Answered step by step

Verified Expert Solution

Question

1 Approved Answer

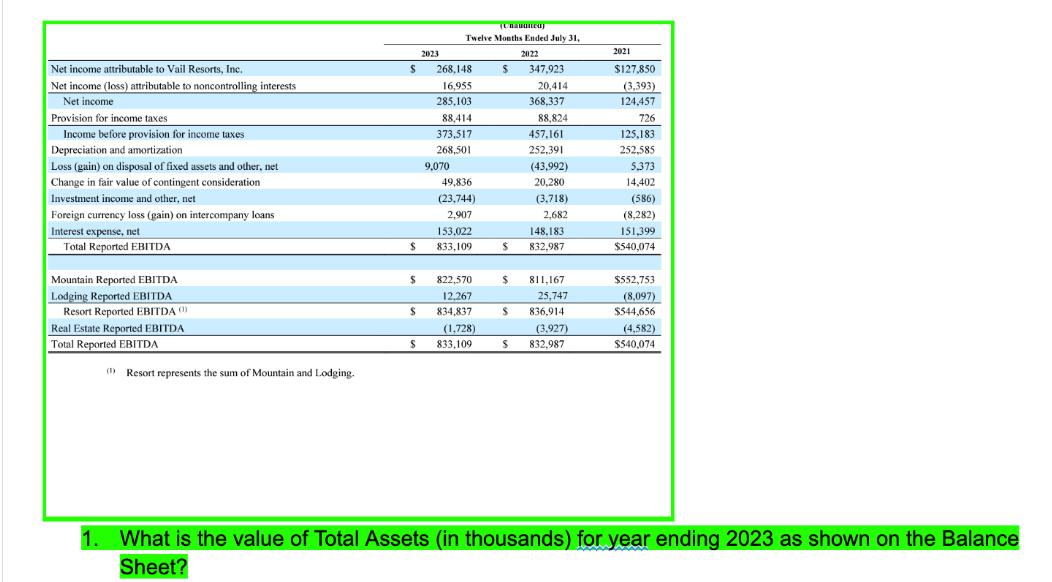

(Unaudited) Twelve Months Ended July 31, 2021 2023 2022 Net income attributable to Vail Resorts, Inc. Net income (loss) attributable to noncontrolling interests Net

(Unaudited) Twelve Months Ended July 31, 2021 2023 2022 Net income attributable to Vail Resorts, Inc. Net income (loss) attributable to noncontrolling interests Net income Provision for income taxes Income before provision for income taxes S 268,148 $ 347,923 $127,850 16,955 285,103 88,414 20,414 368,337 88,824 (3,393) 124,457 726 373,517 457,161 125,183 Depreciation and amortization 268,501 252,391 252,585 Loss (gain) on disposal of fixed assets and other, net 9,070 (43,992) 5.373 Change in fair value of contingent consideration Investment income and other, net Foreign currency loss (gain) on intercompany loans Interest expense, net Total Reported EBITDA Mountain Reported EBITDA Lodging Reported EBITDA 49,836 20,280 14,402 (23,744) (3.718) (586) 2,907 2,682 (8,282) 153.022 148,183 151,399 $ 833,109 $ 832,987 $540,074 $ 822,570 811,167 $552,753 12,267 25,747 (8,097) Resort Reported EBITDA (1) $ 834,837 S 836,914 $544,656 Real Estate Reported EBITDA Total Reported EBITDA $ (1,728) 833,109 S (3.927) 832,987 (4,582) $540,074 (1) Resort represents the sum of Mountain and Lodging. 1. What is the value of Total Assets (in thousands) for year ending 2023 as shown on the Balance Sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started