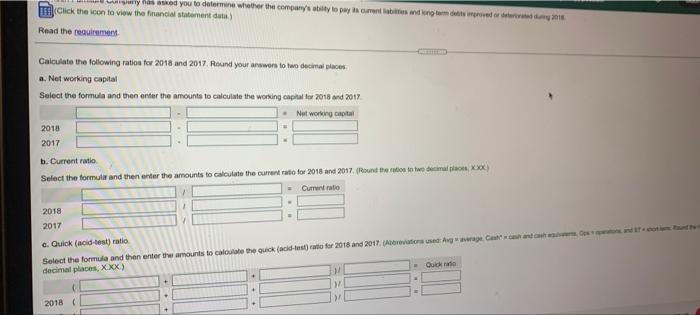

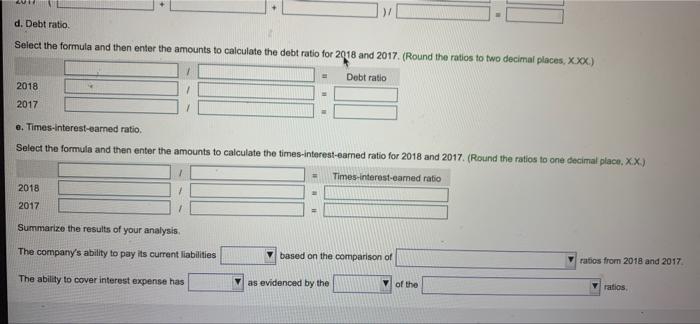

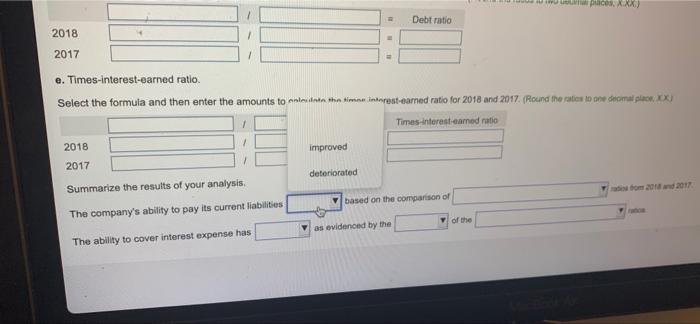

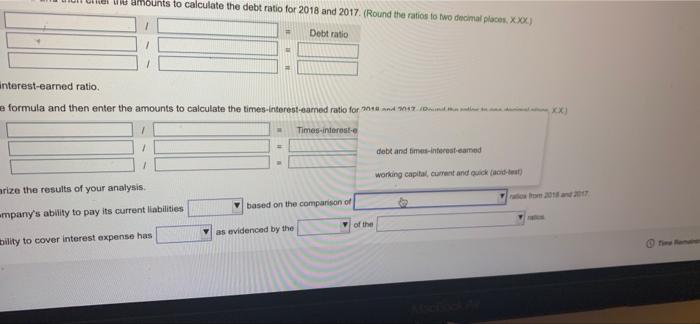

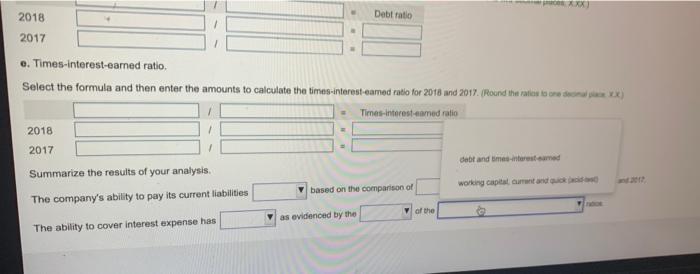

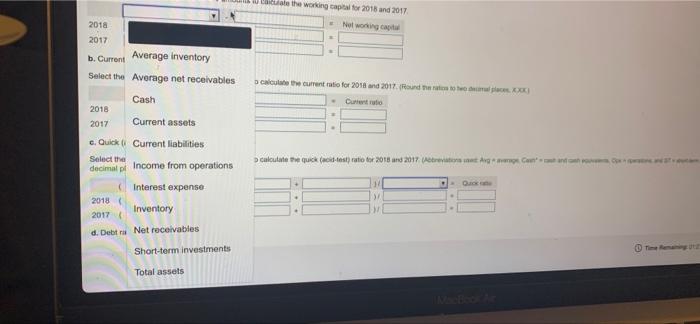

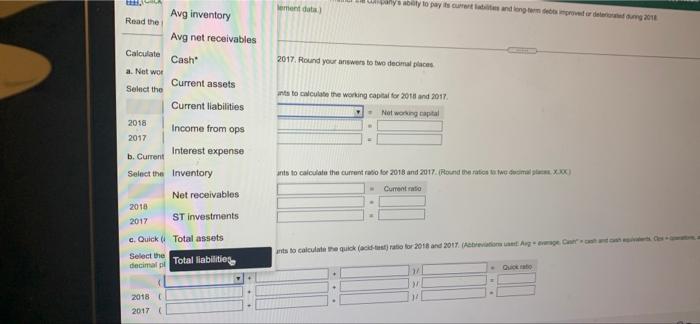

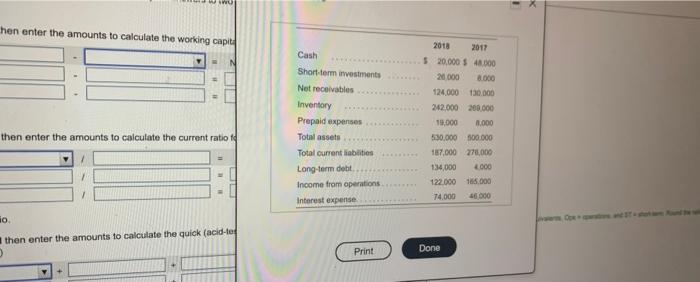

ully asked you to determine whether the company's ability to pay scando Click the icon to view the financial statement data) Read the requirement Calculate the following ration for 2018 and 2017. Round your answers to two decimal places a. Net working capital Select the formula and then enter the amounts to calculate the working capital for 2018 and 2017 Networking crita 2018 2017 b. Current ratio Select the formulir and then enter the amounts to calculate the current ratio for 2018 and 2017. (Round the cutice to win an. XX - Current ratio 2018 2017 c. Quick (acid-test) ratio Select the formula and then enter the amounts to calculate the quick (acid-test) ratio for 2018 and 2017. (Attrovatore Agavage Calcomando decimal places, X.XX) Quicki ) 2018 ( > d. Debt ratio Select the formula and then enter the amounts to calculate the debt ratio for 2018 and 2017. (Round the ratios to two decimal places, X.XX.) Debt ratio 2018 2017 e. Times-interest-earned ratio. Select the formula and then enter the amounts to calculate the times-interest-camed ratio for 2018 and 2017 (Round the ratios to one decimal place, XX) 1 Times-interest-eamed ratio 2018 2017 Summarize the results of your analysis The company's ability to pay its current liabilities based on the comparison of ratios from 2018 and 2017 The ability to cover interest expense has as evidenced by the y of the ratios www.aces AXA Debt ratio 2018 2017 e. Times-interest-earned ratio. Select the formula and then enter the amounts to let the time interest-earned ratio for 2018 and 2017 (Round the ratio ondeomapa) Times interesteamed ratio 1 2018 improved 2017 deteriorated Summarize the results of your analysis, based on the comparison of The company's ability to pay its current liabilities of the as evidenced by the The ability to cover interest expense has U amounts to calculate the debt ratio for 2018 and 2017. (Round the ratios to two decimal places, XOC) Debt ratio Interest-earned ratio. e formula and then enter the amounts to calculate the times-interest-samned ratio ford x) Times-intereste debt and times interest.camed working capital current and Quick- arize the results of your analysis. 2017 based on the comparison of mpany's ability to pay its current liabilities of the as evidenced by the bility to cover interest expense has 0 AXX 2018 Debt ratio 2017 e. Times-interest-camed ratio. Select the formula and then enter the amounts to calculate the times interesteamed ratio for 2018 and 2017. (Round the ration) Times-interesteamed ratio 2018 . 2017 debt and times interest med Summarize the results of your analysis working capital current and based on the comparison of The company's ability to pay its current liabilities The ability to cover interest expense has of the as evidenced by the cate the working capital for 2018 und 2017 No wonga calculate the current for 2018 and 2017. Round Duratio 2018 2017 b. Current Average inventory Select the average net receivables Cash 2018 2017 Current assets c. Quick Current liabilities Select the decimal Income from operations Interest expense 2018 Inventory 2017 calculate the quick and test ratio for 2018 and 2017 At Ang Q > d. Det Net receivables Short-term investments Total assets Sementata uys by to pay is currently route 2016 Avg inventory Read the 2017. Round your answers to two decimal places ints to calculate the working capital for 2018 and 2017 Not working capital Avg net receivables Calculate Cash a Netwo Current assets Select the Current liabilities 2018 Income from ops 2017 Interest expense b. Current Select the Inventory Net receivables 2016 2017 ST investments c. Quick Total assets Select the Total liabilities decimal ints to calculate the current ratio for 2018 and 2017. (Pound the ratio wema XX) Current ratio its to calculate the quick aistratie for 2018 and 2017 Q 3/ 2018 12 2017 hen enter the amounts to calculate the working capita DIE Cash Short-term investments Not receivables Inventory Prepaid expenses Total assets Total current liabilities Long-term debit Income from operations Interest expense 2018 2017 $20.000 $ 40.000 21000 2.000 124.000 130.000 242.000 200.000 19,000 1.000 530.000 300.000 187,000 278,000 134,000 2000 122.000 185.000 74.000 46.000 then enter the amounts to calculate the current ratio io. then enter the amounts to calculate the quick (acid-te Print Done