Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Una instituci n financiera ha celebrado un cross currency swap ( swap de moneda ) a un plazo de 1 0 a os con la

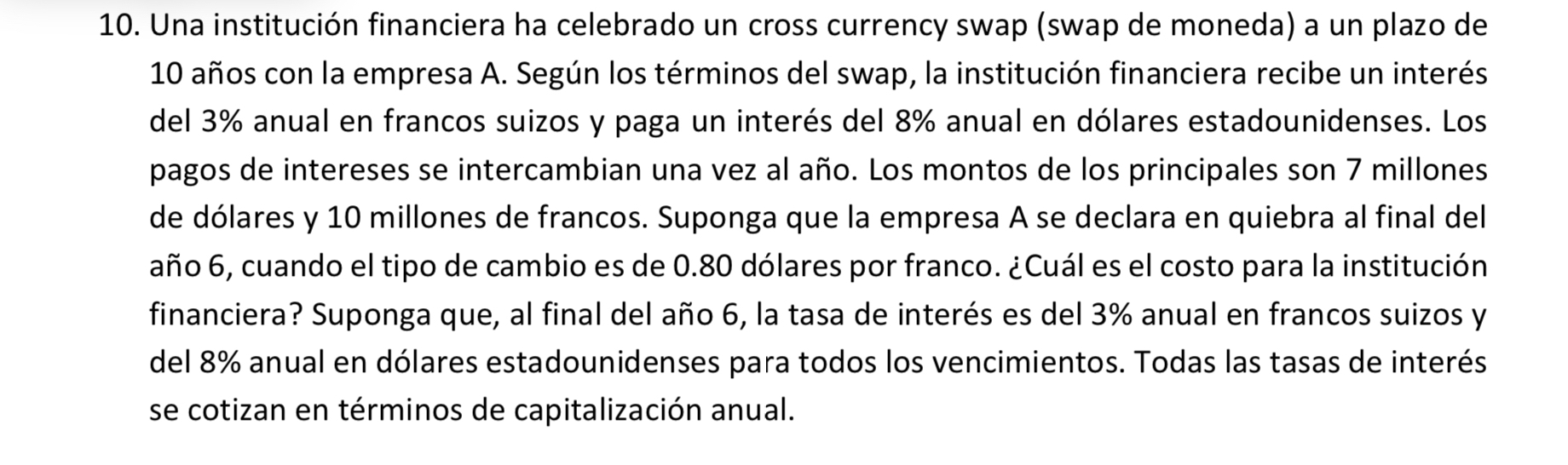

Una institucin financiera ha celebrado un cross currency swap swap de moneda a un plazo de aos con la empresa Segn los trminos del swap, la institucin financiera recibe un inters del anual en francos suizos y paga un inters del anual en dlares estadounidenses. Los pagos de intereses se intercambian una vez al ao Los montos de los principales son millones de dlares y millones de francos. Suponga que la empresa A se declara en quiebra al final del ao cuando el tipo de cambio es de dlares por franco. Cul es el costo para la institucin financiera? Suponga que, al final del ao la tasa de inters es del anual en francos suizos y del anual en dlares estadounidenses para todos los vencimientos. Todas las tasas de inters se cotizan en trminos de capitalizacin anual.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started