undefined

undefined

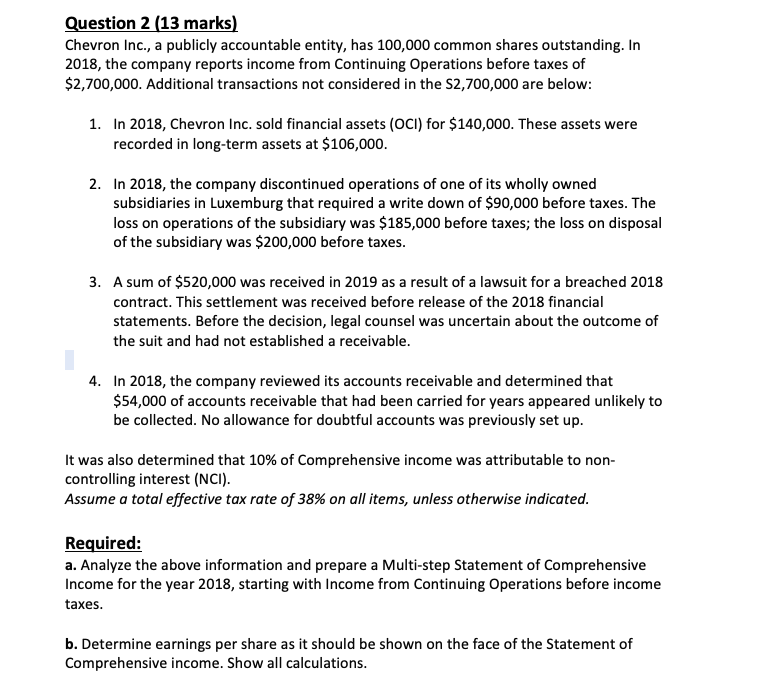

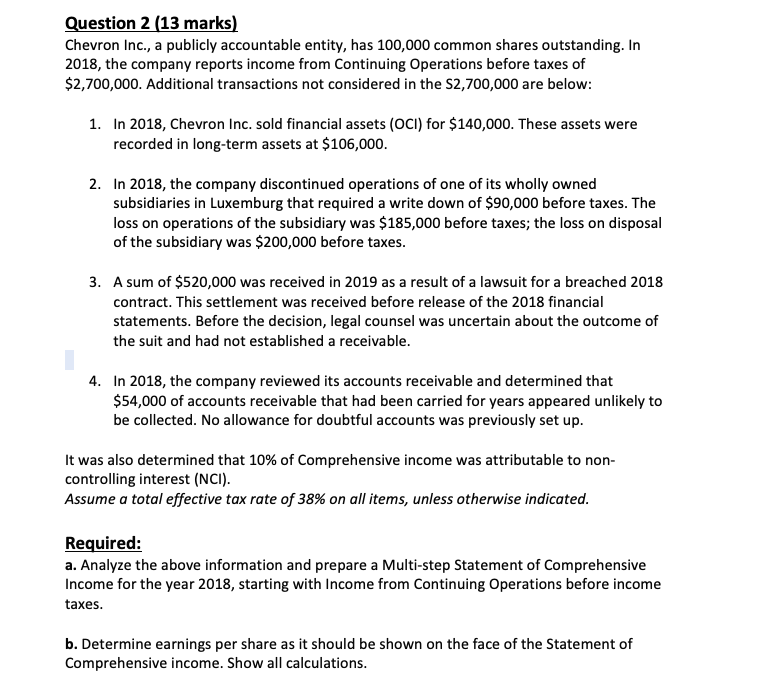

Question 2 (13 marks) Chevron Inc., a publicly accountable entity, has 100,000 common shares outstanding. In 2018, the company reports income from Continuing Operations before taxes of $2,700,000. Additional transactions not considered in the S2,700,000 are below: 1. In 2018, Chevron Inc. sold financial assets (OCI) for $140,000. These assets were recorded in long-term assets at $106,000. 2. In 2018, the company discontinued operations of one of its wholly owned subsidiaries in Luxemburg that required a write down of $90,000 before taxes. The loss on operations of the subsidiary was $185,000 before taxes; the loss on disposal of the subsidiary was $200,000 before taxes. 3. A sum of $520,000 was received in 2019 as a result of a lawsuit for a breached 2018 contract. This settlement was received before release of the 2018 financial statements. Before the decision, legal counsel was uncertain about the outcome of the suit and had not established a receivable. 4. In 2018, the company reviewed its accounts receivable and determined that $54,000 of accounts receivable that had been carried for years appeared unlikely to be collected. No allowance for doubtful accounts was previously set up. It was also determined that 10% of Comprehensive income was attributable to non- controlling interest (NCI). Assume a total effective tax rate of 38% on all items, unless otherwise indicated. Required: a. Analyze the above information and prepare a Multi-step Statement of Comprehensive Income for the year 2018, starting with Income from Continuing Operations before income taxes. b. Determine earnings per share as it should be shown on the face of the Statement of Comprehensive income. Show all calculations. Question 2 (13 marks) Chevron Inc., a publicly accountable entity, has 100,000 common shares outstanding. In 2018, the company reports income from Continuing Operations before taxes of $2,700,000. Additional transactions not considered in the S2,700,000 are below: 1. In 2018, Chevron Inc. sold financial assets (OCI) for $140,000. These assets were recorded in long-term assets at $106,000. 2. In 2018, the company discontinued operations of one of its wholly owned subsidiaries in Luxemburg that required a write down of $90,000 before taxes. The loss on operations of the subsidiary was $185,000 before taxes; the loss on disposal of the subsidiary was $200,000 before taxes. 3. A sum of $520,000 was received in 2019 as a result of a lawsuit for a breached 2018 contract. This settlement was received before release of the 2018 financial statements. Before the decision, legal counsel was uncertain about the outcome of the suit and had not established a receivable. 4. In 2018, the company reviewed its accounts receivable and determined that $54,000 of accounts receivable that had been carried for years appeared unlikely to be collected. No allowance for doubtful accounts was previously set up. It was also determined that 10% of Comprehensive income was attributable to non- controlling interest (NCI). Assume a total effective tax rate of 38% on all items, unless otherwise indicated. Required: a. Analyze the above information and prepare a Multi-step Statement of Comprehensive Income for the year 2018, starting with Income from Continuing Operations before income taxes. b. Determine earnings per share as it should be shown on the face of the Statement of Comprehensive income. Show all calculations

undefined

undefined