Answered step by step

Verified Expert Solution

Question

1 Approved Answer

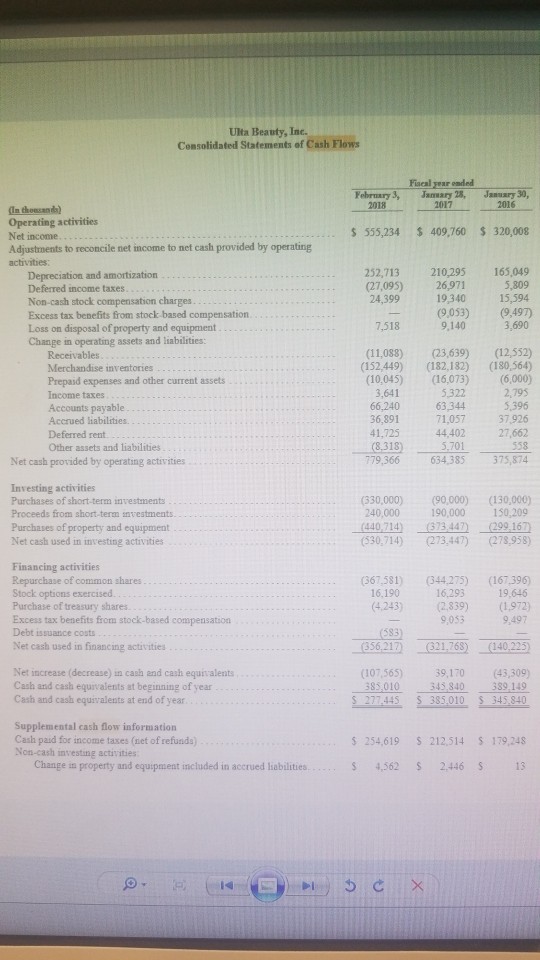

Ulta Beauty, Inc. Consolidated Statements of Cash Flows Fiacal year onded 3, Jaary 28, February 2018 January 30, Operating activities Net income Adjustments to reconcile

Ulta Beauty, Inc. Consolidated Statements of Cash Flows Fiacal year onded 3, Jaary 28, February 2018 January 30, Operating activities Net income Adjustments to reconcile net income to net cash provided by operating s 555,234 409,760 320,008 252,713 210,295 165,049 Depreciation and amortization Deferred income taxes Non-cash stock compensation charges Excess tax benefits from stock based compensation Loss on disposal of property and equipment Change in operating assets and liabilities: (27,095) 26,971 19,340 15,594 (9,497) ?: (9,053) (11,088) (23,639) (12,552) (152,449) (182,182) (180,564) (10,045) (16,073) (6,000) Receivables Merchandise inventories Prepaid expenses and other current assets Income taxes Accounts payable Accrued liabilities. Deferred rent Other assets and liabilities 3,641 5,322 2,79 36,891 41,725 66,240 63344 71,057 44.402 7 926 27,662 Net cash provided by operating activities 779,366 634,385 375,874 Investing activities Purchases of short-term investments Proceeds firom short-tern nvestments. Purchases of property and equipment Net cash used in investing activities (330,000) (90,000) (130,000) 240,000 190,000 150,209 440714)(373447) 299 167 (630,714) 344) (278,958) Financing activities Repurchase of common shares Stock options esercised Purchase of treasury shares. Excess tax benefits from stock-based Debt issuance costs Net cash used in financing activities 367.581) 4425 (167396 19.646 4,243) 2.839) (1972) 9,053 (356.21 21,768) (140.225) Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 107,565) 39,170 (43,309) 85010345 840 89.149 3 4540 Supplemental cash flow information Cash paid for income taxes (net of refunds) Non-cash investing activities s 254,619 212,514 S 179,248 4,562 $ 2.446 S 13 Change in property and equipment included in accrued liabilities Ulta Beauty, Inc. Consolidated Statements of Cash Flows Fiacal year onded 3, Jaary 28, February 2018 January 30, Operating activities Net income Adjustments to reconcile net income to net cash provided by operating s 555,234 409,760 320,008 252,713 210,295 165,049 Depreciation and amortization Deferred income taxes Non-cash stock compensation charges Excess tax benefits from stock based compensation Loss on disposal of property and equipment Change in operating assets and liabilities: (27,095) 26,971 19,340 15,594 (9,497) ?: (9,053) (11,088) (23,639) (12,552) (152,449) (182,182) (180,564) (10,045) (16,073) (6,000) Receivables Merchandise inventories Prepaid expenses and other current assets Income taxes Accounts payable Accrued liabilities. Deferred rent Other assets and liabilities 3,641 5,322 2,79 36,891 41,725 66,240 63344 71,057 44.402 7 926 27,662 Net cash provided by operating activities 779,366 634,385 375,874 Investing activities Purchases of short-term investments Proceeds firom short-tern nvestments. Purchases of property and equipment Net cash used in investing activities (330,000) (90,000) (130,000) 240,000 190,000 150,209 440714)(373447) 299 167 (630,714) 344) (278,958) Financing activities Repurchase of common shares Stock options esercised Purchase of treasury shares. Excess tax benefits from stock-based Debt issuance costs Net cash used in financing activities 367.581) 4425 (167396 19.646 4,243) 2.839) (1972) 9,053 (356.21 21,768) (140.225) Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 107,565) 39,170 (43,309) 85010345 840 89.149 3 4540 Supplemental cash flow information Cash paid for income taxes (net of refunds) Non-cash investing activities s 254,619 212,514 S 179,248 4,562 $ 2.446 S 13 Change in property and equipment included in accrued liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started