Question

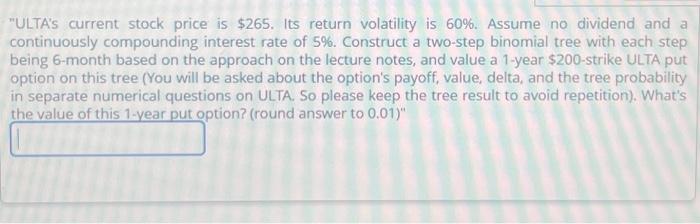

ULTA's current stock price is $265. Its return volatility is 60%. Assume no dividend and a continuously compounding interest rate of 5%. Construct a

"ULTA's current stock price is $265. Its return volatility is 60%. Assume no dividend and a continuously compounding interest rate of 5%. Construct a two-step binomial tree with each step being 6-month based on the approach on the lecture notes, and value a 1-year $200-strike ULTA put option on this tree (You will be asked about the option's payoff, value, delta, and the tree probability in separate numerical questions on ULTA. So please keep the tree result to avoid repetition). What's the value of this 1-year put option? (round answer to 0.01)"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To value the 1year 200strike ULTA put option using a twostep binomial tree we need to follow these steps 1 Calculate the parameters for the binomial t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Management Science and Business Analytics A Modeling And Case Studies Approach With Spreadsheets

Authors: Frederick S. Hillier, Mark S. Hillier

7th Edition

1260716295, 9781260716290

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App