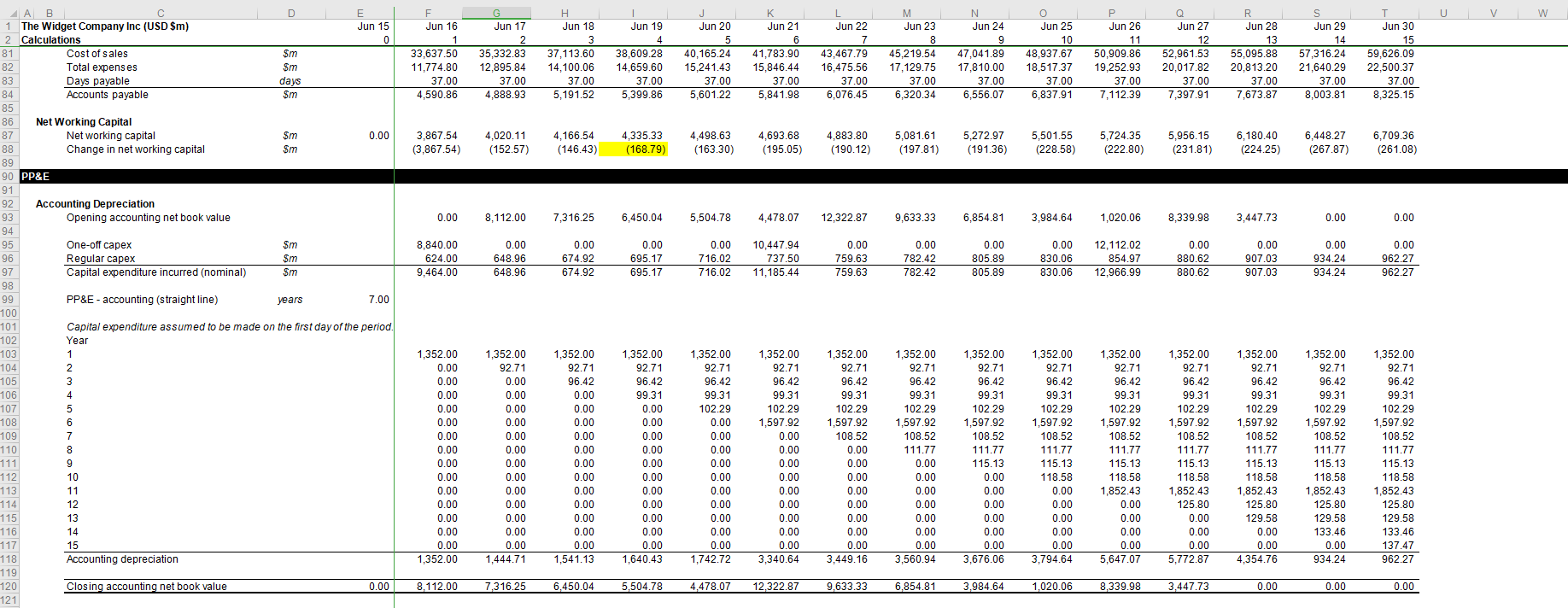

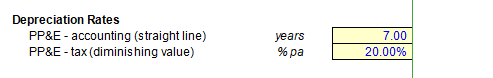

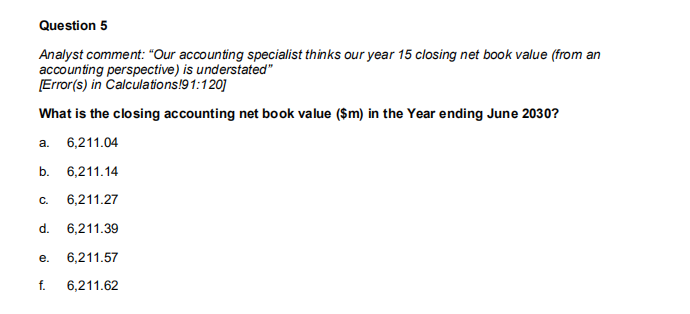

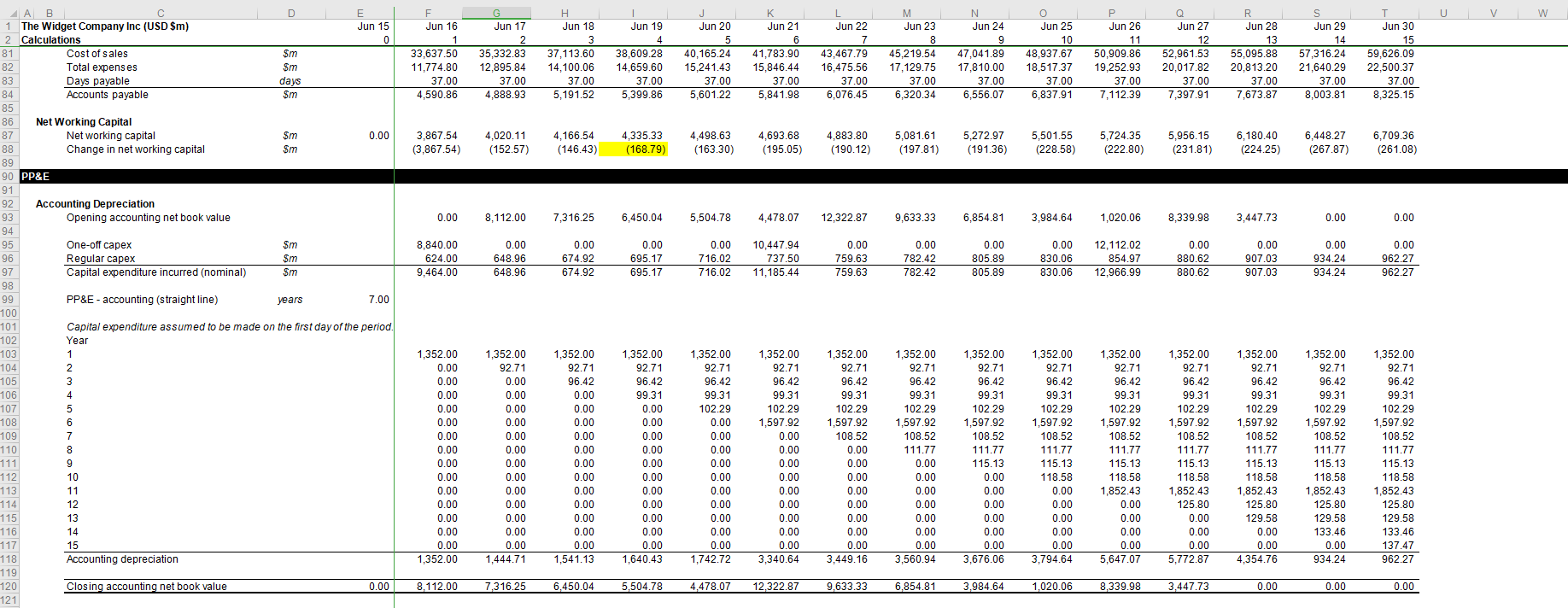

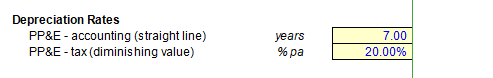

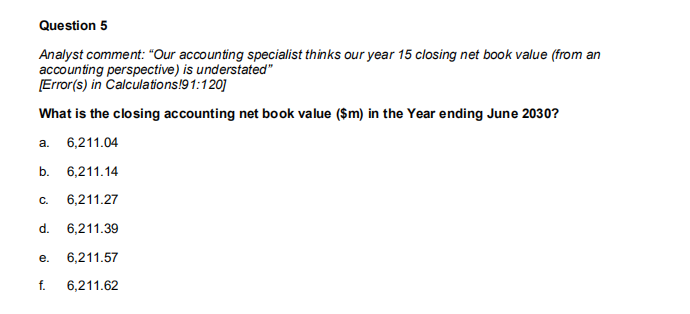

U V W E Jun 15 F Jun 16 G Jun 17 Jun 19 N Jun 24 0 Jun 25 Jun 26 4 6 7 11 81 A B 1 The Widget Company Inc (USD $m) 2 Calculations Cost of sales Total expenses Days payable Accounts payable $m $m days 33,637.50 11,774.80 37.00 4,590.86 H Jun 18 3 37,113.60 14,100.06 37.00 5,191.52 35,332.83 12,895.84 37.00 4,888.93 Jun 20 5 40,165.24 15,241.43 37.00 5,601.22 38,609.28 14,659.60 37.00 ,399.86 KL M Jun 21 Jun 22 Jun 23 8 41,783.90 43,467.7945,219.54 15,846.44 16,475.56 17,129.75 37.00 37.00 37.00 5,841.98 6,076.45 6 ,320.34 83 47,041.89 1 7,810.00 37.00 6,556.07 48,937.67 18,517.37 37.00 6,837.91 Jun 27 12 52,961.53 20,017.82 37.00 7,397.91 50,909.86 19,252.93 37.00 7,112.39 Jun 28 Jun 29 Jun 30 13 14 15 55,095.88 57,316.24 59,626.09 20,813.20 21,640.29 22,500.37 37.00 37.00 37.00 7,673.878,003.818,325.15 84 $m 5 85 0.00 4 3,867.54 (3,867.54) 4,020.11 (152.57) ,166.54 (146.43) 4,335.33 (168.79) 4,498.63 (163.30) 4,693.68 (195.05) 4,883.80 (190.12) 5,081.61 (197.81) 5,272.975,501.555,724.35 (191.36) (228.58) (222.80) 5,956.15 (231.81) 6,180.406 (224.25) ,448.276 (267.87) ,709.36 (261.08) 86 Net Working Capital Net working capital Change in net working capital 89 90 PP&E 91 92 Accounting Depreciation Opening accounting net book value 93 0.00 8,112.00 7,316.25 6,450.04 5,504.78 4,478.07 12,322.87 9,633.336,854.813,984.64 1,020.06 8,339.98 3,447.73 0.00 0.00 94 Sm 0.00 96 One-off capex Regular capex Capital expenditure incurred (nominal) Sm 8,840.00 624.00 9,464.00 0.00 648.96 648.96 0.00 674.92 674.92 0.00 695.17 695.17 0.00 716.02 716.02 10,447.94 737.50 11,185.44 0.00 759.63 759.63 782.42 782.42 0.00 805.89 805.89 0.00 830.06 830.06 12,112.02 8 54.97 12,966.99 0.00 880.62 880.62 0.00 907.03 907.03 0.00 934.24 934.24 0.00 962.27 962.27 97 Sm PP&E - accounting (straight line) years 7.00 Capital expenditure assumed to be made on the first day of the period. Year 99 100 101 102 103 104 105 106 107 108 109 1,352.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,352.00 1,352.00 92.71 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,352.00 92.71 96.42 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,541.13 1,352.00 92.71 96.42 99.31 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,640.43 1,352.00 92.71 96.42 99.31 102.29 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,352.00 92.71 96.42 99.31 102.29 1,597.92 0.00 0.00 0.00 0.00 0.00 0.00 0.00 110 111 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 0.00 0.00 0.00 0.00 0.00 0.00 0.00 3,560.94 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 0.00 0.00 0.00 0.00 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 0.00 0.00 0.00 0.00 0.00 3,794.64 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 1,852.43 0.00 0.00 0.00 0.00 5,647.07 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 1,852.43 125.80 0.00 0.00 0.00 5,772.87 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 1.852.43 125.80 129.58 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 1,852.43 125.80 129.58 133.46 0.00 934.24 1,352.00 92.71 96.42 99.31 102.29 1,597.92 108.52 111.77 115.13 118.58 1,852.43 125.80 129.58 133.46 137.47 962.27 112 113 114 0.00 0.00 0.00 0.00 0.00 0.00 0.00 115 117 118 120 0.00 1,444.71 0.00 3,340.64 0.00 3,676.06 0.00 4,354.76 Accounting depreciation 1,742.72 3,449.16 719 Closing accounting net book value 0.00 8.112.00 7.316.25 6.450.04 5,504.78 4 .478.07 12,322.87 9,633.33 6 ,854.81 3 .984.64 1,020.06 8,339.98 3.447.73 0.00 0.00 0.00 121 Depreciation Rates PP&E - accounting (straight line) PP&E - tax (diminishing value) years % pa 7.00 20.00% Question 5 Analyst comment: "Our accounting specialist thinks our year 15 closing net book value (from an accounting perspective) is understated" [Error(s) in Calculations!91:120] What is the closing accounting net book value ($m) in the Year ending June 2030? a. 6,211.04 b. 6,211.14 6,211.27 d. 6,211.39 e. 6,211.57 f. 6,211.62