undefined

undefined

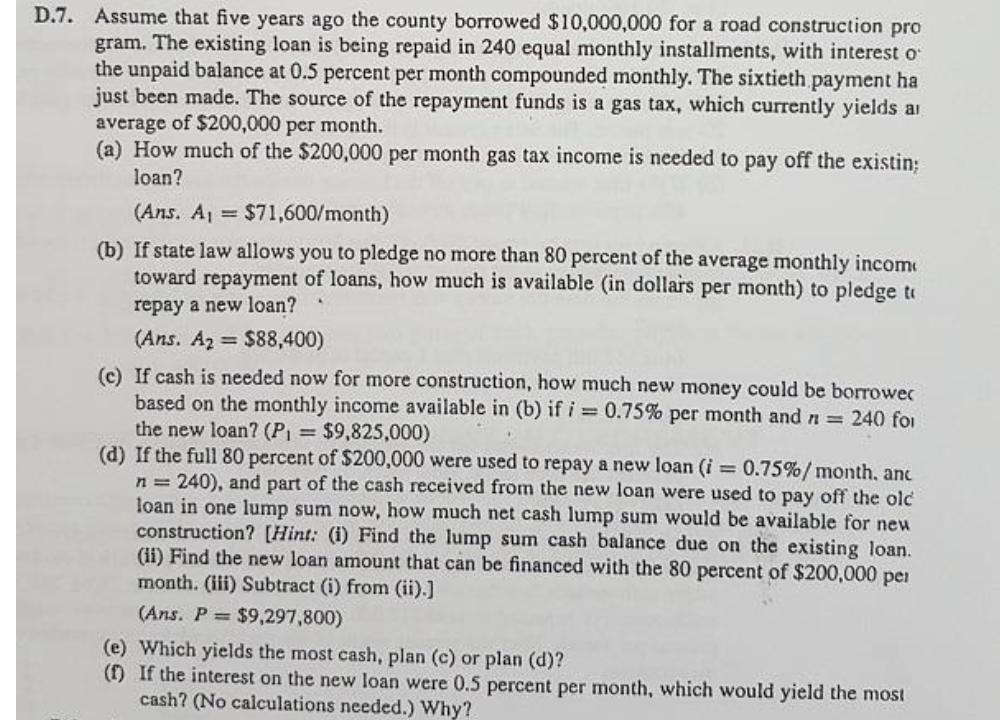

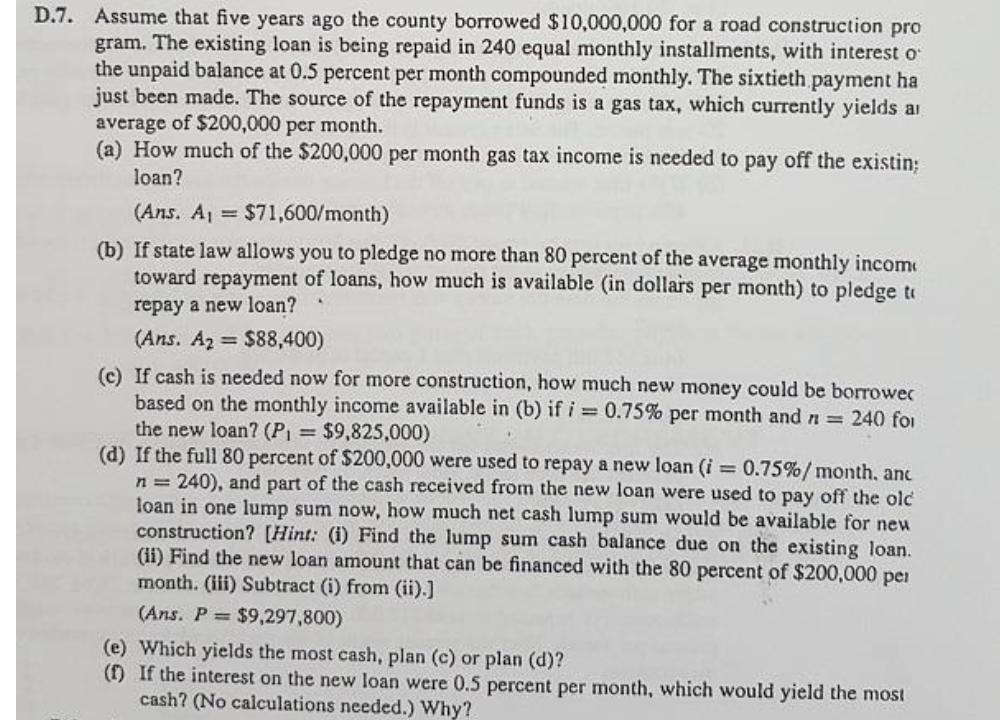

D.7. Assume that five years ago the county borrowed $10,000,000 for a road construction pro gram. The existing loan is being repaid in 240 equal monthly installments, with interest o the unpaid balance at 0.5 percent per month compounded monthly. The sixtieth payment ha just been made. The source of the repayment funds is a gas tax, which currently yields ar average of $200,000 per month. (a) How much of the $200,000 per month gas tax income is needed to pay off the existin; loan? (Ans. Aj = $71,600/month) (b) If state law allows you to pledge no more than 80 percent of the average monthly incom toward repayment of loans, how much is available in dollars per month) to pledge to repay a new loan? (Ans. Az = $88,400) (c) If cash is needed now for more construction, how much new money could be borrower based on the monthly income available in (b) if i = 0.75% per month and n = 240 foi the new loan? (P = $9,825,000) (d) If the full 80 percent of $200,000 were used to repay a new loan (i = 0.75%/ month, anc n=240), and part of the cash received from the new loan were used to pay off the old loan in one lump sum now, how much net cash lump sum would be available for neu construction? (Hint: (i) Find the lump sum cash balance due on the existing loan. (11) Find the new loan amount that can be financed with the 80 percent of $200,000 per month. (iii) Subtract (i) from (ii).) (Ans. P = $9,297,800) (e) Which yields the most cash, plan (c) or plan (d)? (1) If the interest on the new loan were 0.5 percent per month, which would yield the most cash? (No calculations needed.) Why? D.7. Assume that five years ago the county borrowed $10,000,000 for a road construction pro gram. The existing loan is being repaid in 240 equal monthly installments, with interest o the unpaid balance at 0.5 percent per month compounded monthly. The sixtieth payment ha just been made. The source of the repayment funds is a gas tax, which currently yields ar average of $200,000 per month. (a) How much of the $200,000 per month gas tax income is needed to pay off the existin; loan? (Ans. Aj = $71,600/month) (b) If state law allows you to pledge no more than 80 percent of the average monthly incom toward repayment of loans, how much is available in dollars per month) to pledge to repay a new loan? (Ans. Az = $88,400) (c) If cash is needed now for more construction, how much new money could be borrower based on the monthly income available in (b) if i = 0.75% per month and n = 240 foi the new loan? (P = $9,825,000) (d) If the full 80 percent of $200,000 were used to repay a new loan (i = 0.75%/ month, anc n=240), and part of the cash received from the new loan were used to pay off the old loan in one lump sum now, how much net cash lump sum would be available for neu construction? (Hint: (i) Find the lump sum cash balance due on the existing loan. (11) Find the new loan amount that can be financed with the 80 percent of $200,000 per month. (iii) Subtract (i) from (ii).) (Ans. P = $9,297,800) (e) Which yields the most cash, plan (c) or plan (d)? (1) If the interest on the new loan were 0.5 percent per month, which would yield the most cash? (No calculations needed.) Why

undefined

undefined