Answered step by step

Verified Expert Solution

Question

1 Approved Answer

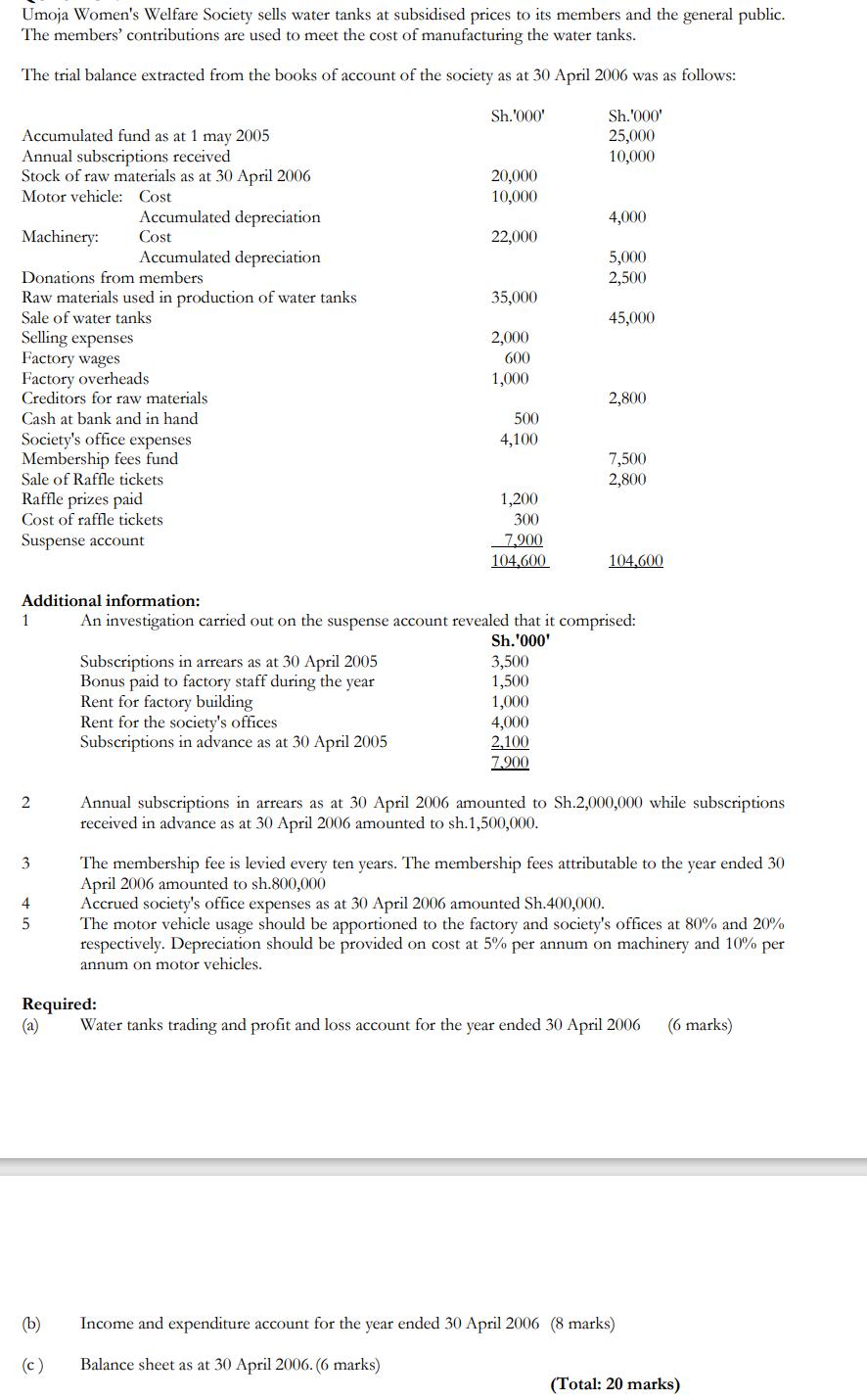

Umoja Women's Welfare Society sells water tanks at subsidised prices to its members and the general public. The members' contributions are used to meet

Umoja Women's Welfare Society sells water tanks at subsidised prices to its members and the general public. The members' contributions are used to meet the cost of manufacturing the water tanks. The trial balance extracted from the books of account of the society as at 30 April 2006 was as follows: Sh.'000' Accumulated fund as at 1 may 2005 Annual subscriptions received Stock of raw materials as at 30 April 2006 Motor vehicle: Cost Accumulated depreciation Cost Machinery: Donations from members Raw materials used in production of water tanks Sale of water tanks Selling expenses Factory wages Factory overheads Creditors for raw materials Cash at bank and in hand Society's office expenses Membership fees fund Sale of Raffle tickets Raffle prizes paid Cost of raffle tickets Suspense account 2 Accumulated depreciation 3 4 5 (b) (c) 20,000 10,000 Subscriptions in arrears as at 30 April 2005 Bonus paid to factory staff during the year Rent for factory building Rent for the society's offices Subscriptions in advance as at 30 April 2005 22,000 35,000 2,000 600 1,000 500 4,100 1,200 300 7.900 104,600 Additional information: 1 An investigation carried out on the suspense account revealed that it comprised: Sh.'000' 3,500 1,500 1,000 Sh.'000' 25,000 10,000 4,000 2,100 7,900 4,000 5,000 2,500 45,000 2,800 7,500 2,800 104,600 Annual subscriptions in arrears as at 30 April 2006 amounted to Sh.2,000,000 while subscriptions received in advance as at 30 April 2006 amounted to sh.1,500,000. The membership fee is levied every ten years. The membership fees attributable to the year ended 30 April 2006 amounted to sh.800,000 Accrued society's office expenses as at 30 April 2006 amounted Sh.400,000. The motor vehicle usage should be apportioned to the factory and society's offices at 80% and 20% respectively. Depreciation should be provided on cost at 5% per annum on machinery and 10% per annum on motor vehicles. Required: (a) Water tanks trading and profit and loss account for the year ended 30 April 2006 (6 marks) Income and expenditure account for the year ended 30 April 2006 (8 marks) Balance sheet as at 30 April 2006. (6 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started