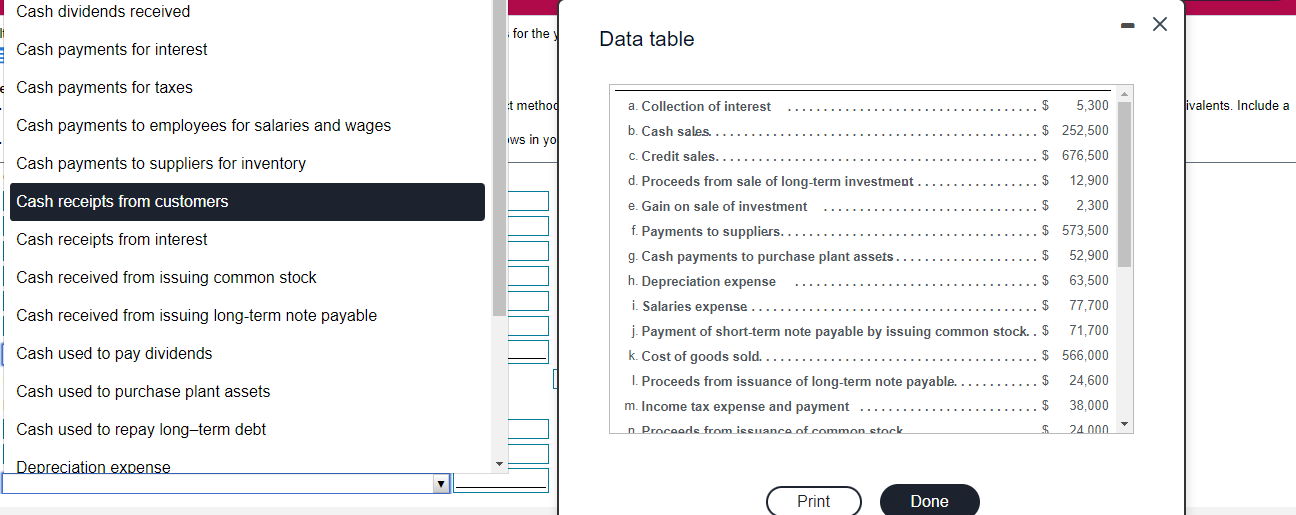

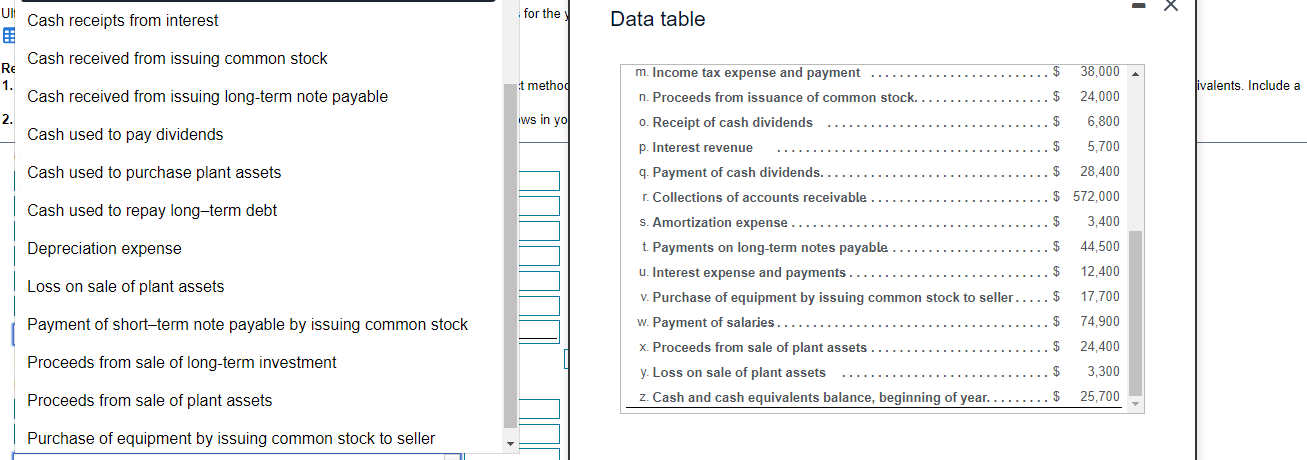

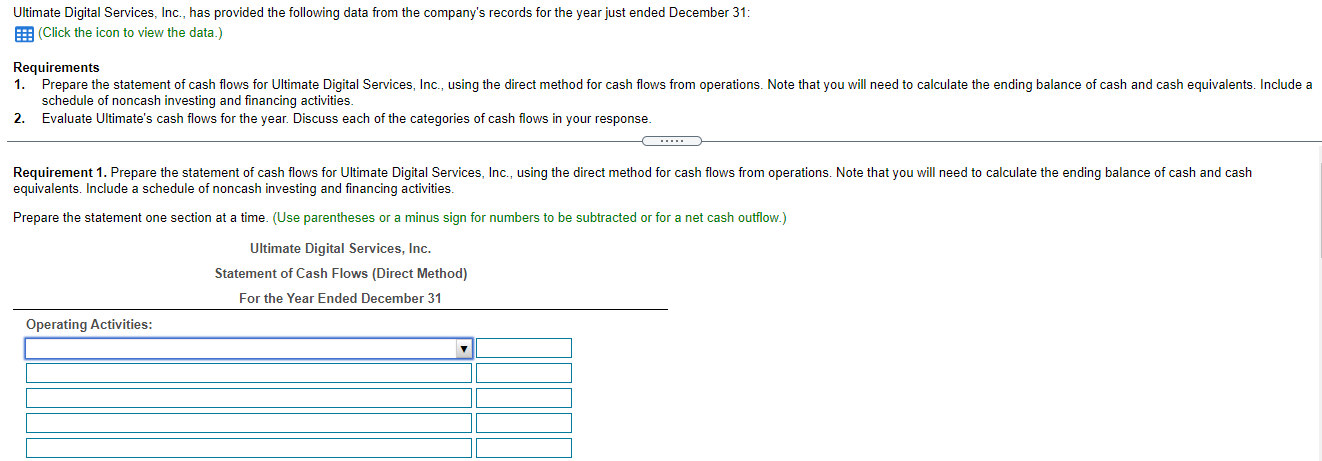

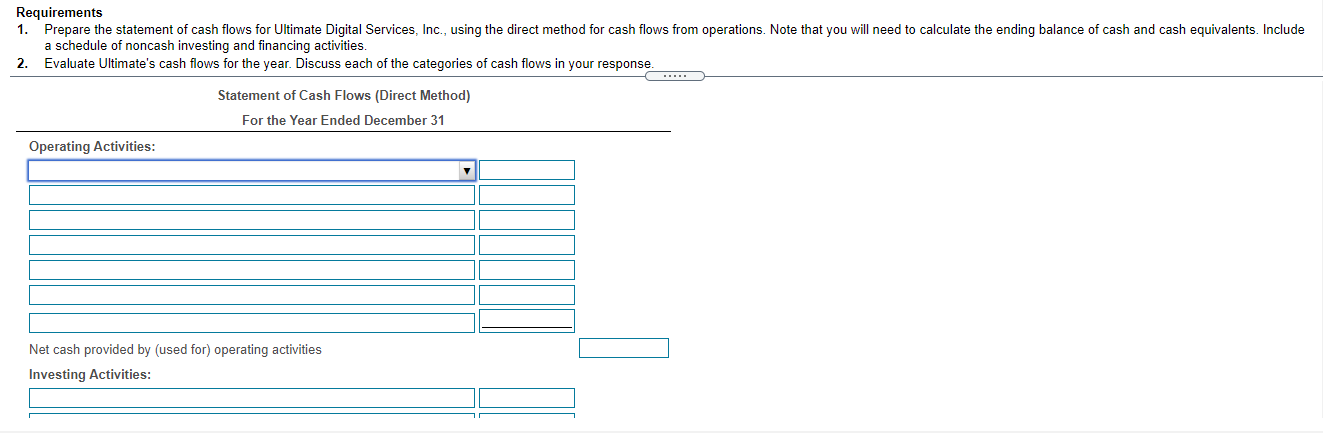

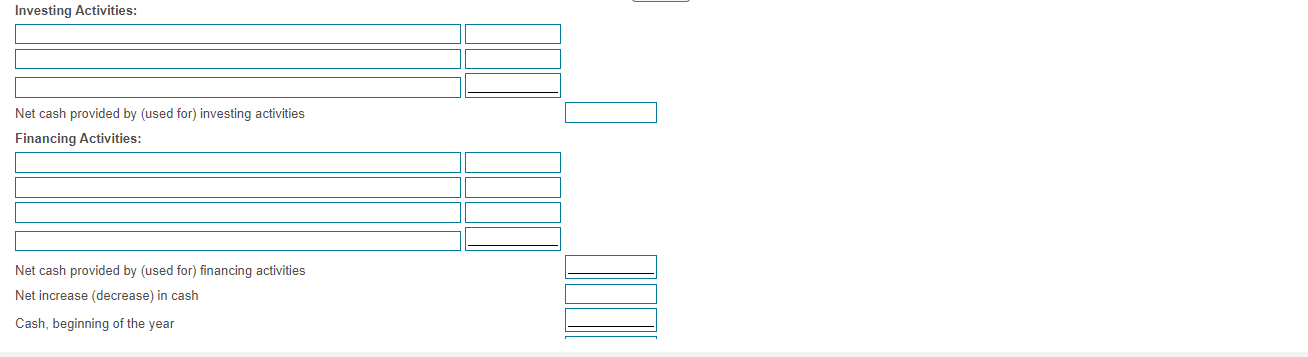

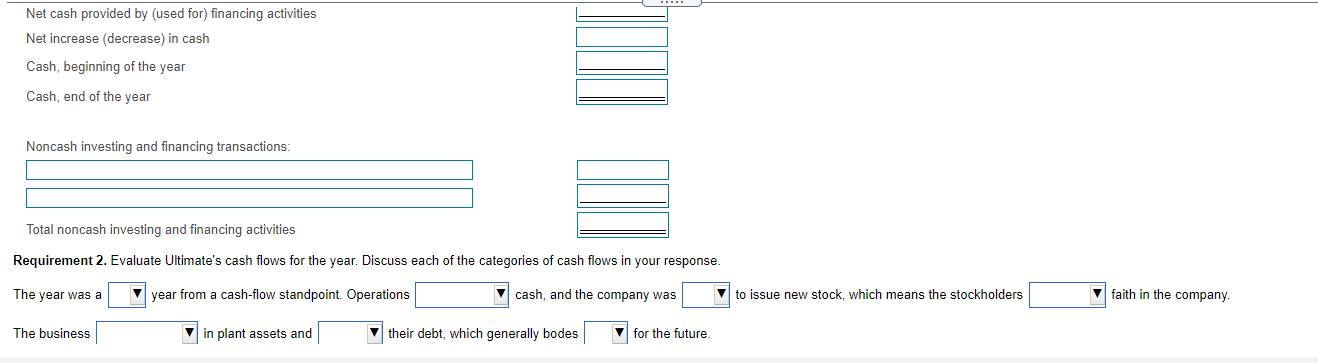

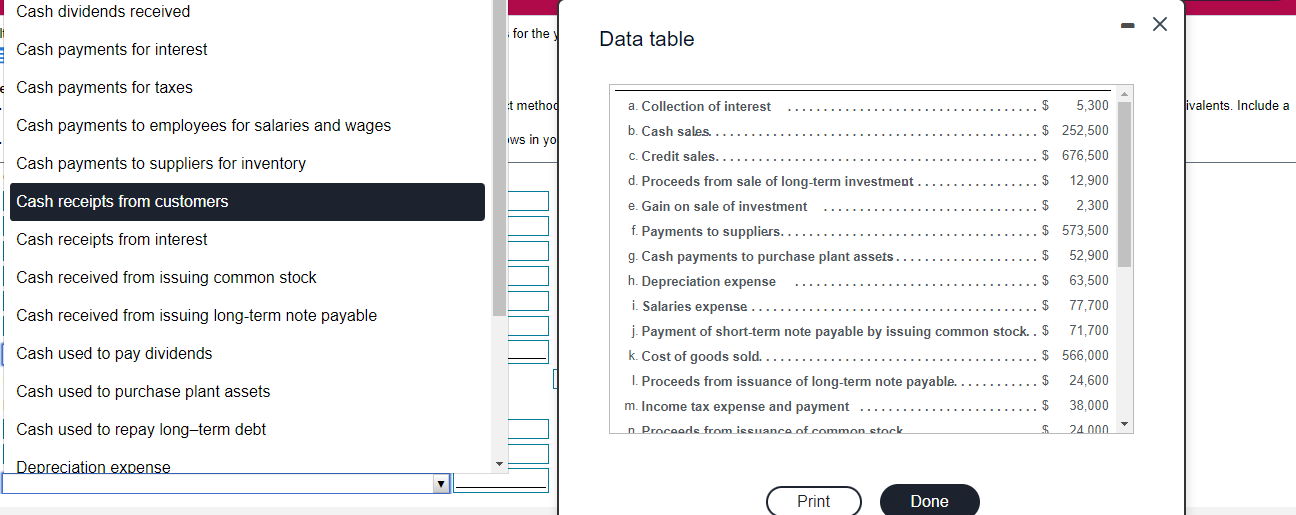

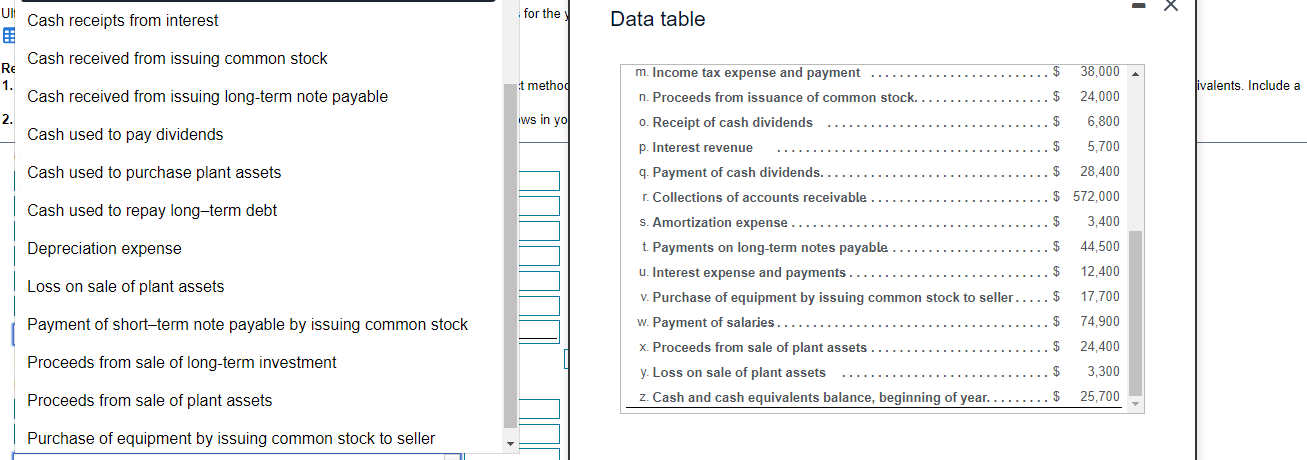

Ultimate Digital Services, Inc., has provided the following data from the company's records for the year just ended December 31: F: (Click the icon to view the data.) Requirements 1. Prepare the statement of cash flows for Ultimate Digital Services, Inc., using the direct method for cash flows from operations. Note that you will need to calculate the ending balance of cash and cash equivalents. Include a schedule of noncash investing and financing activities. 2. Evaluate Ultimate's cash flows for the year. Discuss each of the categories of cash flows in your response. Requirement 1. Prepare the statement of cash flows for Ultimate Digital Services, Inc., using the direct method for cash flows from operations. Note that you will need to calculate the ending balance of cash and cash equivalents. Include a schedule of noncash investing and financing activities. Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted or for a net cash outflow.) Ultimate Digital Services, Inc. Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: Requirements 1. Prepare the statement of cash flows for Ultimate Digital Services, Inc., using the direct method for cash flows from operations. Note that you will need to calculate the ending balance of cash and cash equivalents. Include a schedule of noncash investing and financing activities. 2. Evaluate Ultimate's cash flows for the year. Discuss each of the categories of cash flows in your response Statement of Cash Flows (Direct Method) For the Year Ended December 31 Operating Activities: Net cash provided by (used for) operating activities Investing Activities: Investing Activities: Net cash provided by used for) investing activities Financing Activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash Cash, beginning of the year MI Net cash provided by used for) financing activities Net increase (decrease) in cash Cash, beginning of the year Cash, end of the year Noncash investing and financing transactions: Total noncash investing and financing activities Requirement 2. Evaluate Ultimate's cash flows for the year. Discuss each of the categories of cash flows in your response. The year was a year from a cash-flow standpoint. Operations cash, and the company was to issue new stock, which means the stockholders faith in the company The business in plant assets and their debt, which generally bodes for the future. Cash dividends received - X for the Data table Cash payments for interest Cash payments for taxes it method a. Collection of interest 5,300 ivalents. Include a Cash payments to employees for salaries and wages b. Cash sales. $ 252,500 wws in yol Cash payments to suppliers for inventory Cash receipts from customers Cash receipts from interest Cash received from issuing common stock c. Credit sales. $ 676,500 d. Proceeds from sale of long-term investment $ 12.900 e. Gain on sale of investment $ 2,300 f. Payments to suppliers. $ 573,500 g. Cash payments to purchase plant assets. $ 52.900 h. Depreciation expense $ 63,500 i. Salaries expense... 77,700 j. Payment of short-term note payable issuing common stock. . $ 71.700 k. Cost of goods sold... $ 566,000 1. Proceeds from issuance of long-term note payable. $ 24,600 m. Income tax expense and payment $ 38,000 n Proceede from issuance of common stock 24.00 Cash received from issuing long-term note payable Cash used to pay dividends Cash used to purchase plant assets Cash used to repay long-term debt Depreciation expense Print Done UB for the Cash receipts from interest Data table Cash received from issuing common stock Re 1. it method ivalents. Include a Cash received from issuing long-term note payable 2. ws in yo Cash used to pay dividends Cash used to purchase plant assets Cash used to repay long-term debt m. Income tax expense and payment 38,000 n. Proceeds from issuance of common stock. 24,000 o. Receipt of cash dividends $ 6.800 p. Interest revenue $ 5.700 9. Payment of cash dividends. $ 28,400 1. Collections of accounts receivable $ 572,000 s. Amortization expense. 3,400 t. Payments on long-term notes payable $ 44.500 u. Interest expense and payments $ 12,400 v. Purchase of equipment by issuing common stock to seller..... $ 17,700 w. Payment of salaries... 74,900 x. Proceeds from sale of plant assets $ 24,400 y. Loss on sale of plant assets $ 3,300 z. Cash and cash equivalents balance, beginning of year. ........ $ 25,700 Depreciation expense Loss on sale of plant assets Payment of short-term note payable by issuing common stock Proceeds from sale of long-term investment Proceeds from sale of plant assets Purchase of equipment by issuing common stock to seller