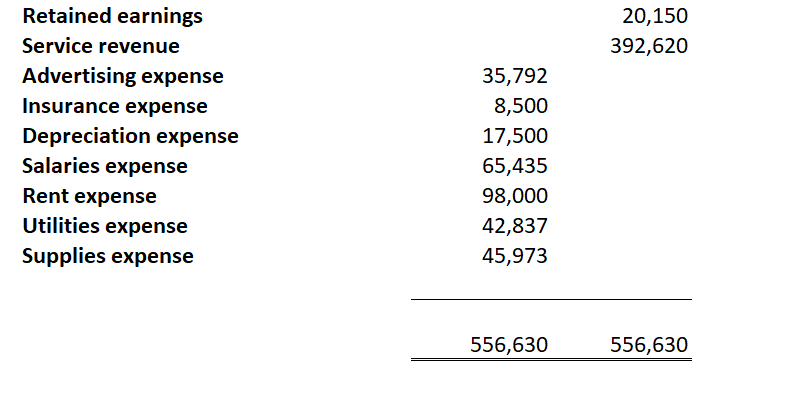

unadjusted trial balance

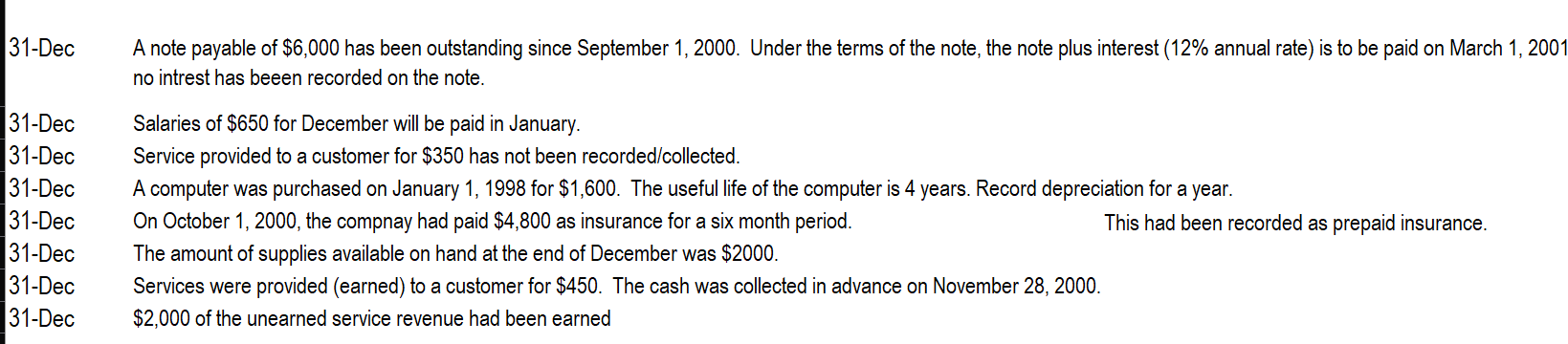

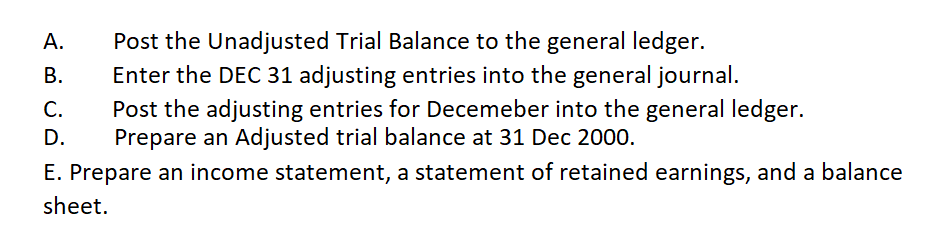

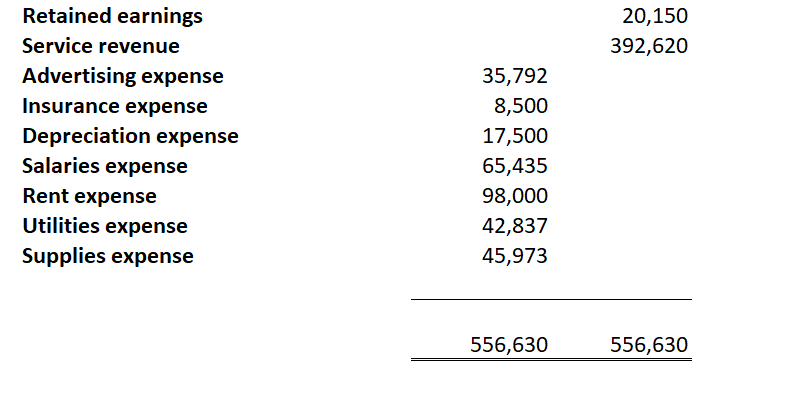

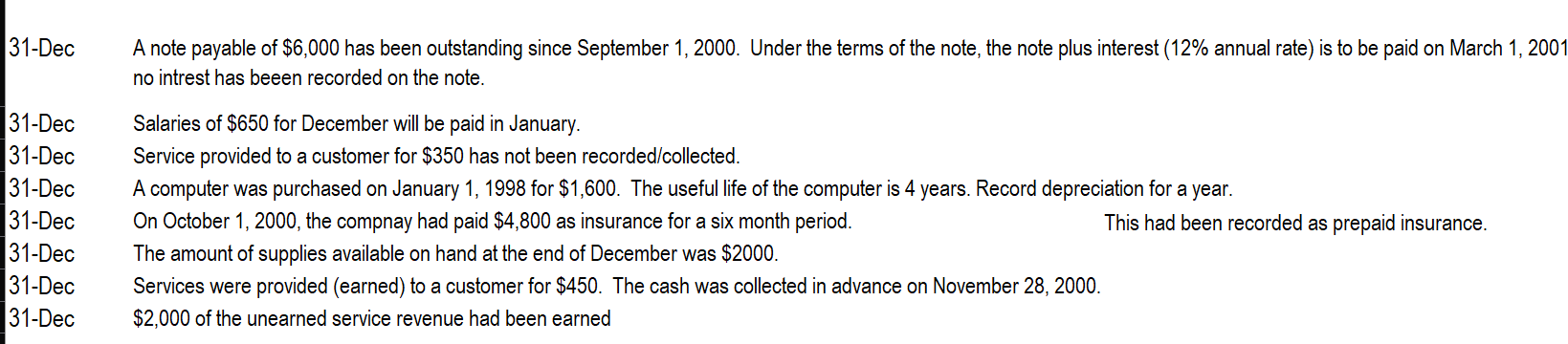

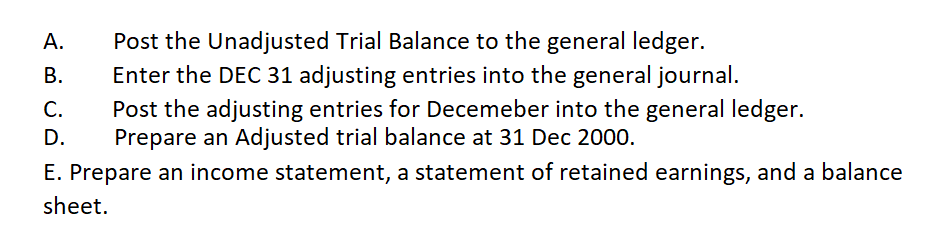

Retained earnings Service revenue Advertising expense Insurance expense Depreciation expense Salaries expense Rent expense Utilities expense Supplies expense 20,150392,620556,630 A note payable of $6,000 has been outstanding since September 1,2000 . Under the terms of the note, the note plus interest (12\% annual rate) is to be paid on March 1,200 no intrest has beeen recorded on the note. Salaries of $650 for December will be paid in January. Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1,1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. This had been recorded as prepaid insurance. The amount of supplies available on hand at the end of $2000. Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28,2000. $2,000 of the unearned service revenue had been earned A. Post the Unadjusted Trial Balance to the general ledger. B. Enter the DEC 31 adjusting entries into the general journal. C. Post the adjusting entries for Decemeber into the general ledger. D. Prepare an Adjusted trial balance at 31Dec2000. E. Prepare an income statement, a statement of retained earnings, and a balance sheet. Retained earnings Service revenue Advertising expense Insurance expense Depreciation expense Salaries expense Rent expense Utilities expense Supplies expense 20,150392,620556,630 A note payable of $6,000 has been outstanding since September 1,2000 . Under the terms of the note, the note plus interest (12\% annual rate) is to be paid on March 1,200 no intrest has beeen recorded on the note. Salaries of $650 for December will be paid in January. Service provided to a customer for $350 has not been recorded/collected. A computer was purchased on January 1,1998 for $1,600. The useful life of the computer is 4 years. Record depreciation for a year. On October 1, 2000, the compnay had paid $4,800 as insurance for a six month period. This had been recorded as prepaid insurance. The amount of supplies available on hand at the end of $2000. Services were provided (earned) to a customer for $450. The cash was collected in advance on November 28,2000. $2,000 of the unearned service revenue had been earned A. Post the Unadjusted Trial Balance to the general ledger. B. Enter the DEC 31 adjusting entries into the general journal. C. Post the adjusting entries for Decemeber into the general ledger. D. Prepare an Adjusted trial balance at 31Dec2000. E. Prepare an income statement, a statement of retained earnings, and a balance sheet