Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ukulele company uses the allowance method of accounting for uncollectible receivables. Financial information extracted from Ukulele's accounts receivable subsidiary ledger and general ledger at

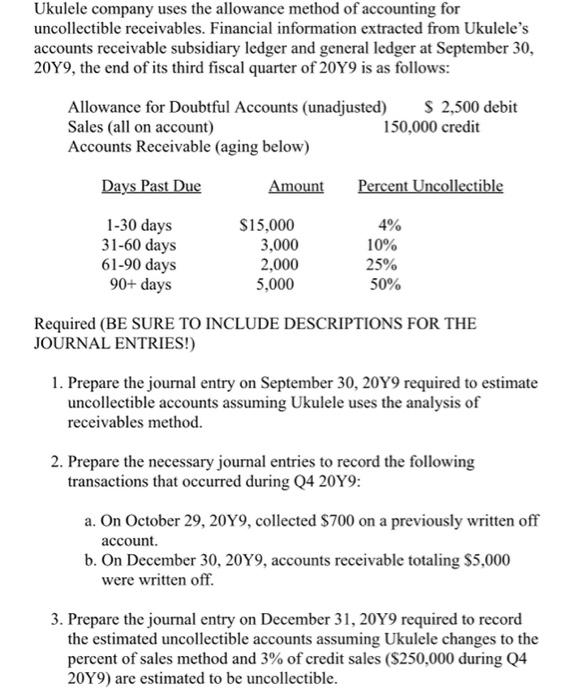

Ukulele company uses the allowance method of accounting for uncollectible receivables. Financial information extracted from Ukulele's accounts receivable subsidiary ledger and general ledger at September 30, 20Y9, the end of its third fiscal quarter of 2019 is as follows: Allowance for Doubtful Accounts (unadjusted) Sales (all on account) Accounts Receivable (aging below) Days Past Due 1-30 days 31-60 days 61-90 days 90+ days Amount $15,000 3,000 2,000 5,000 $ 2,500 debit 150,000 credit Percent Uncollectible 4% 10% 25% 50% Required (BE SURE TO INCLUDE DESCRIPTIONS FOR THE JOURNAL ENTRIES!) 1. Prepare the journal entry on September 30, 20Y9 required to estimate uncollectible accounts assuming Ukulele uses the analysis of receivables method. 2. Prepare the necessary journal entries to record the following transactions that occurred during Q4 20Y9: a. On October 29, 20Y9, collected $700 on a previously written off account. b. On December 30, 20Y9, accounts receivable totaling $5,000 were written off. 3. Prepare the journal entry on December 31, 20Y9 required to record the estimated uncollectible accounts assuming Ukulele changes to the percent of sales method and 3% of credit sales ($250,000 during Q4 20Y9) are estimated to be uncollectible.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Req a Estimatd uncolectible is as under Age 130 days 3160 days 6190 days Over 90 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started