uestion 1 a) Calculate the following ratios for Rio Tinto plc for the year ended 31st December 2019 (20 Marks) 1. Return On Capital Employed 2. Inventory Turnover (stock days) 3. Debtor ratio (debtors days) 4. Creditor ratio (creditor days) 5. Current ratio 6. Quick ratio 7. Debt/equity ratio 8. Interest cover 9. Return on Equity 10. Price Earnings Ratio (P/E Ratio) Additional Information Share price at close of business on 31st December 2019 = 4,503 pence /$ exchange rate @ 31st December 2019 = $1.326

uestion 1 a) Calculate the following ratios for Rio Tinto plc for the year ended 31st December 2019 (20 Marks) 1. Return On Capital Employed 2. Inventory Turnover (stock days) 3. Debtor ratio (debtors days) 4. Creditor ratio (creditor days) 5. Current ratio 6. Quick ratio 7. Debt/equity ratio 8. Interest cover 9. Return on Equity 10. Price Earnings Ratio (P/E Ratio) Additional Information Share price at close of business on 31st December 2019 = 4,503 pence /$ exchange rate @ 31st December 2019 = $1.326

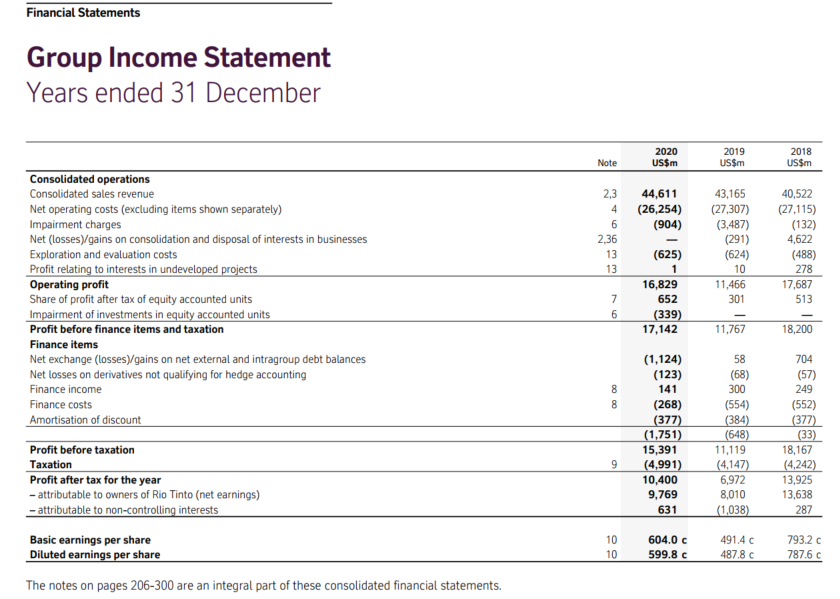

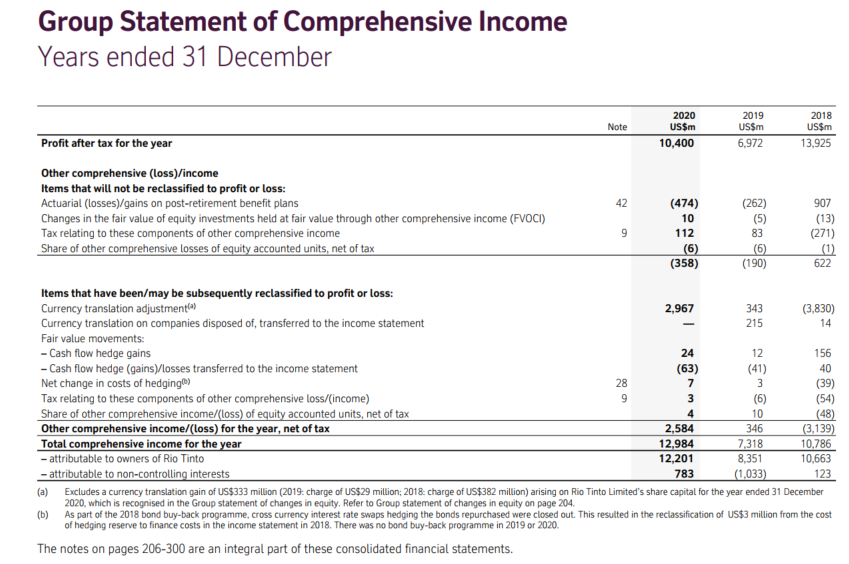

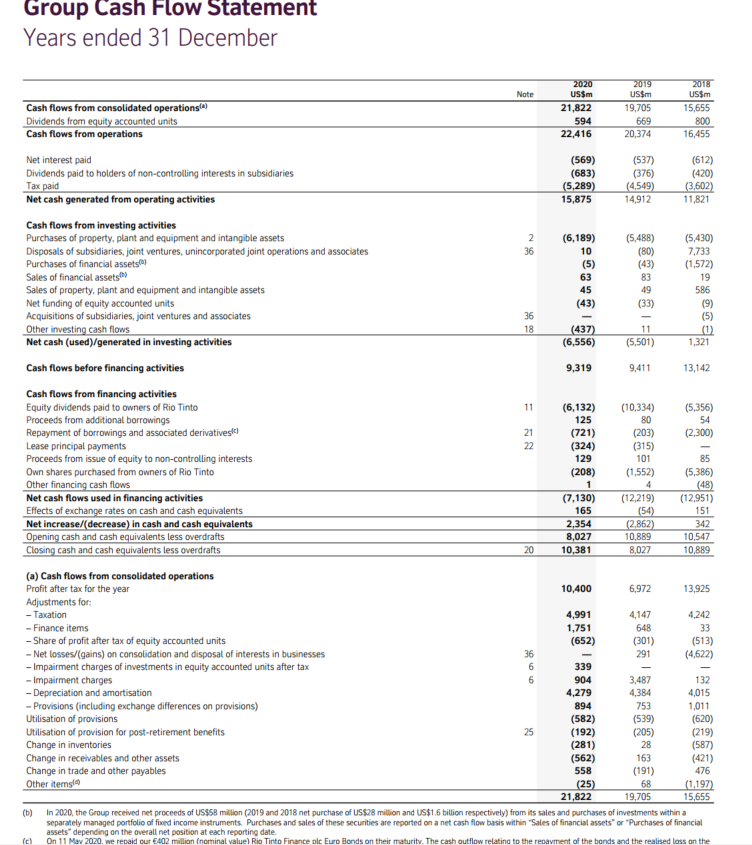

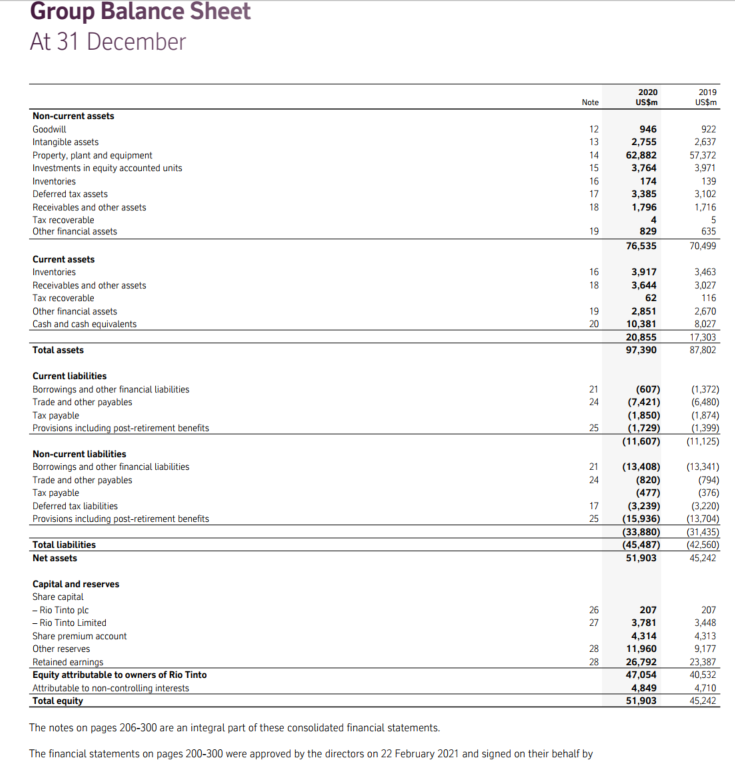

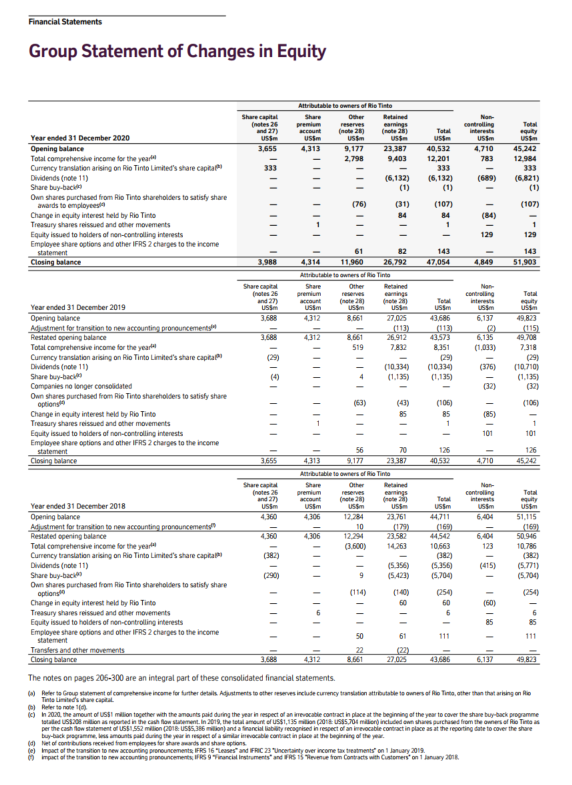

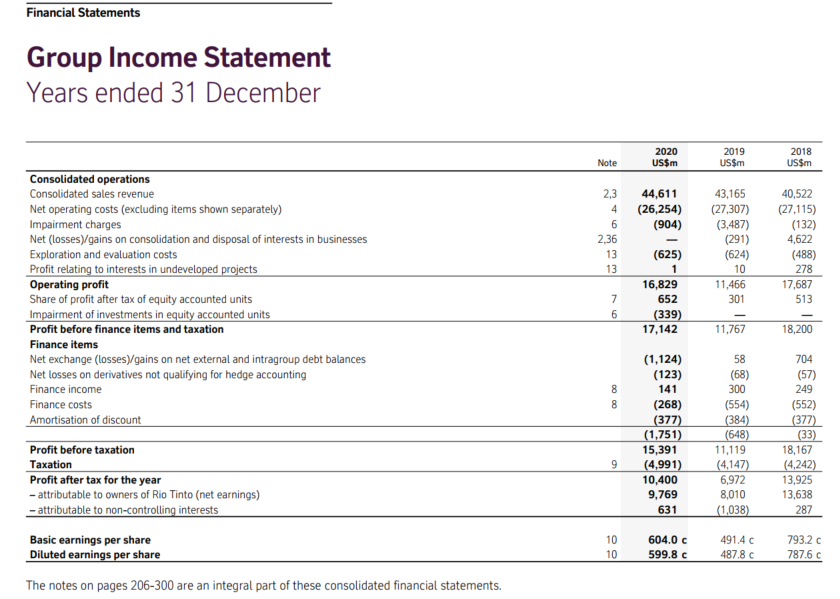

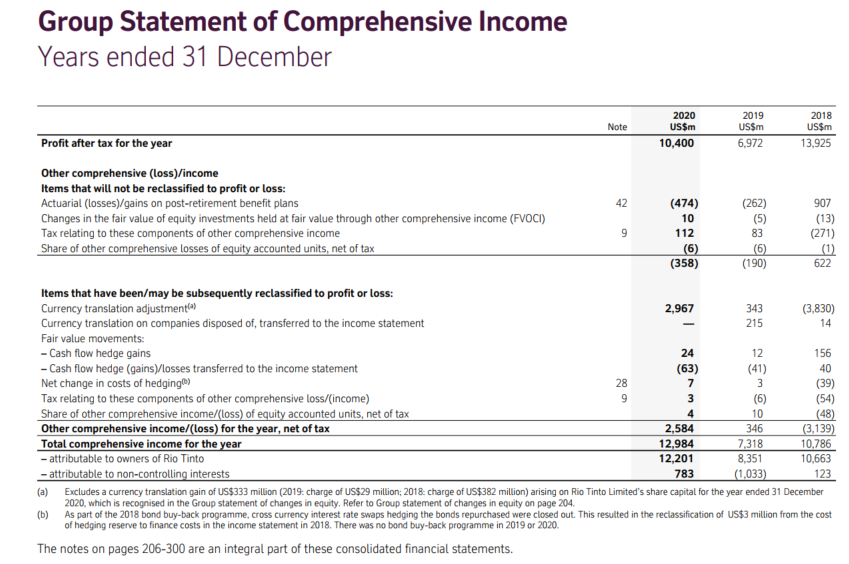

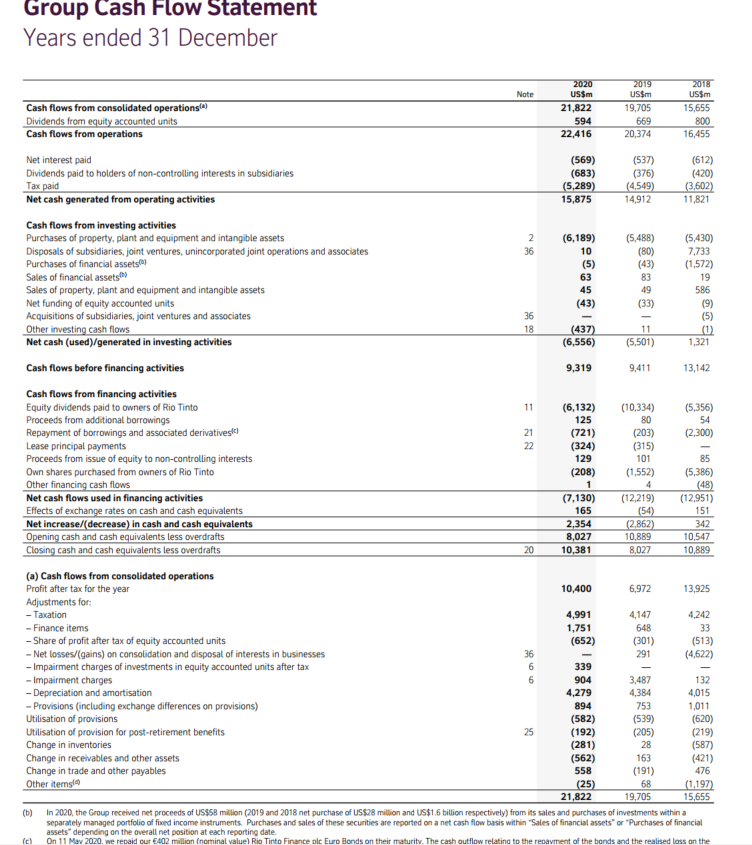

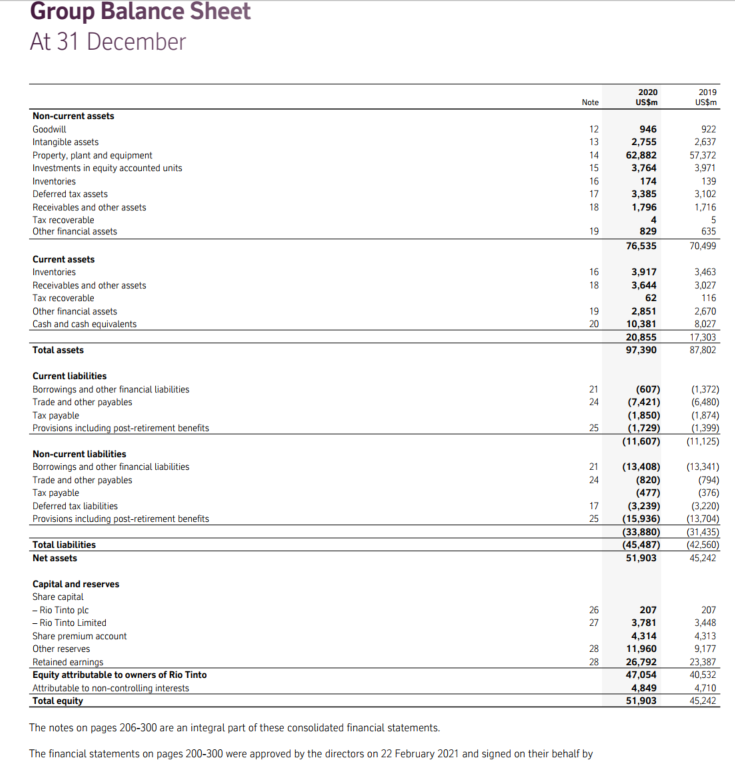

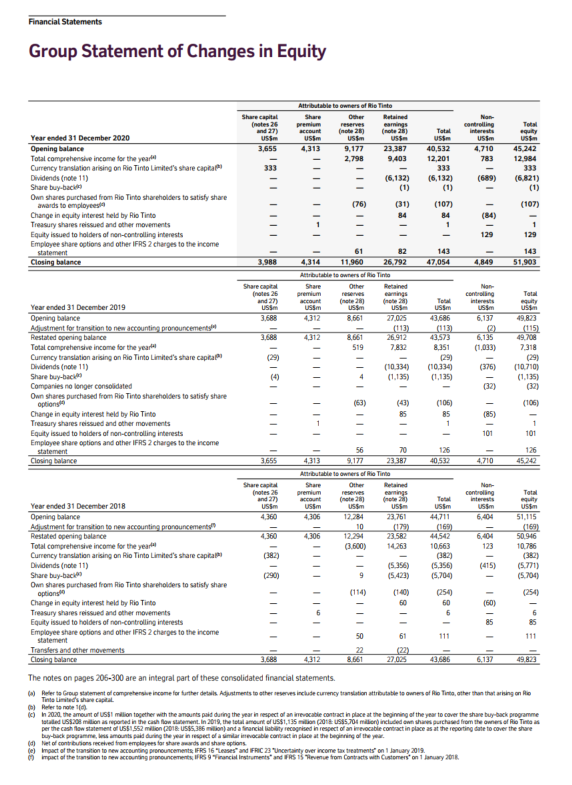

Financial Statements Group Income Statement Years ended 31 December 2020 US$m 2019 US$m 2018 US$m Note 2.3 4 6 2,36 13 13 44,611 (26,254) (904) Consolidated operations Consolidated sales revenue Net operating costs (excluding items shown separately) Impairment charges Net (Losses)/gains on consolidation and disposal of interests in businesses Exploration and evaluation costs Profit relating to interests in undeveloped projects Operating profit Share of profit after tax of equity accounted units Impairment of investments in equity accounted units Profit before finance items and taxation Finance items Net exchange (Losses)/gains on net external and intragroup debt balances Net losses on derivatives not qualifying for hedge accounting Finance income Finance costs Amortisation of discount 43,165 (27,307) (3,487) (291) (624) 10 11,466 301 40,522 (27,115) (132) 4,622 (488) 278 17,687 513 (625) 1 16,829 652 (339) 17.142 7 6 11,767 18,200 58 (68) 00 00 8 8 (1,124) (123) 141 (268) (377) (1,751) 15,391 (4,991) 10,400 9,769 631 704 (57) 249 (552) (377) (33) 18,167 (4,242) 13,925 13,638 287 300 (554) (384) (648) 11,119 (4,147) 6,972 8,010 (1,038) Profit before taxation Taxation Profit after tax for the year - attributable to owners of Rio Tinto (net earnings) - attributable to non-controlling interests 9 Basic earnings per share Diluted earnings per share 10 10 604,0 599.8 c 491.40 487.8 c 793.2 c 787.6 C The notes on pages 206-300 are an integral part of these consolidated financial statements. Group Statement of Comprehensive Income Years ended 31 December Note 2020 US$m 10,400 2019 US$m 6,972 2018 US$m 13.925 Profit after tax for the year Other comprehensive (Loss)/income Items that will not be reclassified to profit or loss: Actuarial (Losses)/gains on post-retirement benefit plans Changes in the fair value of equity investments held at fair value through other comprehensive income (FVOCI) Tax relating to these components of other comprehensive income Share of other comprehensive losses of equity accounted units, net of tax 42 9 (474) 10 112 (6) (358) (262) (5) 83 (6) (190) 907 (13) (271) (1) 622 343 - 14 12 28 3 4 (48) Items that have been/may be subsequently reclassified to profit or loss: Currency translation adjustment) 2,967 (3,830) Currency translation on companies disposed of, transferred to the income statement 215 Fair value movements: - Cash flow hedge gains 24 156 - Cash flow hedge (gains) losses transferred to the income statement (63) (41) 40 Net change in costs of hedging) 7 (39) Tax relating to these components of other comprehensive loss/(income) 9 3 (6) (54) Share of other comprehensive income/(loss) of equity accounted units, net of tax 10 Other comprehensive income/(Loss) for the year, net of tax 2,584 346 (3.139) Total comprehensive income for the year 12,984 7.318 10.786 - attributable to owners of Rio Tinto 12,201 8,351 10,663 - attributable to non-controlling interests 783 (1,033) 123 (a) Excludes a currency translation gain of US$333 million (2019 charge of US$29 million: 2018 charge of US$382 million) arising on Rio Tinto Limited's share capital for the year ended 31 December 2020, which is recognised in the Group statement of changes in equity, Refer to Group statement of changes in equity on page 204. (b) As part of the 2018 bond buy-back programme, cross currency interest rate swaps hedging the bonds repurchased were closed out. This resulted in the reclassification of US$3 million from the cost of hedging reserve to finance costs in the income statement in 2018. There was no bond buy-back programme in 2019 or 2020. The notes on pages 206-300 are an integral part of these consolidated financial statements. Group Cash Flow Statement Years ended 31 December Note Cash flows from consolidated operations) Dividends from equity accounted units Cash flows from operations 2020 US$m 21,822 594 22,416 2019 US$m 19.705 669 20,374 2018 US$m 15,655 800 16,455 Net interest paid (569) (537) (612) Dividends paid to holders of non-controlling interests in subsidiaries (683) (376) (420) Tax paid (5,289) (4,549) (3,602) Net cash generated from operating activities 15,875 14,912 11,821 Cash flows from investing activities Purchases of property, plant and equipment and intangible assets 2 (6,189) (5,488) (5,430) Disposals of subsidiaries, joint ventures, unincorporated joint operations and associates 36 10 (80) 7,733 Purchases of financial assetsal (5) (43) (1,572) Sales of financial assets the 63 83 19 Sales of property, plant and equipment and intangible assets 45 49 586 Net funding of equity accounted units (43) (33) (9) Acquisitions of subsidiaries, joint ventures and associates 36 (5) Other investing cash flows 18 (437) 11 0 Net cash (used)/generated in investing activities (6,556) (5,501) 1,321 Cash flows before financing activities 9,319 9,411 13,142 Cash flows from financing activities Equity dividends paid to owners of Rio Tinto 11 (6,132) (10,334) (5,356) Proceeds from additional borrowings 125 80 54 Repayment of borrowings and associated derivativeste 21 (721) (203) (2.300) Lease principal payments 22 (324) (315) Proceeds from issue of equity to non-controlling interests 129 101 85 Own shares purchased from owners of Rio Tinto (208) (1.552) (5,386) Other financing cash flows 1 4 (48) Net cash flows used in financing activities (7,130) (12,219) (12,951) Effects of exchange rates on cash and cash equivalents 165 (54) 151 Net increase/(decrease) in cash and cash equivalents 2,354 (2.862) Opening cash and cash equivalents less overdrafts 8,027 10,889 10,547 Closing cash and cash equivalents less overdrafts 20 10,381 8,027 10,889 (a) Cash flows from consolidated operations Profit after tax for the year 10,400 6.972 13,925 Adjustments for: - Taxation 4,991 4,147 4,242 - Finance items 1,751 648 33 - Share of profit after tax of equity accounted units (652) (301) (513) - Net losses/(gains) on consolidation and disposal of interests in businesses 36 291 (4,622) - Impairment charges of investments in equity accounted units after tax 6 339 - Impairment charges 6 904 3,487 132 - Depreciation and amortisation 4,279 4,384 4,015 - Provisions (including exchange differences on provisions) 894 1,011 Utilisation of provisions (582) (539) (620) Utilisation of provision for post-retirement benefits 25 (192) (205) (219) Change in inventories (281) 28 (587) Change in receivables and other assets (562) 163 (421) Change in trade and other payables 558 (191) 476 Other items (25) 68 (1.197) 21,822 19,705 15,655 (b) In 2020, the Group received net proceeds of US$58 million (2019 and 2018 net purchase of US$28 million and US$1.6 billion respectively) from its sales and purchases of investments within a separately managed portfolio of fixed income instruments Purchases and sales of these securities are reported on a net cash flow basis within Sales of financial assets" or "Purchases of financial assets" depending on the overall net position at each reporting date. On 11 May 2020. we repaid our 402 million inominal value) Rio Tinto Finance plc Euro Bonds on their maturity. The cash outflow relating to the repayment of the bonds and the realised loss on the 342 + 753 icl Group Balance Sheet At 31 December Note 2020 US $m 2019 US$m Non-current assets Goodwill Intangible assets Property, plant and equipment Investments in equity accounted units Inventories Deferred tax assets Receivables and other assets Tax recoverable Other financial assets 12 13 14 15 16 17 18 946 2,755 62,882 3,764 174 3,385 1.796 4 829 76,535 922 2,637 57,372 3,971 139 3,102 1.716 5 635 70,499 19 16 18 Current assets Inventories Receivables and other assets Tax recoverable Other financial assets Cash and cash equivalents 19 20 3,917 3,644 62 2,851 10,381 20,855 97,390 3,463 3,027 116 2.670 8,027 17,303 87,802 Total assets Current Liabilities Borrowings and other financial liabilities Trade and other payables Tax payable Provisions including post-retirement benefits 21 24 (607) (7,421) (1,850) (1,729) (11,607) (1.372) (6,480) (1.874) (1,399) (11,125) 25 21 24 17 25 (13,408) (820) (477) (3,239) (15,936) (33,880) (45,487) 51,903 (13,341) (794) (376) (3.220) (13,704) (31,435) (42,560) 45,242 Non-current liabilities Borrowings and other financial Liabilities Trade and other payables Tax payable Deferred tax liabilities Provisions including post-retirement benefits Total liabilities Net assets Capital and reserves Share capital - Rio Tinto plc - Rio Tinto Limited Share premium account Other reserves Retained earnings Equity attributable to owners of Rio Tinto Attributable to non-controlling interests Total equity 26 27 28 28 207 3,781 4,314 11,960 26,792 47,054 4,849 51,903 207 3,448 4,313 9.177 23,387 40,532 4.710 45,242 The notes on pages 206-300 are an integral part of these consolidated financial statements. The financial statements on pages 200-300 were approved by the directors on 22 February 2021 and signed on their behalf by Financial Statements Group Statement of Changes in Equity 333 (84) Attributable to owners of Rio Tinto Share capital Other Retained Non notes 26 premium reserves and 27) earings Total EUR note 26) controlling (note 28) Total equity Year ended 31 December 2020 US USim US US US US UST Opening balance 3,655 4,313 9,177 23,387 40,532 4.710 45.242 Total comprehensive income for the year 2.798 9.403 12,201 783 12.984 Currency translation arising on Rio Tinto Limited's share capital 333 Dividends (note 11) (6,132) (6,132) (689) (6.821) Share buy-bacille (1) (1) Own shares purchased from Rio Tinto shareholders to satisfy share awards to employees (76) (31) (107) (107) Change in equity interest held by Rio Tinto 84 84 Treasury shares reissued and other movements 1 1 Equity issued to holders of non-controlling interests 129 129 Employee share options and other IFRS 2 changes to the income statement 61 82 143 143 Closing balance 3.988 4,314 11,960 26.792 47,054 4,849 51,903 Attributable to owners of Rio Tinto Share capital Share Other Retained notes 26 premium earnings controlling Tata and 27) account Year ended 31 December 2019 (note 2) 2) Total uity USS USSM US US USS US Opening balance 3.688 12 8.661 27.005 43.686 49.823 Adjustment for transition to new accounting pronouncements (113) (113) (115) Restated opening balance 3.688 4312 8.661 26,912 43,573 6,135 49.708 Total comprehensive income for the year 519 7.832 8.351 (1.033) 7318 Currency translation arising on Rio Tinto Limited's share capital (29) (29) (29) Dividends (note 11) (10,334 (10,334 (376) (10.710) Share buy-back (41) (1.135) (1,135) (1.135) Companies no longer consolidated (32) Own shares purchased from Rio Tinto shareholders to satisfy share option (63) (106) (106) Change in equity interest held by Rio Tinto 85 85 Treasury shares reissued and other movements 1 1 Equity issued to holders of non-controlling interests 101 Employee share options and other IFRS 2 charges to the income statement 56 70 126 126 Closing balance 3655 4313 9,177 23387 40532 4710 45.242 Attributable to owners of Rio Tinto Share capital Other Retained Non notes 26 reserves Total and 27) controlling account (note 280 ne) Total interest uity Year ended 31 December 2018 USSM USSM USS US USSM US US Opening balance 4360 12.784 23.761 44,711 6,404 51.115 Adjustment for transition to new accounting pronouncements 10 (179) (169) (169 Restated opening balance 4.360 4.306 12.294 23.582 44,542 6,404 50.946 Total comprehensive income for the year (3.600) 14.263 10.663 123 10.786 Currency translation arising on Rio Tinto Limited's share capital (382) (382) (382) Dividends (note 11) (5.356) (5.356) (415) (5.771) Share buy-back (290) 9 (5.423) (5,704) (5.704) Own shares purchased from Rio Tinto shareholders to satisfy share options (114) (140) (254) (254) Change in equity interest held by Rio Tinto 50 60 (60) Treasury shares reissued and other movements 6 6 Equity issued to holders of non-controlling interests 85 85 Employee share options and other IFRS 2 charges to the income statement 50 61 111 111 Transfers and other movements 22 Closing balance 3.688 4312 8.661 27.025 43686 6.137 4923 The notes on pages 206-300 are an integral part of these consolidated financial statements. Hetes te Group statement of comprehensive income for further details Adjustments to other reserves include currency translation attributable to owners of Rio Tinta, other than that arising on Rio 10 2020, the amount of US$1 milion together with the amounts paid during the year in respect of an irrevocable contract in place at the beginning of the year to cover the share buy-back programme stated US$20 milionas reported in the cash flow statement in 2019, the total amount of SS1,135 million (2018 US5.70 million included on sus purchased from the owners of Romas per the cash flow statement of US$1.552 million (2018-U555,386 million and financial ability recognised in respect of an irrevocabile contact in place as at the reporting date to cover the share Buy-back programme, les amounts paid during the year in respecto a la intocable contact in place at the beginning of the year et of contributions received from employees for store ads and share options le) impact of the transition to new accounting pronouncements, IFRS 16 Lesses and IFRIC 23 Uncertainty over income tax treatments on January 2019. impact of the transition to new accounting pronouncements, IFRS 9 Financial Instruments and FRS 15 Revenue from Contracts with Customers' on 1 January 2016 gag ''g | | | Financial Statements Group Income Statement Years ended 31 December 2020 US$m 2019 US$m 2018 US$m Note 2.3 4 6 2,36 13 13 44,611 (26,254) (904) Consolidated operations Consolidated sales revenue Net operating costs (excluding items shown separately) Impairment charges Net (Losses)/gains on consolidation and disposal of interests in businesses Exploration and evaluation costs Profit relating to interests in undeveloped projects Operating profit Share of profit after tax of equity accounted units Impairment of investments in equity accounted units Profit before finance items and taxation Finance items Net exchange (Losses)/gains on net external and intragroup debt balances Net losses on derivatives not qualifying for hedge accounting Finance income Finance costs Amortisation of discount 43,165 (27,307) (3,487) (291) (624) 10 11,466 301 40,522 (27,115) (132) 4,622 (488) 278 17,687 513 (625) 1 16,829 652 (339) 17.142 7 6 11,767 18,200 58 (68) 00 00 8 8 (1,124) (123) 141 (268) (377) (1,751) 15,391 (4,991) 10,400 9,769 631 704 (57) 249 (552) (377) (33) 18,167 (4,242) 13,925 13,638 287 300 (554) (384) (648) 11,119 (4,147) 6,972 8,010 (1,038) Profit before taxation Taxation Profit after tax for the year - attributable to owners of Rio Tinto (net earnings) - attributable to non-controlling interests 9 Basic earnings per share Diluted earnings per share 10 10 604,0 599.8 c 491.40 487.8 c 793.2 c 787.6 C The notes on pages 206-300 are an integral part of these consolidated financial statements. Group Statement of Comprehensive Income Years ended 31 December Note 2020 US$m 10,400 2019 US$m 6,972 2018 US$m 13.925 Profit after tax for the year Other comprehensive (Loss)/income Items that will not be reclassified to profit or loss: Actuarial (Losses)/gains on post-retirement benefit plans Changes in the fair value of equity investments held at fair value through other comprehensive income (FVOCI) Tax relating to these components of other comprehensive income Share of other comprehensive losses of equity accounted units, net of tax 42 9 (474) 10 112 (6) (358) (262) (5) 83 (6) (190) 907 (13) (271) (1) 622 343 - 14 12 28 3 4 (48) Items that have been/may be subsequently reclassified to profit or loss: Currency translation adjustment) 2,967 (3,830) Currency translation on companies disposed of, transferred to the income statement 215 Fair value movements: - Cash flow hedge gains 24 156 - Cash flow hedge (gains) losses transferred to the income statement (63) (41) 40 Net change in costs of hedging) 7 (39) Tax relating to these components of other comprehensive loss/(income) 9 3 (6) (54) Share of other comprehensive income/(loss) of equity accounted units, net of tax 10 Other comprehensive income/(Loss) for the year, net of tax 2,584 346 (3.139) Total comprehensive income for the year 12,984 7.318 10.786 - attributable to owners of Rio Tinto 12,201 8,351 10,663 - attributable to non-controlling interests 783 (1,033) 123 (a) Excludes a currency translation gain of US$333 million (2019 charge of US$29 million: 2018 charge of US$382 million) arising on Rio Tinto Limited's share capital for the year ended 31 December 2020, which is recognised in the Group statement of changes in equity, Refer to Group statement of changes in equity on page 204. (b) As part of the 2018 bond buy-back programme, cross currency interest rate swaps hedging the bonds repurchased were closed out. This resulted in the reclassification of US$3 million from the cost of hedging reserve to finance costs in the income statement in 2018. There was no bond buy-back programme in 2019 or 2020. The notes on pages 206-300 are an integral part of these consolidated financial statements. Group Cash Flow Statement Years ended 31 December Note Cash flows from consolidated operations) Dividends from equity accounted units Cash flows from operations 2020 US$m 21,822 594 22,416 2019 US$m 19.705 669 20,374 2018 US$m 15,655 800 16,455 Net interest paid (569) (537) (612) Dividends paid to holders of non-controlling interests in subsidiaries (683) (376) (420) Tax paid (5,289) (4,549) (3,602) Net cash generated from operating activities 15,875 14,912 11,821 Cash flows from investing activities Purchases of property, plant and equipment and intangible assets 2 (6,189) (5,488) (5,430) Disposals of subsidiaries, joint ventures, unincorporated joint operations and associates 36 10 (80) 7,733 Purchases of financial assetsal (5) (43) (1,572) Sales of financial assets the 63 83 19 Sales of property, plant and equipment and intangible assets 45 49 586 Net funding of equity accounted units (43) (33) (9) Acquisitions of subsidiaries, joint ventures and associates 36 (5) Other investing cash flows 18 (437) 11 0 Net cash (used)/generated in investing activities (6,556) (5,501) 1,321 Cash flows before financing activities 9,319 9,411 13,142 Cash flows from financing activities Equity dividends paid to owners of Rio Tinto 11 (6,132) (10,334) (5,356) Proceeds from additional borrowings 125 80 54 Repayment of borrowings and associated derivativeste 21 (721) (203) (2.300) Lease principal payments 22 (324) (315) Proceeds from issue of equity to non-controlling interests 129 101 85 Own shares purchased from owners of Rio Tinto (208) (1.552) (5,386) Other financing cash flows 1 4 (48) Net cash flows used in financing activities (7,130) (12,219) (12,951) Effects of exchange rates on cash and cash equivalents 165 (54) 151 Net increase/(decrease) in cash and cash equivalents 2,354 (2.862) Opening cash and cash equivalents less overdrafts 8,027 10,889 10,547 Closing cash and cash equivalents less overdrafts 20 10,381 8,027 10,889 (a) Cash flows from consolidated operations Profit after tax for the year 10,400 6.972 13,925 Adjustments for: - Taxation 4,991 4,147 4,242 - Finance items 1,751 648 33 - Share of profit after tax of equity accounted units (652) (301) (513) - Net losses/(gains) on consolidation and disposal of interests in businesses 36 291 (4,622) - Impairment charges of investments in equity accounted units after tax 6 339 - Impairment charges 6 904 3,487 132 - Depreciation and amortisation 4,279 4,384 4,015 - Provisions (including exchange differences on provisions) 894 1,011 Utilisation of provisions (582) (539) (620) Utilisation of provision for post-retirement benefits 25 (192) (205) (219) Change in inventories (281) 28 (587) Change in receivables and other assets (562) 163 (421) Change in trade and other payables 558 (191) 476 Other items (25) 68 (1.197) 21,822 19,705 15,655 (b) In 2020, the Group received net proceeds of US$58 million (2019 and 2018 net purchase of US$28 million and US$1.6 billion respectively) from its sales and purchases of investments within a separately managed portfolio of fixed income instruments Purchases and sales of these securities are reported on a net cash flow basis within Sales of financial assets" or "Purchases of financial assets" depending on the overall net position at each reporting date. On 11 May 2020. we repaid our 402 million inominal value) Rio Tinto Finance plc Euro Bonds on their maturity. The cash outflow relating to the repayment of the bonds and the realised loss on the 342 + 753 icl Group Balance Sheet At 31 December Note 2020 US $m 2019 US$m Non-current assets Goodwill Intangible assets Property, plant and equipment Investments in equity accounted units Inventories Deferred tax assets Receivables and other assets Tax recoverable Other financial assets 12 13 14 15 16 17 18 946 2,755 62,882 3,764 174 3,385 1.796 4 829 76,535 922 2,637 57,372 3,971 139 3,102 1.716 5 635 70,499 19 16 18 Current assets Inventories Receivables and other assets Tax recoverable Other financial assets Cash and cash equivalents 19 20 3,917 3,644 62 2,851 10,381 20,855 97,390 3,463 3,027 116 2.670 8,027 17,303 87,802 Total assets Current Liabilities Borrowings and other financial liabilities Trade and other payables Tax payable Provisions including post-retirement benefits 21 24 (607) (7,421) (1,850) (1,729) (11,607) (1.372) (6,480) (1.874) (1,399) (11,125) 25 21 24 17 25 (13,408) (820) (477) (3,239) (15,936) (33,880) (45,487) 51,903 (13,341) (794) (376) (3.220) (13,704) (31,435) (42,560) 45,242 Non-current liabilities Borrowings and other financial Liabilities Trade and other payables Tax payable Deferred tax liabilities Provisions including post-retirement benefits Total liabilities Net assets Capital and reserves Share capital - Rio Tinto plc - Rio Tinto Limited Share premium account Other reserves Retained earnings Equity attributable to owners of Rio Tinto Attributable to non-controlling interests Total equity 26 27 28 28 207 3,781 4,314 11,960 26,792 47,054 4,849 51,903 207 3,448 4,313 9.177 23,387 40,532 4.710 45,242 The notes on pages 206-300 are an integral part of these consolidated financial statements. The financial statements on pages 200-300 were approved by the directors on 22 February 2021 and signed on their behalf by Financial Statements Group Statement of Changes in Equity 333 (84) Attributable to owners of Rio Tinto Share capital Other Retained Non notes 26 premium reserves and 27) earings Total EUR note 26) controlling (note 28) Total equity Year ended 31 December 2020 US USim US US US US UST Opening balance 3,655 4,313 9,177 23,387 40,532 4.710 45.242 Total comprehensive income for the year 2.798 9.403 12,201 783 12.984 Currency translation arising on Rio Tinto Limited's share capital 333 Dividends (note 11) (6,132) (6,132) (689) (6.821) Share buy-bacille (1) (1) Own shares purchased from Rio Tinto shareholders to satisfy share awards to employees (76) (31) (107) (107) Change in equity interest held by Rio Tinto 84 84 Treasury shares reissued and other movements 1 1 Equity issued to holders of non-controlling interests 129 129 Employee share options and other IFRS 2 changes to the income statement 61 82 143 143 Closing balance 3.988 4,314 11,960 26.792 47,054 4,849 51,903 Attributable to owners of Rio Tinto Share capital Share Other Retained notes 26 premium earnings controlling Tata and 27) account Year ended 31 December 2019 (note 2) 2) Total uity USS USSM US US USS US Opening balance 3.688 12 8.661 27.005 43.686 49.823 Adjustment for transition to new accounting pronouncements (113) (113) (115) Restated opening balance 3.688 4312 8.661 26,912 43,573 6,135 49.708 Total comprehensive income for the year 519 7.832 8.351 (1.033) 7318 Currency translation arising on Rio Tinto Limited's share capital (29) (29) (29) Dividends (note 11) (10,334 (10,334 (376) (10.710) Share buy-back (41) (1.135) (1,135) (1.135) Companies no longer consolidated (32) Own shares purchased from Rio Tinto shareholders to satisfy share option (63) (106) (106) Change in equity interest held by Rio Tinto 85 85 Treasury shares reissued and other movements 1 1 Equity issued to holders of non-controlling interests 101 Employee share options and other IFRS 2 charges to the income statement 56 70 126 126 Closing balance 3655 4313 9,177 23387 40532 4710 45.242 Attributable to owners of Rio Tinto Share capital Other Retained Non notes 26 reserves Total and 27) controlling account (note 280 ne) Total interest uity Year ended 31 December 2018 USSM USSM USS US USSM US US Opening balance 4360 12.784 23.761 44,711 6,404 51.115 Adjustment for transition to new accounting pronouncements 10 (179) (169) (169 Restated opening balance 4.360 4.306 12.294 23.582 44,542 6,404 50.946 Total comprehensive income for the year (3.600) 14.263 10.663 123 10.786 Currency translation arising on Rio Tinto Limited's share capital (382) (382) (382) Dividends (note 11) (5.356) (5.356) (415) (5.771) Share buy-back (290) 9 (5.423) (5,704) (5.704) Own shares purchased from Rio Tinto shareholders to satisfy share options (114) (140) (254) (254) Change in equity interest held by Rio Tinto 50 60 (60) Treasury shares reissued and other movements 6 6 Equity issued to holders of non-controlling interests 85 85 Employee share options and other IFRS 2 charges to the income statement 50 61 111 111 Transfers and other movements 22 Closing balance 3.688 4312 8.661 27.025 43686 6.137 4923 The notes on pages 206-300 are an integral part of these consolidated financial statements. Hetes te Group statement of comprehensive income for further details Adjustments to other reserves include currency translation attributable to owners of Rio Tinta, other than that arising on Rio 10 2020, the amount of US$1 milion together with the amounts paid during the year in respect of an irrevocable contract in place at the beginning of the year to cover the share buy-back programme stated US$20 milionas reported in the cash flow statement in 2019, the total amount of SS1,135 million (2018 US5.70 million included on sus purchased from the owners of Romas per the cash flow statement of US$1.552 million (2018-U555,386 million and financial ability recognised in respect of an irrevocabile contact in place as at the reporting date to cover the share Buy-back programme, les amounts paid during the year in respecto a la intocable contact in place at the beginning of the year et of contributions received from employees for store ads and share options le) impact of the transition to new accounting pronouncements, IFRS 16 Lesses and IFRIC 23 Uncertainty over income tax treatments on January 2019. impact of the transition to new accounting pronouncements, IFRS 9 Financial Instruments and FRS 15 Revenue from Contracts with Customers' on 1 January 2016 gag ''g | | |

uestion 1 a) Calculate the following ratios for Rio Tinto plc for the year ended 31st December 2019 (20 Marks) 1. Return On Capital Employed 2. Inventory Turnover (stock days) 3. Debtor ratio (debtors days) 4. Creditor ratio (creditor days) 5. Current ratio 6. Quick ratio 7. Debt/equity ratio 8. Interest cover 9. Return on Equity 10. Price Earnings Ratio (P/E Ratio) Additional Information Share price at close of business on 31st December 2019 = 4,503 pence /$ exchange rate @ 31st December 2019 = $1.326

uestion 1 a) Calculate the following ratios for Rio Tinto plc for the year ended 31st December 2019 (20 Marks) 1. Return On Capital Employed 2. Inventory Turnover (stock days) 3. Debtor ratio (debtors days) 4. Creditor ratio (creditor days) 5. Current ratio 6. Quick ratio 7. Debt/equity ratio 8. Interest cover 9. Return on Equity 10. Price Earnings Ratio (P/E Ratio) Additional Information Share price at close of business on 31st December 2019 = 4,503 pence /$ exchange rate @ 31st December 2019 = $1.326