Answered step by step

Verified Expert Solution

Question

1 Approved Answer

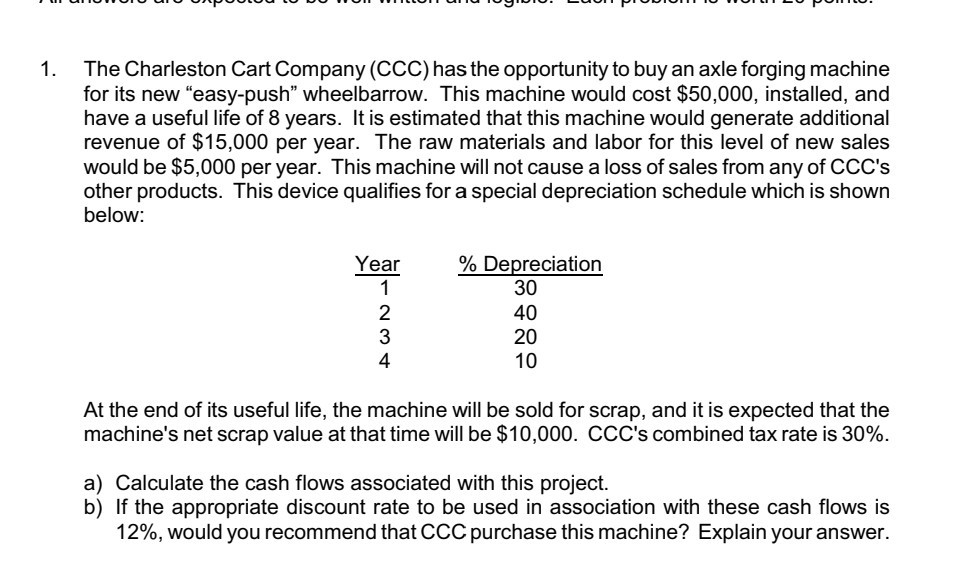

U UPUULUULU POTO. 1. The Charleston Cart Company (CCC) has the opportunity to buy an axle forging machine for its new easy-push wheelbarrow. This machine

U UPUULUULU POTO. 1. The Charleston Cart Company (CCC) has the opportunity to buy an axle forging machine for its new "easy-push" wheelbarrow. This machine would cost $50,000, installed, and have a useful life of 8 years. It is estimated that this machine would generate additional revenue of $15,000 per year. The raw materials and labor for this level of new sales would be $5,000 per year. This machine will not cause a loss of sales from any of CCC's other products. This device qualifies for a special depreciation schedule which is shown below: Year % Depreciation 30 AWN - 40 20 At the end of its useful life, the machine will be sold for scrap, and it is expected that the machine's net scrap value at that time will be $10,000. CCC's combined tax rate is 30%. a) Calculate the cash flows associated with this project. b) If the appropriate discount rate to be used in association with these cash flows is 12%, would you recommend that CCC purchase this machine? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started