Question

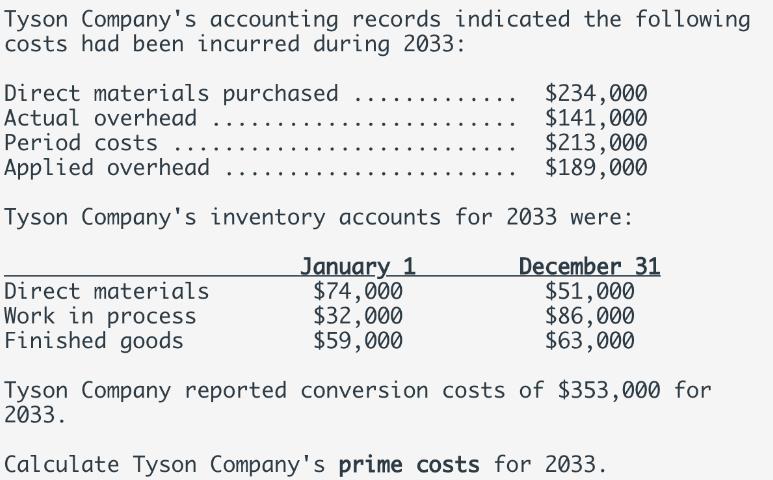

Tyson Company's accounting records indicated the following costs had been incurred during 2033: Direct materials purchased Actual overhead ... Period costs $213,000 Applied overhead

Tyson Company's accounting records indicated the following costs had been incurred during 2033: Direct materials purchased Actual overhead ... Period costs $213,000 Applied overhead $189,000 Tyson Company's inventory accounts for 2033 were: January 1 $74,000 $32,000 $59,000 Direct materials Work in process Finished goods ... $234,000 $141,000 December 31 $51,000 $86,000 $63,000 Tyson Company reported conversion costs of $353,000 for 2033. Calculate Tyson Company's prime costs for 2033.

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Tyson Companys prime costs for 2033 we need to determi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Thomas Edmonds, Christopher Edmonds, Bor Yi Tsay, Philip Olds

8th edition

978-1259569197

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App