Question

u are advising a client on her retirement planning. Her current wealth is $1,000,000 and will be invested in risk free asset with 4% annual

u are advising a client on her retirement planning. Her current wealth is $1,000,000 and will be invested in risk free asset with 4% annual return and risky asset with 10% annual return. The standard deviation for the risky asset return is 20%. Her retirement planning horizon is 10 years and is concerned about a negative wealth at the end of 10 years.

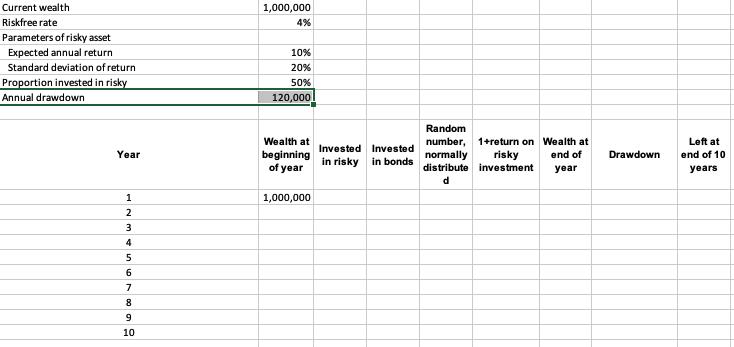

a. Assume that her annual drawdown from the retirement wealth is $120,000 and will keep a 50% in the risky asset and 50% in the risk free asset. Use simulation to find the wealth at the end of 10 years;

b. To lower the probability of having a negative wealth at the end of 10 years, she may either reduce her annual drawdown to $100,000 or to increase her investment in higher return risky asset to 65%. By changing the parameters to part), assess which is more effect on the wealth at the end of 10 years, reducing annual drawdown or increase investment to higher return risky asset?

Data for this question:

Current wealth Riskfree rate Parameters of risky asset Expected annual return Standard deviation of return Proportion invested in risky Annual drawdown Year 1 N345 2 6 7 8 9 10 1,000,000 4% 10% 20% 50% 120,000 Wealth at beginning of year 1,000,000 Invested Invested in risky in bonds Random number, 1+return on normally risky distribute investment d Wealth at end of year Drawdown Left at end of 10 years

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the clients retirement planning scenario we will use simulation to estimate the wealth at the end of 10 years Here are the given data and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started