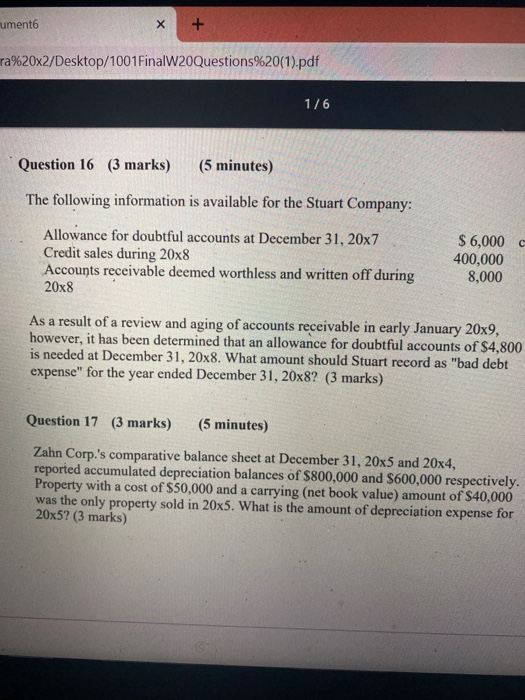

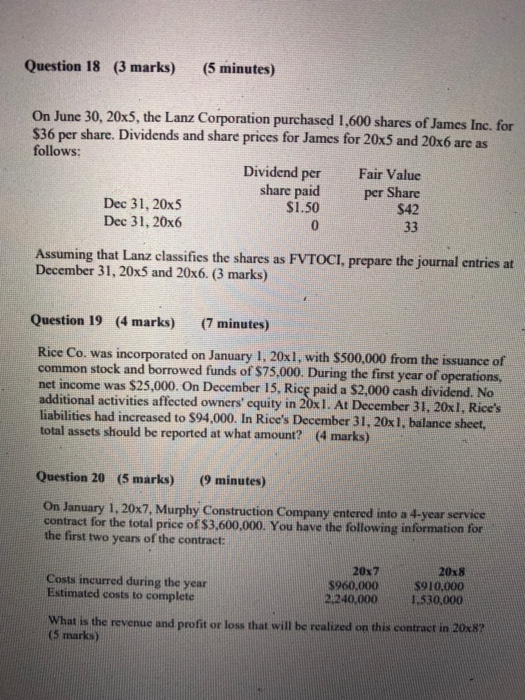

umento ra%20x2/Desktop/1001FinalW20Questions%20(1).pdf 1/6 Question 16 (3 marks) (5 minutes) The following information is available for the Stuart Company: Allowance for doubtful accounts at December 31, 20x7 Credit sales during 20x8 Accounts receivable deemed worthless and written off during 20x8 $ 6,000 C 400,000 8,000 As a result of a review and aging of accounts receivable in early January 20x9, however, it has been determined that an allowance for doubtful accounts of $4.800 is needed at December 31, 20x8. What amount should Stuart record as "bad debt expense" for the year ended December 31, 20x8? (3 marks) Question 17 (3 marks) (5 minutes) Zahn Corp.'s comparative balance sheet at December 31, 20x5 and 20x4, reported accumulated depreciation balances of $800,000 and $600,000 respectively. Property with a cost of $50,000 and a carrying (net book value) amount of $40,000 was the only property sold in 20x5. What is the amount of depreciation expense for 20x5? (3 marks) Question 18 (3 marks) (5 minutes) On June 30, 20x5, the Lanz Corporation purchased 1,600 shares of James Inc. for $36 per share. Dividends and share prices for James for 20x5 and 20x6 are as follows: Dividend per Fair Value share paid per Share Dec 31, 20x5 $1.50 $42 Dec 31, 20x6 33 Assuming that Lanz classifies the shares as FVTOCI, prepare the journal entries at December 31, 20x5 and 20x6. (3 marks) Question 19 (4 marks) (7 minutes) Rice Co. was incorporated on January 1, 20x1, with $500,000 from the issuance of common stock and borrowed funds of $75,000. During the first year of operations, net income was $25,000. On December 15, Rice paid a $2.000 cash dividend. No additional activities affected owners' equity in 20x 1. At December 31, 20x1, Rice's liabilities had increased to $94.000. In Rice's December 31, 20x1, balance sheet. total assets should be reported at what amount? (4 marks) Question 20 (5 marks) (9 minutes) On January 1, 20x7, Murphy Construction Company entered into a 4-year service contract for the total price of $3,600,000. You have the following information for the first two years of the contract: 20x7 20x8 Costs incurred during the year $960,000 $910,000 Estimated costs to complete 2.240,000 1,530,000 What is the revenue and profit or loss that will be realized on this contract in 20x8% (5 marks) umento ra%20x2/Desktop/1001FinalW20Questions%20(1).pdf 1/6 Question 16 (3 marks) (5 minutes) The following information is available for the Stuart Company: Allowance for doubtful accounts at December 31, 20x7 Credit sales during 20x8 Accounts receivable deemed worthless and written off during 20x8 $ 6,000 C 400,000 8,000 As a result of a review and aging of accounts receivable in early January 20x9, however, it has been determined that an allowance for doubtful accounts of $4.800 is needed at December 31, 20x8. What amount should Stuart record as "bad debt expense" for the year ended December 31, 20x8? (3 marks) Question 17 (3 marks) (5 minutes) Zahn Corp.'s comparative balance sheet at December 31, 20x5 and 20x4, reported accumulated depreciation balances of $800,000 and $600,000 respectively. Property with a cost of $50,000 and a carrying (net book value) amount of $40,000 was the only property sold in 20x5. What is the amount of depreciation expense for 20x5? (3 marks) Question 18 (3 marks) (5 minutes) On June 30, 20x5, the Lanz Corporation purchased 1,600 shares of James Inc. for $36 per share. Dividends and share prices for James for 20x5 and 20x6 are as follows: Dividend per Fair Value share paid per Share Dec 31, 20x5 $1.50 $42 Dec 31, 20x6 33 Assuming that Lanz classifies the shares as FVTOCI, prepare the journal entries at December 31, 20x5 and 20x6. (3 marks) Question 19 (4 marks) (7 minutes) Rice Co. was incorporated on January 1, 20x1, with $500,000 from the issuance of common stock and borrowed funds of $75,000. During the first year of operations, net income was $25,000. On December 15, Rice paid a $2.000 cash dividend. No additional activities affected owners' equity in 20x 1. At December 31, 20x1, Rice's liabilities had increased to $94.000. In Rice's December 31, 20x1, balance sheet. total assets should be reported at what amount? (4 marks) Question 20 (5 marks) (9 minutes) On January 1, 20x7, Murphy Construction Company entered into a 4-year service contract for the total price of $3,600,000. You have the following information for the first two years of the contract: 20x7 20x8 Costs incurred during the year $960,000 $910,000 Estimated costs to complete 2.240,000 1,530,000 What is the revenue and profit or loss that will be realized on this contract in 20x8%