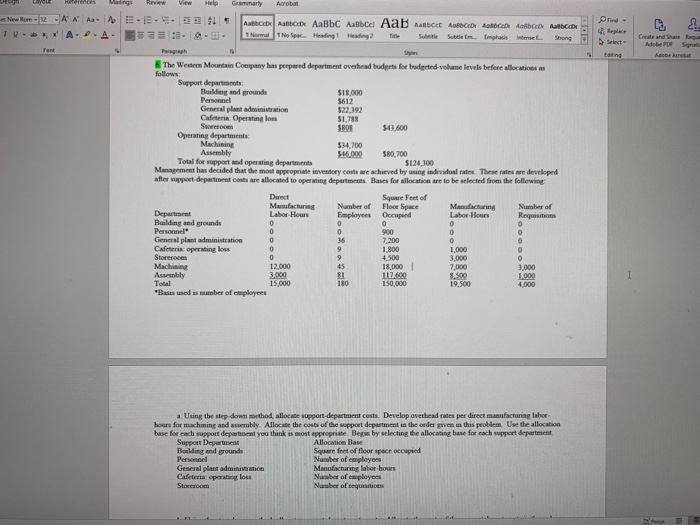

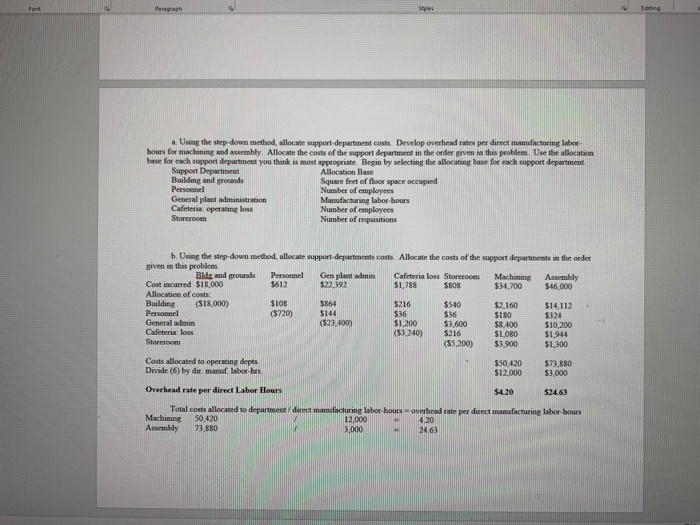

U Malings Review View Help Grammarly Acrobat DE L New Rom TV E - ANA A. -A- T - 9- u bo ABC Aalbcd AaB Aabe AD odce About Ab Normal No Spa Headingt Heading 2 Suite Suble Imphasiswa Strong Create and Share to Adobe PDF Signal & The Western Mountain Company has prepared department overhead budget for bodgeted volume levels before allocations as follows Support departments Building and grounds SIR.000 Personnel 5612 General plant administration $22.392 Cafeteria Operating loss $1.788 $43.500 Operating departments Machining $34.700 Assembly $16.000 $80,700 Total for support and operating departments $124.300 Management has decided that the most appropriate inventory costs are achieved by using individual rates. These rates are developed after support department costs are allocated to operating departments. Bases for allocation are to be selected from the following Direct Manfacturing Labor Hours Square Feet of Floor Space Occupied Number of Number of Employees Macturing Labores Department Building and grounds Personel 1 800 1.000 General plant administration Cafeteris operating loss Storer Machi 12.000 Aumbly Total "Bases used is number of employees 18,000 7,000 8.500 19.500 a Using the step down method, allocate support department costs Develop overhead rates per direct manufacturing labor hours for machining and assembly Allocate the cost of the apport department in the order given in this problem. Use the allocation base for each support department you think is most appropriate. Beg by selecting the allocating base for each support department Support Department Allocation Base Building and grounds Square feet of floor space occupied Number of employees General plant administration Manufacturing labor hours Cafeteria operating loss Number of employees Number of questions a. Using the step down method, allocate support department costs. Develop overhead rats per direct manufacturing labor hours for machining and assembly. Allocate the costs of the support department in the order piven in this problem. Use the allocation base for each support department you think is most appropriate. Begin by selecting the allocating base for each support department Support Department Allocation Base Building and grounds Square feet of floor space occupied Personnel Number of employees General plat administration Manufacturing labor hours Cafeteria operating loss Number of employees Storeroom Number of requisitions . Using the step down method, allocate support departments costs. Allocate the costs of the support departments in the order given in this problem Bldg and grounds Personnel Gen plantadmin Cafeteria loss Storeroom Machining Assembly Cost incurred $18,000 $612 $22392 $1.788 $808 $34,700 $16.000 Allocation of costs Building (S18,000) S864 $216 $540 $2.160 $14,112 Personnel ($720) 536 $36 $190 $124 General adann ($ 100) $1,200 $3.600 $8.400 $10.200 Cafeteria: loss $3240) $216 SL080 $1,944 Storeroom ($5,200) $3.900 $1,300 $108 5144 Costs allocated to operating depts. Divide (6) by dur, m. labor hrs. $50.420 $12.000 $73.880 $3.000 Overhead rate per direct Laber Hours $4.20 $24.63 overhead rate per direct manufacturing labor bours Total costs allocated to department de manufacturing labor bours Machining 50,420 12,000 Assembly 73.880 U Malings Review View Help Grammarly Acrobat DE L New Rom TV E - ANA A. -A- T - 9- u bo ABC Aalbcd AaB Aabe AD odce About Ab Normal No Spa Headingt Heading 2 Suite Suble Imphasiswa Strong Create and Share to Adobe PDF Signal & The Western Mountain Company has prepared department overhead budget for bodgeted volume levels before allocations as follows Support departments Building and grounds SIR.000 Personnel 5612 General plant administration $22.392 Cafeteria Operating loss $1.788 $43.500 Operating departments Machining $34.700 Assembly $16.000 $80,700 Total for support and operating departments $124.300 Management has decided that the most appropriate inventory costs are achieved by using individual rates. These rates are developed after support department costs are allocated to operating departments. Bases for allocation are to be selected from the following Direct Manfacturing Labor Hours Square Feet of Floor Space Occupied Number of Number of Employees Macturing Labores Department Building and grounds Personel 1 800 1.000 General plant administration Cafeteris operating loss Storer Machi 12.000 Aumbly Total "Bases used is number of employees 18,000 7,000 8.500 19.500 a Using the step down method, allocate support department costs Develop overhead rates per direct manufacturing labor hours for machining and assembly Allocate the cost of the apport department in the order given in this problem. Use the allocation base for each support department you think is most appropriate. Beg by selecting the allocating base for each support department Support Department Allocation Base Building and grounds Square feet of floor space occupied Number of employees General plant administration Manufacturing labor hours Cafeteria operating loss Number of employees Number of questions a. Using the step down method, allocate support department costs. Develop overhead rats per direct manufacturing labor hours for machining and assembly. Allocate the costs of the support department in the order piven in this problem. Use the allocation base for each support department you think is most appropriate. Begin by selecting the allocating base for each support department Support Department Allocation Base Building and grounds Square feet of floor space occupied Personnel Number of employees General plat administration Manufacturing labor hours Cafeteria operating loss Number of employees Storeroom Number of requisitions . Using the step down method, allocate support departments costs. Allocate the costs of the support departments in the order given in this problem Bldg and grounds Personnel Gen plantadmin Cafeteria loss Storeroom Machining Assembly Cost incurred $18,000 $612 $22392 $1.788 $808 $34,700 $16.000 Allocation of costs Building (S18,000) S864 $216 $540 $2.160 $14,112 Personnel ($720) 536 $36 $190 $124 General adann ($ 100) $1,200 $3.600 $8.400 $10.200 Cafeteria: loss $3240) $216 SL080 $1,944 Storeroom ($5,200) $3.900 $1,300 $108 5144 Costs allocated to operating depts. Divide (6) by dur, m. labor hrs. $50.420 $12.000 $73.880 $3.000 Overhead rate per direct Laber Hours $4.20 $24.63 overhead rate per direct manufacturing labor bours Total costs allocated to department de manufacturing labor bours Machining 50,420 12,000 Assembly 73.880