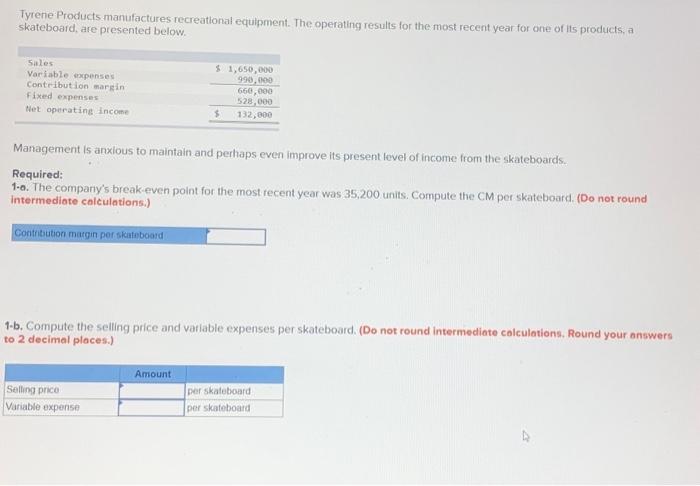

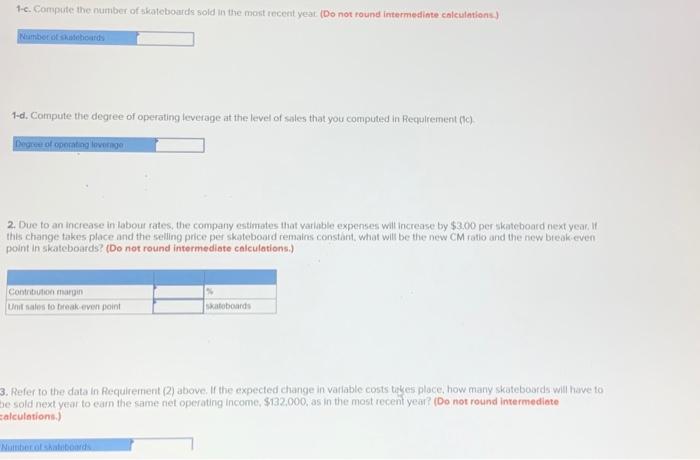

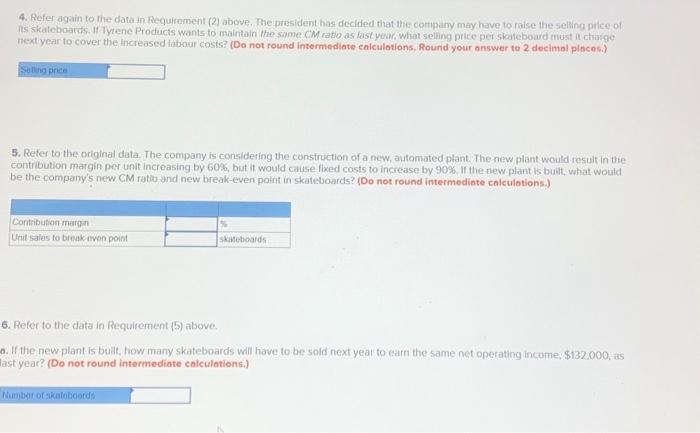

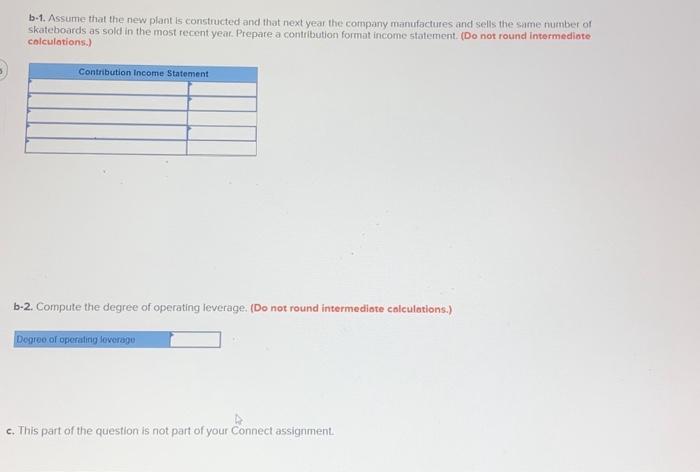

Tyrene Products manufactures recreational equipment. The operating results for the most recent year for one of its prodiucts. a skateboard, are presented betow Management is anxious to maintain and perhaps even improve its present level of income from the skateboards Required: 1-o. The company's breakeven point for the most recent year was 35,200 units. Compute the CM per skateboard. (Do not round intermediate colculations.) 1-b. Compute the selling price and varlable expenses per skateboard, (Do not round Intermediate calculations. Round your enswer: to 2 decimal pleces) Tyrene Products manufactures recreational equipment. The operating results for the most recent year for one of its products, a skateboard, are presented below. Management is anxious to maintain and perhaps even improve its present lovel of income from the skateboards. Required: 1.a. The company's break-even point for the most recent year was 35,200 units. Compute the CM per skateboard. (Do not round intermediate calculations:) 1-b. Compute the selling price and variable expenses per skateboard. (Do not round intermediate calculations. Round your answers - 2 decimal places.) 1-c. Compute the number of skateboards sold in the mont iecent year (Do not round intermedinte calculations) 1-d. Compute the degree of operating leverage at the level of sales that you computed in Requirement (ic) 2. Due to an increase in labour rates, the company estimates that varlable expenses wilt increase by $3.00 per skateboard next year. If this change takes place and the selling price per skateboord remains constant, what will be the new CM ratio and the new break:even point in skateboards? (Do not round intermediote calculations.) Refer to the data in Requirement (2) above. If the expected change in varlable costs tayes ploce, how many skateboards will have to e sold next yetar to earn the same net operating income, $132,000, as in the most recent year? (Do not round intermediate alculations.) 4. Refer again to the data in Requirement (2) above. The president has decided that the company may have to raise the selling price of Its skateboards. If Tytene Producis wants to maintain the same. CM ratio as last year, what seling ptice per skateboard mist it chinge next year to cover the increased tabour costs? (Do not round intermediate calculotions, Round your onswer to 2 decimol plnces.) 5. Reter to the original data. The company is considesing the construction of a new, automated plant. The new plant would result in the contribution margin per unit increasing by 60%, but it would cause foced costs to increase by 90%. If the new plant is built, what would be the company's new CM ratio and new break-even point in skateboards? (Do not round intermediate calculations.) Refer to the data in Requirement (5) above If the new plant is bull, how many skateboards will have to be sold next yeat to carn the same net operating income; \$132.000, as st yeat? (Do not round intermediote calculotions.) b-1. Assume that the new plant is constructed and that next year the company manufactures and sells the same number of skateboards as sold in the most recent yeat. Prepare a contribution format income statement. (Do not round intermediote colculotions.) b-2. Compute the degree of operating leverage: (Do not round intermediote calculations.) c. This part of the question is not part of your Connect assignment