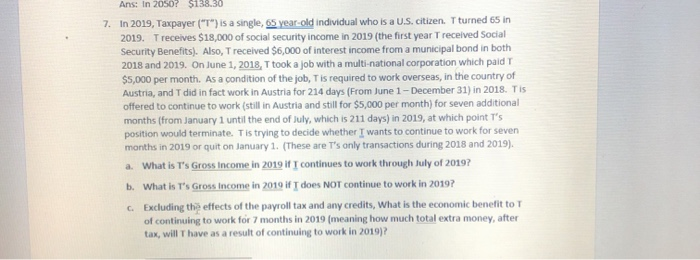

u 2015, Taxpayer is a single, year old individual who ka US. cit . Turned 65 in 2019Treceives $18,000 of social security income in 2019 (the first year received Social Security Benes). Also, Treceived $6,000 of interest income from a municipal bond in both 2015 and 2019. Onune 2011 Took a job with a multinational corporation which pard $5,000 per month. As condition of the Tis required to work w as, in the country of n ded in fact work in Austria for 14 days from 1-December 31 2018 TIS offered to continue to work in Austria and still for $.00 per month for seven additional months from January untithe end of which is 211 days) in 2019, at which point's position wouldert istrito d e whether wants to continue to work for even months in 2019 ton nay(These are is only transactions during 2013 and 2019) What is so me in 2010 Totes to work thuyo 2012 What it's weir d contine to work in 20191 Excluding the effects of the p rotax and credits What is the economic benetton of continuing to work for months in 2019 mening how much total extra money, after tax will have a result of continuing to work in 2019? Ans: In 2050? $138.30 7. In 2019, Taxpayer ("T") is a single, 65 year-old individual who is a U.S. citizen. Tturned 65 in 2019. Treceives $18,000 of social security income in 2019 (the first year Treceived Social Security Benefits). Also, Treceived $6,000 of interest income from a municipal bond in both 2018 and 2019. On June 1, 2018, T took a job with a multi-national corporation which paid T $5,000 per month. As a condition of the job, Tis required to work overseas, in the country of Austria, and T did in fact work in Austria for 214 days (From June 1-December 31) in 2018. Tis offered to continue to work (still in Austria and still for $5,000 per month) for seven additional months (from January 1 until the end of July, which is 211 days) in 2019, at which point t's position would terminate. Tis trying to decide whether I wants to continue to work for seven months in 2019 or quit on January 1. (These are T's only transactions during 2018 and 2019). a. What is T's Gross income in 2019 if I continues to work through July of 2019? b. What is T's Gross income in 2019 if T does NOT continue to work in 2019? c Excluding the effects of the payroll tax and any credits, What is the economic benefit to T of continuing to work for 7 months in 2019 (meaning how much total extra money, after tax, will have as a result of continuing to work in 2019)? u 2015, Taxpayer is a single, year old individual who ka US. cit . Turned 65 in 2019Treceives $18,000 of social security income in 2019 (the first year received Social Security Benes). Also, Treceived $6,000 of interest income from a municipal bond in both 2015 and 2019. Onune 2011 Took a job with a multinational corporation which pard $5,000 per month. As condition of the Tis required to work w as, in the country of n ded in fact work in Austria for 14 days from 1-December 31 2018 TIS offered to continue to work in Austria and still for $.00 per month for seven additional months from January untithe end of which is 211 days) in 2019, at which point's position wouldert istrito d e whether wants to continue to work for even months in 2019 ton nay(These are is only transactions during 2013 and 2019) What is so me in 2010 Totes to work thuyo 2012 What it's weir d contine to work in 20191 Excluding the effects of the p rotax and credits What is the economic benetton of continuing to work for months in 2019 mening how much total extra money, after tax will have a result of continuing to work in 2019? Ans: In 2050? $138.30 7. In 2019, Taxpayer ("T") is a single, 65 year-old individual who is a U.S. citizen. Tturned 65 in 2019. Treceives $18,000 of social security income in 2019 (the first year Treceived Social Security Benefits). Also, Treceived $6,000 of interest income from a municipal bond in both 2018 and 2019. On June 1, 2018, T took a job with a multi-national corporation which paid T $5,000 per month. As a condition of the job, Tis required to work overseas, in the country of Austria, and T did in fact work in Austria for 214 days (From June 1-December 31) in 2018. Tis offered to continue to work (still in Austria and still for $5,000 per month) for seven additional months (from January 1 until the end of July, which is 211 days) in 2019, at which point t's position would terminate. Tis trying to decide whether I wants to continue to work for seven months in 2019 or quit on January 1. (These are T's only transactions during 2018 and 2019). a. What is T's Gross income in 2019 if I continues to work through July of 2019? b. What is T's Gross income in 2019 if T does NOT continue to work in 2019? c Excluding the effects of the payroll tax and any credits, What is the economic benefit to T of continuing to work for 7 months in 2019 (meaning how much total extra money, after tax, will have as a result of continuing to work in 2019)