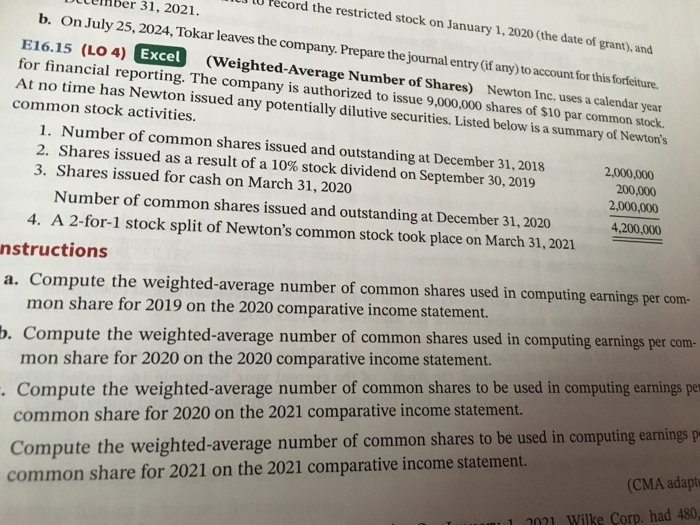

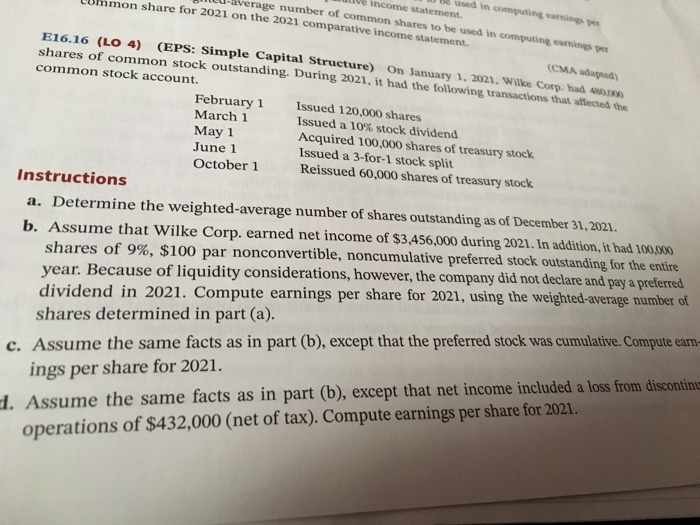

U record the restricted stock on January 1, 2020 (the date of grant), and D uinber 31, 2021. b. On July 25, 2024, Tokar leaves the company. Prepare the journal entry (if any) to account for this forfeiture. E16.15 (LO 4) Excel (Weighted Average Number of Shares) Newton Inc. uses a calendar year for financial reporting. The company is authorized to issue 9,000,000 shares of $10 par common stock. At no time has Newton issued any potentially dilutive securities. Listed below is a summary of Newton's common stock activities. 1. Number of common shares issued and outstanding at December 31, 2018 2,000,000 2. Shares issued as a result of a 10% stock dividend on September 30, 2019 200,000 3. Shares issued for cash on March 31, 2020 2,000,000 Number of common shares issued and outstanding at December 31, 2020 4. A 2-for-1 stock split of Newton's common stock took place on March 31, 2021 4,200,000 instructions a. Compute the weighted-average number of common shares used in computing earnings per com- mon share for 2019 on the 2020 comparative income statement. b. Compute the weighted average number of common shares used in computing earnings per com- mon share for 2020 on the 2020 comparative income statement. . Compute the weighted average number of common shares to be used in computing earnings pe common share for 2020 on the 2021 comparative income statement. Compute the weighted-average number of common shares to be used in computing earnings pr common share for 2021 on the 2021 comparative income statement (CMA adapt 1 2021 Wilke Corp. had 480. be used in computing live income statement U-average number of common shares to be used in computing camper Lummon share for 2021 on the 2021 comparative income statement (CMA adap E16.16 (LO 4) (EPS: Simple Capital Structure) On January 1, 2021. Wike Cory had shares of common stock outstanding. During 2021, it had the following transactions that affected the common stock account. February 1 Issued 120,000 shares Issued a 10% stock dividend Acquired 100,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 60,000 shares of treasury stock March 1 May 1 June 1 October 1 Instructions a. Determine the weighted average number of shares outstanding as of December 31, 2021. b. Assume that Wilke Corp. earned net income of $3,456,000 during 2021. In addition, it had 100.000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2021. Compute earnings per share for 2021, using the weighted average number of shares determined in part (a). c. Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earne ings per share for 2021. 1. Assume the same facts as in part (b), except that net income included a loss from discontiny operations of $432,000 (net of tax). Compute earnings per share for 2021