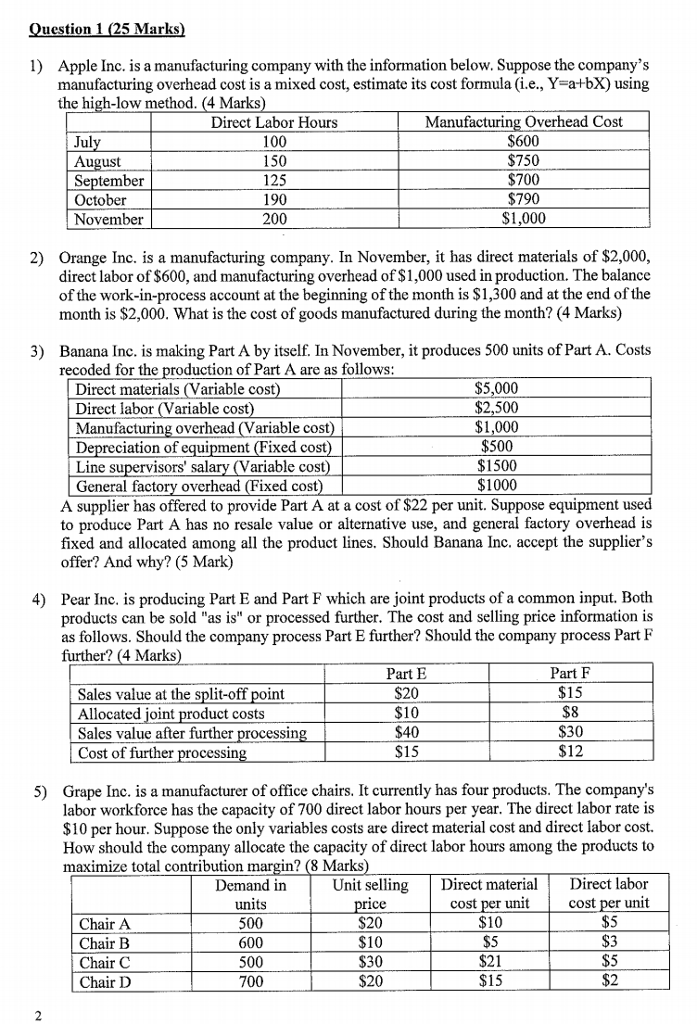

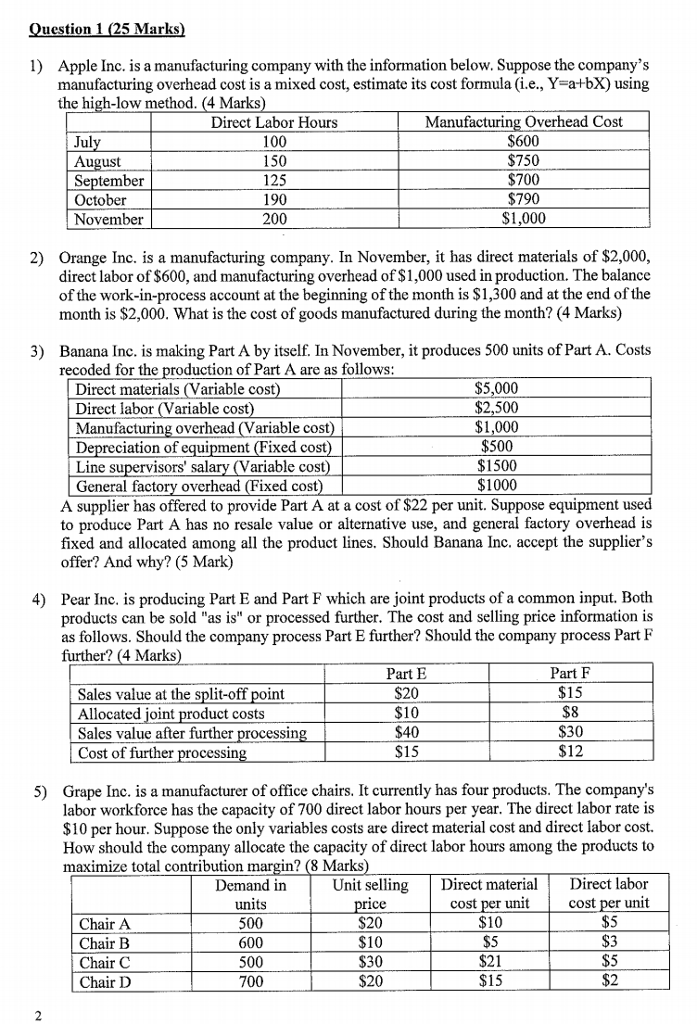

uestion 1 (25 Marks Apple Inc. is a manufacturing company with the information below. Suppose the company's manufacturing overhead cost is a mixed cost, estimate its cost formula (i.e., Y-a-+bX) using the high-low method. (4 Marks 1) Manufacturing Overhead Cost S600 $750 $700 $790 S1,000 Direct Labor Hours Jul August September October November 150 125 190 200 Orange Inc. is a manufacturing company. In November, it has direct materials of $2,000, direct labor of $600, and manufacturing overhead of $1,000 used in production. The balance of the work-in-process account at the beginning of the month is $1,300 and at the end of the month is $2,000. What is the cost of goods manufactured during the month? (4 Marks) 2) Banana Inc. is making Part A by itself. In November, it produces 500 units of Part A. Costs recoded for the production of Part A are as follows: 3) $5,000 $2,500 $1,000 $500 $1500 $1000 Direct materials (Variable cost Direct labor (Variable cost Manufacturing overhead (Variable cost Depreciation of equipment (Fixed cost Line supervisors' salary (Variable cost General factory overhead (Fixed cost A supplier has offered to provide Part A at a cost of $22 per unit. Suppose equipment used to produce Part A has no resale value or alternative use, and gencral factory overhead is fixed and allocated among all the product lines. Should Banana Inc. accept the supplier's offer? And why? (5 Mark) Pear Inc. is producing Part E and Part F which are joint products of a common input. Both products can be sold "as is" or processed further. The cost and selling price information is as follows. Should the company process Part E further? Should the company process Part F further? (4 Marks 4) Part E $20 $10 $40 S15 Part F $15 $8 $30 Sales value at the split-off point Allocated joint product costs Sales value after further processin Cost of further processin Grape Inc. is a manufacturer of office chairs. It currently has four products. The company's labor workforce has the capacity of 700 direct labor hours per year. The direct labor rate is $10 per hour. Suppose the only variables costs are direct material cost and direct labor cost. How should the company allocate the capacity of direct labor hours among the products to maximize total contribution 5) in? (8 Marks Unit selling Direct material Direct labor cost per unit Demand in units 500 600 500 700 cost per unit S5 $3 S5 $2 rice Chair A $20 Chair C Chair D $30 $20 S5 $21 $15