Answered step by step

Verified Expert Solution

Question

1 Approved Answer

uestion: In Excel, create a spreadsheet for the amortization of the bond premium or discount using the effective interestmethod. Your spreadsheet must have appropriate headings

uestion: In Excel, create a spreadsheet for the amortization of the bond premium or discount using the effective interestmethod. Your spreadsheet must have appropriate headings for the table, use of formulas, and formatting forthe cells. (See pages 13-12 and 13-14 for examples.) Extra credit if, using your spreadsheet, I can enter anyprinciple amount, market

In Excel, create a spreadsheet for the amortization of the bond premium or discount using the effective interestmethod. Your spreadsheet must have appropriate headings for the table, use of formulas, and formatting forthe cells. See pages and for examples. Extra credit if using your spreadsheet, I can enter anyprinciple amount, market rate, and stated rate and the spreadsheet will calculate the price of the bond, thepremium or discount, and the table will complete itself. I will let you assume bonds with semiannual interestand no longer than year terms.The $ bond payable is dated January and is issued on that date. Interest is paidsemiannually on June and December The term of the bond, in years, and the stated and market ratesare given for each of the on the table below.Term in years: Stated rate: Market rate:

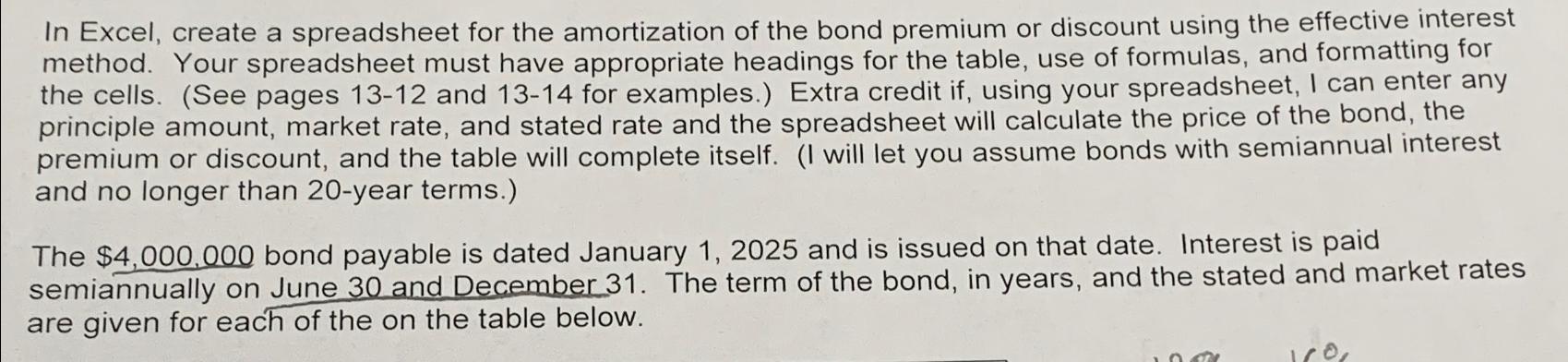

In Excel, create a spreadsheet for the amortization of the bond premium or discount using the effective interest method. Your spreadsheet must have appropriate headings for the table, use of formulas, and formatting for the cells. (See pages 13-12 and 13-14 for examples.) Extra credit if, using your spreadsheet, I can enter any principle amount, market rate, and stated rate and the spreadsheet will calculate the price of the bond, the premium or discount, and the table will complete itself. (I will let you assume bonds with semiannual interest and no longer than 20-year terms.) The $4,000,000 bond payable is dated January 1, 2025 and is issued on that date. Interest is paid semiannually on June 30 and December 31. The term of the bond, in years, and the stated and market rates are given for each of the on the table below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started