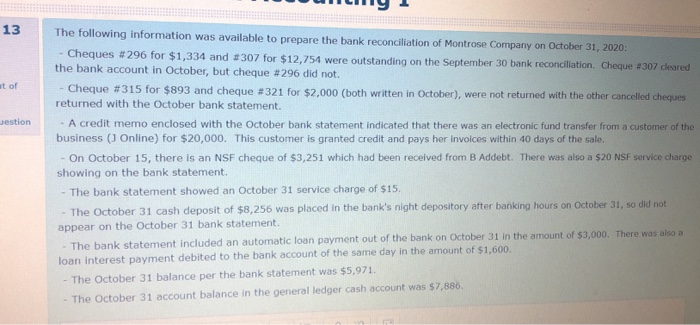

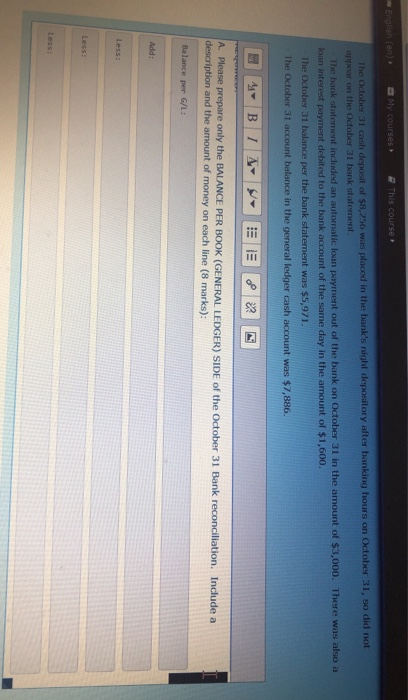

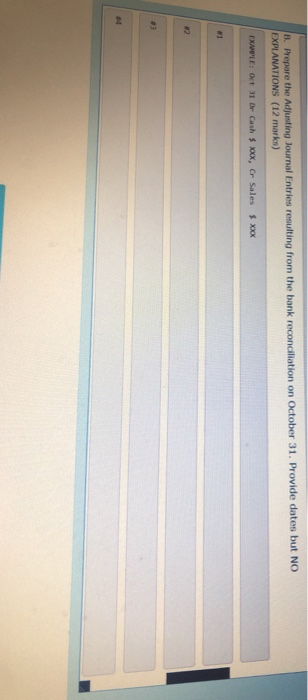

UMLy 1 13 at of Jestion The following information was available to prepare the bank reconciliation of Montrose Company on October 31, 2020 - Cheques #296 for $1,334 and 307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque 1307 deared the bank account in October, but cheque #296 did not - Cheque #315 for $893 and cheque #321 for $2,000 (both written in October), were not returned with the other cancelled cheques returned with the October bank statement. - A credit memo enclosed with the October bank statement indicated that there was an electronic fund transfer from a customer of the business (1 Online) for $20,000. This customer is granted credit and pays her invoices within 40 days of the sale. - On October 15, there is an NSF cheque of $3,251 which had been received from B Addebt. There was also a $20 NSF service charge showing on the bank statement. - The bank statement showed an October 31 service charge of $15. - The October 31 cash deposit of $8,256 was placed in the bank's night depository after banking hours on October 31, so did not appear on the October 31 bank statement. - The bank statement included an automatic loan payment out of the bank on October 31 in the amount of $3,000. There was also a loan interest payment debited to the bank account of the same day in the amount of $1,600 - The October 31 balance per the bank statement was $5,971. - The October 31 account balance in the general ledger cash account was $7,886. English (en) My courses This course -The October 31 cash deposit of $8,256 was placed in the bank's night depository after banking hours on October 31, so did not appear on the October 31 bank statement. The bank statement included an automatic loan payment out of the bank on October 31 in the amount of $3,000. There was also a loan interest payment debited to the bank account of the same day in the amount of $1,600. The October 31 balance per the bank statement was $5,971. The October 31 account balance in the general ledger cash account was $7,886, 4 B 1 4 - DEE ? A. Please prepare only the BALANCE PER BOOK (GENERAL LEDGER) SIDE of the October 31 Bank reconciliation. Include a description and the amount of money on each line (8 marks): Balance per G/L: B. Prepare the Adjusting Journal Entries resulting from the bank reconciliation on October 31. Provide dates but NO EXPLANATIONS (12 marks) EXOPLE: Oct 31 Dr Cash $ xox, Cr Sales $ xxx