Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ues any fund management company located in Muscat to solve the following questions . Assessment Type: Case analysis Part A: You are working in a

ues any fund management company located in Muscat to solve the following questions .

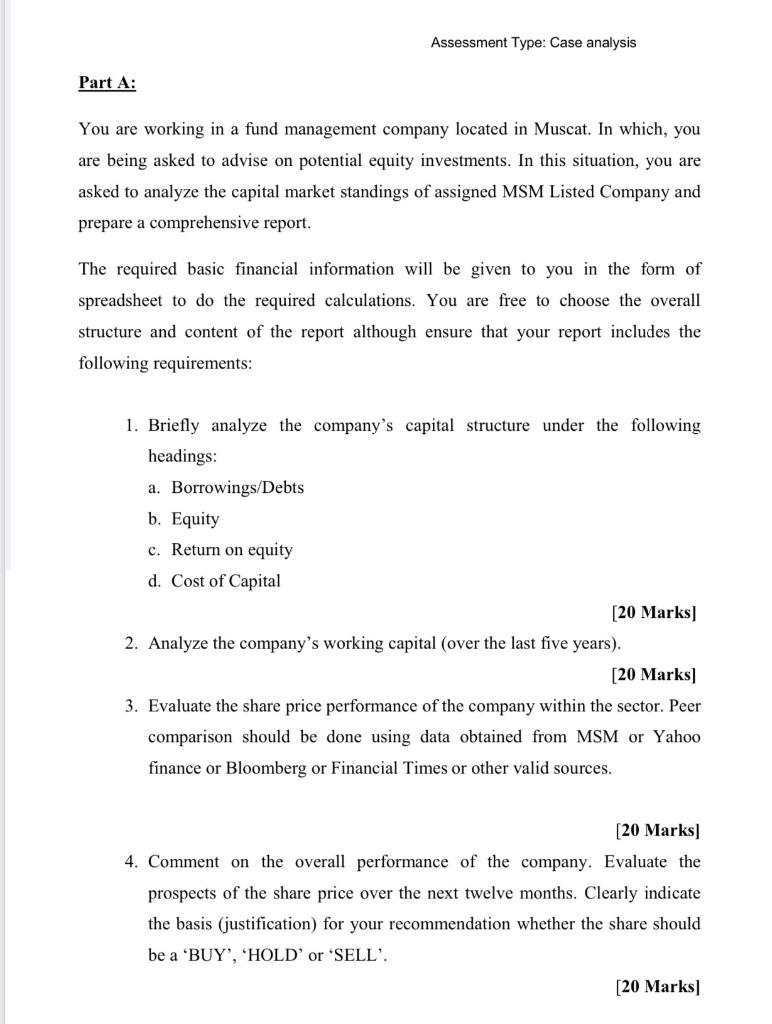

Assessment Type: Case analysis Part A: You are working in a fund management company located in Muscat. In which, you are being asked to advise on potential equity investments. In this situation, you are asked to analyze the capital market standings of assigned MSM Listed Company and prepare a comprehensive report. The required basic financial information will be given to you in the form of spreadsheet to do the required calculations. You are free to choose the overall structure and content of the report although ensure that your report includes the following requirements: 1. Briefly analyze the company's capital structure under the following headings: a. Borrowings/Debts b. Equity c. Return on equity d. Cost of Capital [20 Marks] 2. Analyze the company's working capital (over the last five years). [20 Marks) 3. Evaluate the share price performance of the company within the sector. Peer comparison should be done using data obtained from MSM or Yahoo finance or Bloomberg or Financial Times or other valid sources. [20 Marks) 4. Comment on the overall performance of the company. Evaluate the prospects of the share price over the next twelve months. Clearly indicate the basis (justification) for your recommendation whether the share should be a "BUY', 'HOLD' or 'SELL'. [20 Marks) Assessment Type: Case analysis Part A: You are working in a fund management company located in Muscat. In which, you are being asked to advise on potential equity investments. In this situation, you are asked to analyze the capital market standings of assigned MSM Listed Company and prepare a comprehensive report. The required basic financial information will be given to you in the form of spreadsheet to do the required calculations. You are free to choose the overall structure and content of the report although ensure that your report includes the following requirements: 1. Briefly analyze the company's capital structure under the following headings: a. Borrowings/Debts b. Equity c. Return on equity d. Cost of Capital [20 Marks] 2. Analyze the company's working capital (over the last five years). [20 Marks) 3. Evaluate the share price performance of the company within the sector. Peer comparison should be done using data obtained from MSM or Yahoo finance or Bloomberg or Financial Times or other valid sources. [20 Marks) 4. Comment on the overall performance of the company. Evaluate the prospects of the share price over the next twelve months. Clearly indicate the basis (justification) for your recommendation whether the share should be a "BUY', 'HOLD' or 'SELL'. [20 Marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started