Question

Umpqua Bank started its first day of operations with $10 million in capital on September 1, 2020. $180 million in checkable deposits was received. The

Umpqua Bank started its first day of operations with $10 million in capital on September 1, 2020. $180 million in checkable deposits was received. The bank invested in a $80 million commercial loan and $50 million mortgages, with the following term:

- Mortgages: 250 standard 30-year, fixed-rate with a nominal annual rate of 3.5% each for $200,000.

- Commercial loan: 5-year loan, simple interest paid monthly at 1.0% per month

The bank also purchased $40 million in 30-day T-bills. The T-bills were trading at $990.099 for a $1,000 face value.

On September 2, 2020, deposits fell by $5 million. Shortly after the deposit outflow, Umpqua Bank had borrowed the needed fund in the fed funds market to cover the shortfall in reserves for the remainder of the month (29 days, from 9/2 to 9/30). The required yield on a discount basis was 3.5%.

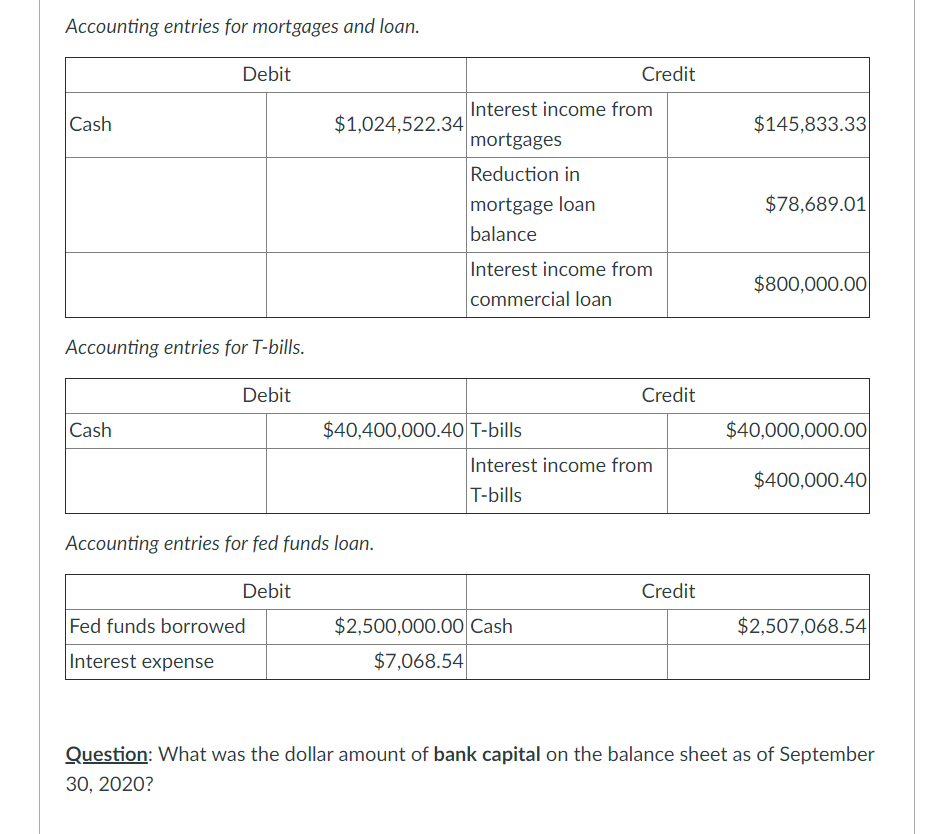

On September 30, 2020, Umpqua Bank finally received the first required payments from its mortgages, loan, and T-bills, and it also paid off its fed funds loan. Umpqua Bank was required to establish a loan loss reserve of $100,000 and the bank was in the 35% tax bracket. The bank had not engaged in any off-balance-sheet activities.

The following accounting entries record these cash flow transactions.

A. $11,338,765.20

B. $10,006,346.79

C. $10,805,197.37

D. $10,000,000.00

Accounting entries for mortgages and loan. Debit Credit Cash $145,833.33 Interest income from $1,024,522.34 mortgages Reduction in mortgage loan balance Interest income from commercial loan $78,689.01 $800,000.00 Accounting entries for T-bills. Debit Credit Cash $40,000,000.00 $40,400,000.40 T-bills Interest income from T-bills $400,000.40 Accounting entries for fed funds loan. Debit Credit $2,507,068.54 Fed funds borrowed Interest expense $2,500,000.00 Cash $7,068.54 Question: What was the dollar amount of bank capital on the balance sheet as of September 30, 2020? Accounting entries for mortgages and loan. Debit Credit Cash $145,833.33 Interest income from $1,024,522.34 mortgages Reduction in mortgage loan balance Interest income from commercial loan $78,689.01 $800,000.00 Accounting entries for T-bills. Debit Credit Cash $40,000,000.00 $40,400,000.40 T-bills Interest income from T-bills $400,000.40 Accounting entries for fed funds loan. Debit Credit $2,507,068.54 Fed funds borrowed Interest expense $2,500,000.00 Cash $7,068.54 Question: What was the dollar amount of bank capital on the balance sheet as of September 30, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started