Answered step by step

Verified Expert Solution

Question

1 Approved Answer

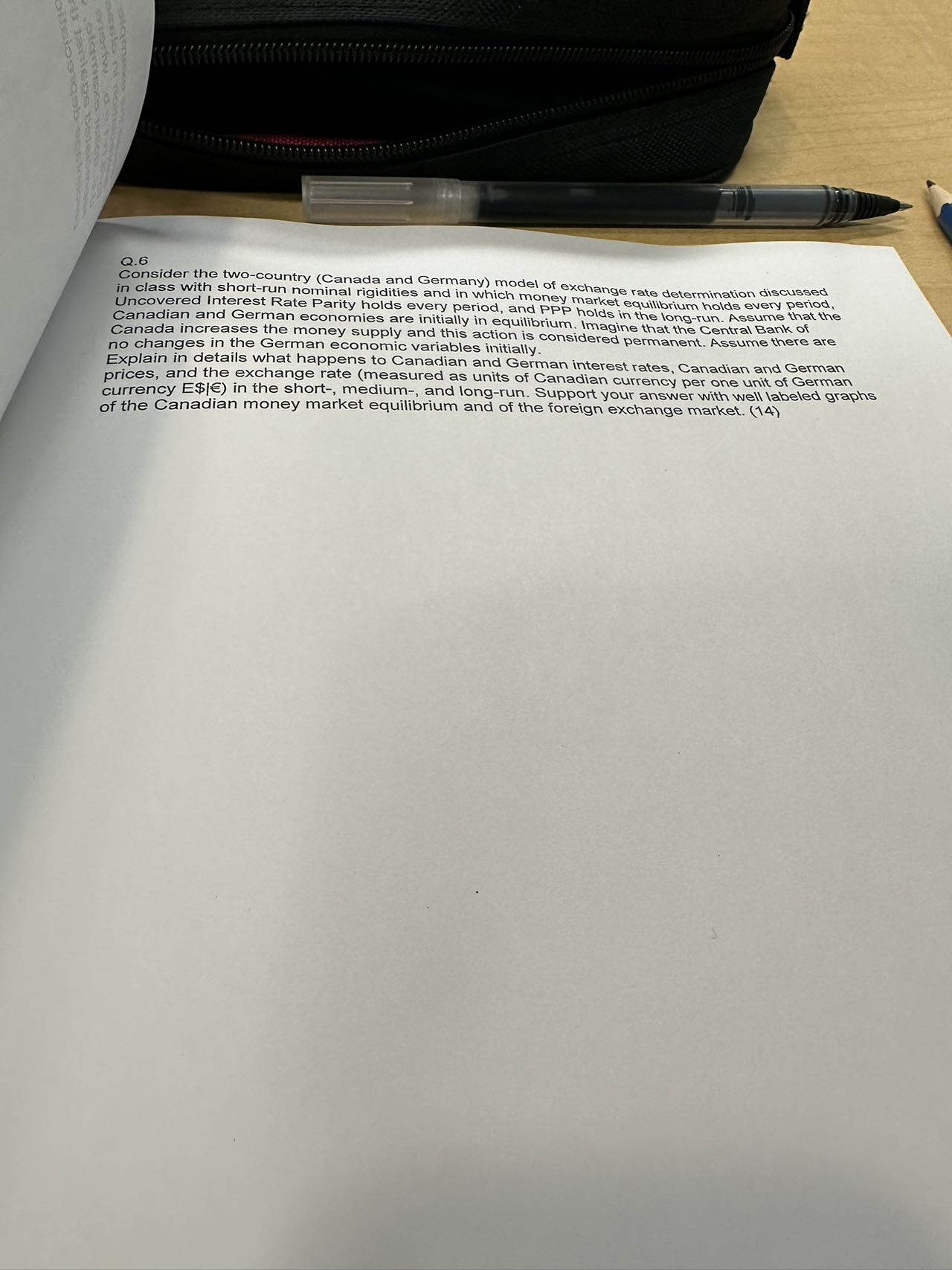

u jan Q.6 Consider the two-country (Canada and Germany) model of exchange rate determination discussed in class with short-run nominal rigidities and in which

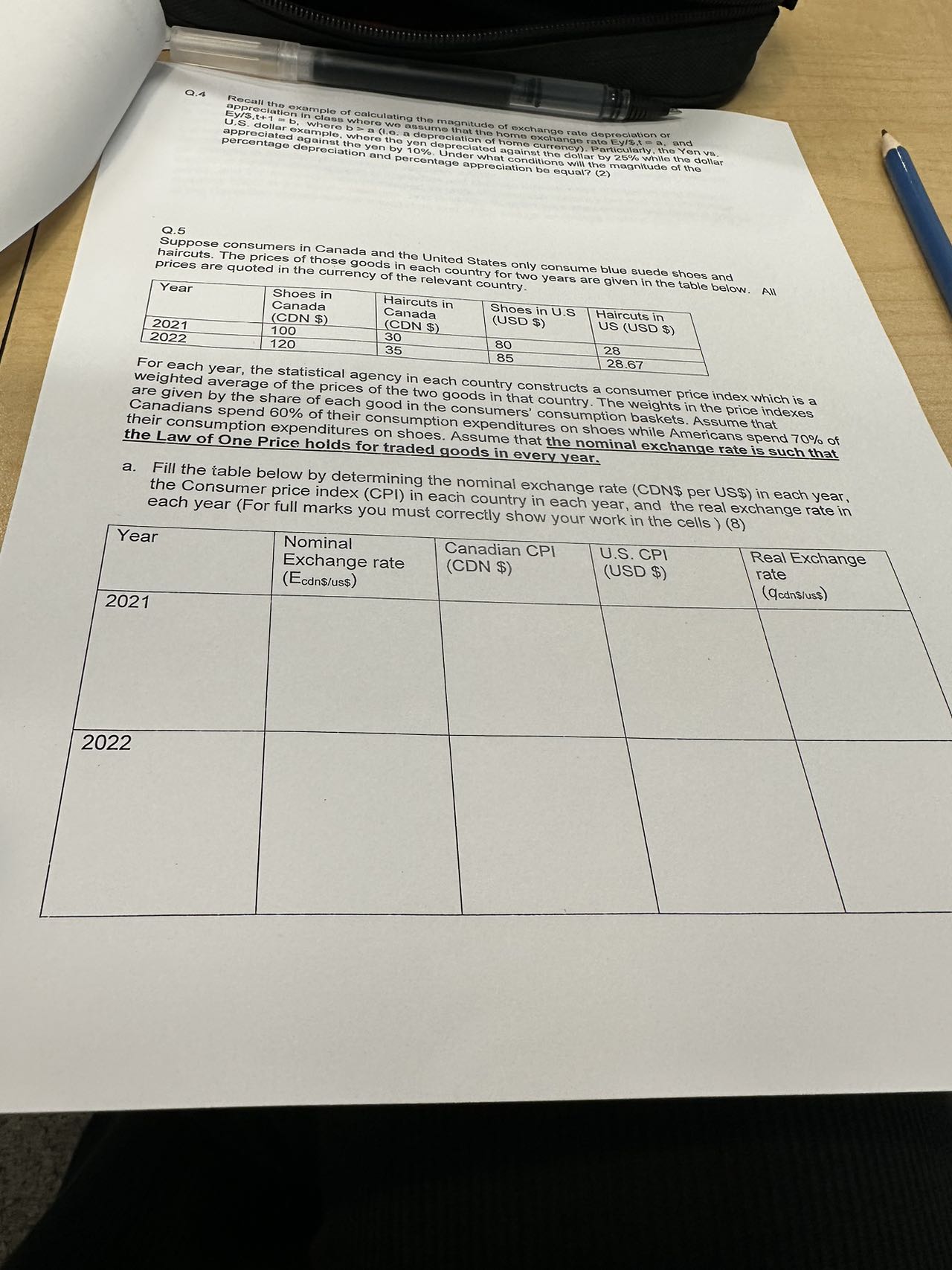

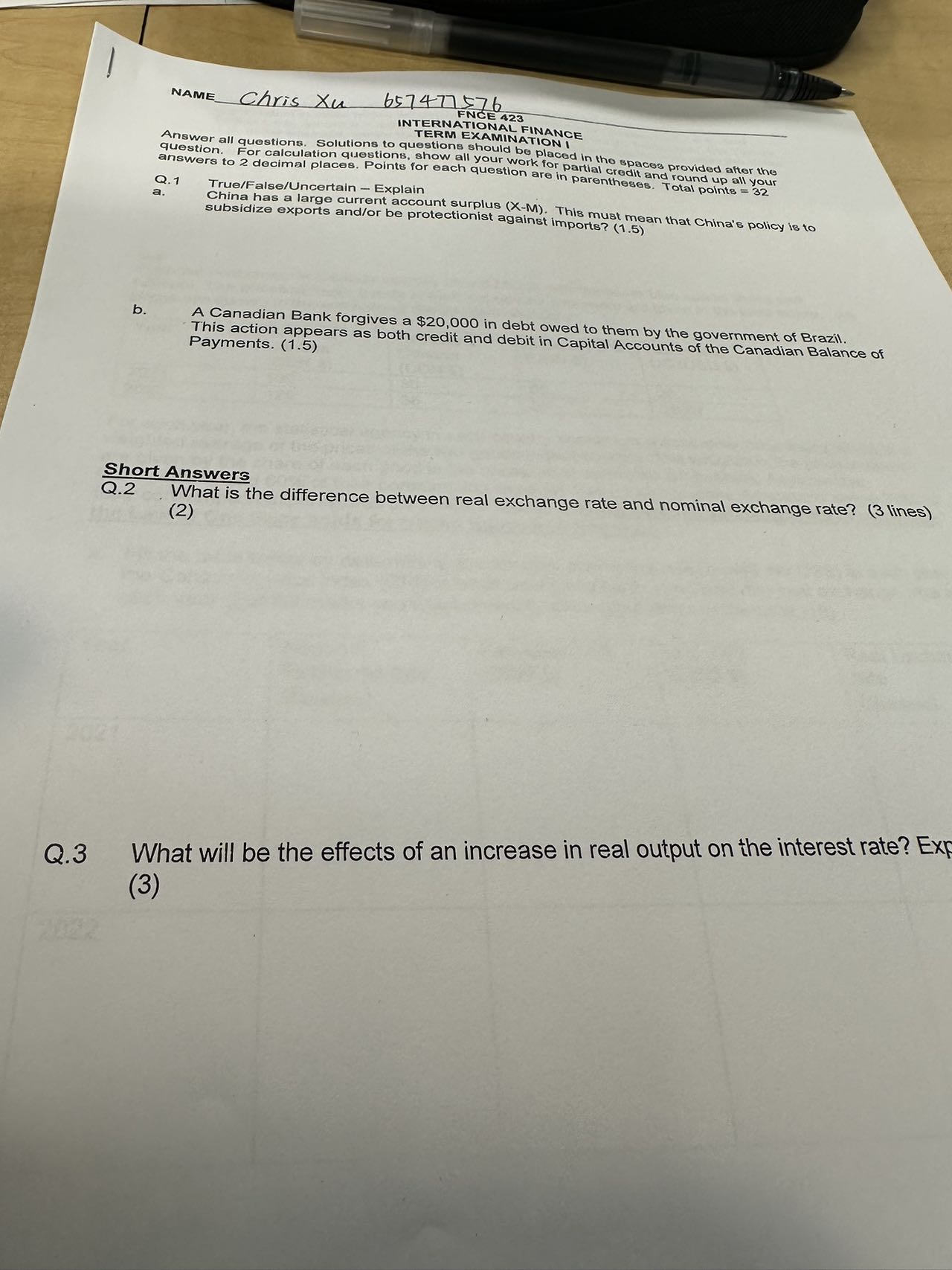

u jan Q.6 Consider the two-country (Canada and Germany) model of exchange rate determination discussed in class with short-run nominal rigidities and in which money market equilibrium holds every period. Uncovered Interest Rate Parity holds every period, and PPP holds in the long-run. Assume that the Canadian and German economies are initially in equilibrium. Imagine that the Central Bank of Canada increases the money supply and this action is considered permanent. Assume there are no changes in the German economic variables initially. Explain in details what happens to Canadian and German interest rates, Canadian and German prices, and the exchange rate (measured as units of Canadian currency per one unit of German currency E$) in the short-, medium-, and long-run. Support your answer with well labeled graphs of the Canadian money market equilibrium and of the foreign exchange market. (14) Q.4 2021 Q.5 Suppose consumers in Canada and the United States only consume blue suede shoes and haircuts. The prices of those goods in each country for two years are given in the table below. prices are quoted in the currency of the relevant country. Year 2021 2022 Year 2022 Recall the example of calculating the magnitude of exchange rate depreciate a appreciation in where we assume that the home exchange rate Ey/s.ta, and Ey/$.t+1 a t U.S. dollar example, where the yen depreciated against the dollar by 25% while the dollar b>a (1.o, a depreciation of home currency). Particularly, the Yon vs. percentage depreciation and percentage appreciation be equal? (2) of the Shoes in Canada (CDN $) 100 12 Haircuts in Canada (CDN $) 30 35 Shoes in U.S (USD $) 80 85 For each year, the statistical agency in each country constructs a consumer price index which is a weighted average of the prices of the two goods in that country. The weights in the price indexes are given by the share of each good in the consumers' consumption baskets. Assume that Canadians spend 60% of their consumption expenditures on shoes while Americans spend 70% of their consumption expenditures on shoes. Assume that the nominal exchange rate is such that the Law of One Price holds for traded goods in every year. Nominal Exchange rate (Ecdn$/us$) a. Fill the table below by determining the nominal exchange rate (CDN$ per US$) in each year, the Consumer price index (CPI) in each country in each year, and the real exchange rate in each year (For full marks you must correctly show your work in the cells) (8) Haircuts in US (USD $) 28 28.67 Canadian CPI (CDN $) All U.S. CPI (USD $) Real Exchange rate (qcdns/uss) Q.3 b. Chris Xu 657477576 FNCE 423 INTERNATIONAL FINANCE TERM EXAMINATION I Answer all questions. Solutions to questions should be placed in the spaces provided after the answers to 2 decimal places. Points for each question are in parentheses. Total points = 32 For calculation questions, show all your work for partial credit and round up all your question. NAME Q.1 a. True/False/Uncertain - Explain China has a large current account surplus (X-M). This must mean that China's policy is to subsidize exports and/or be protectionist against imports? (1.5) A Canadian Bank forgives a $20,000 in debt owed to them by the government of Brazil. This action appears as both credit and debit in Capital Accounts of the Canadian Balance of Payments. (1.5) Short Answers Q.2 What is the difference between real exchange rate and nominal exchange rate? (3 lines) (2) What will be the effects of an increase in real output on the interest rate? Exp (3)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer 6 Model Assumptions TwoCountry Model We consider only Canada and Germany Nominal Rigidities Shortterm sticky prices Money Market Equilibrium Money supply equals money demand in both countries i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started