undefined

undefined

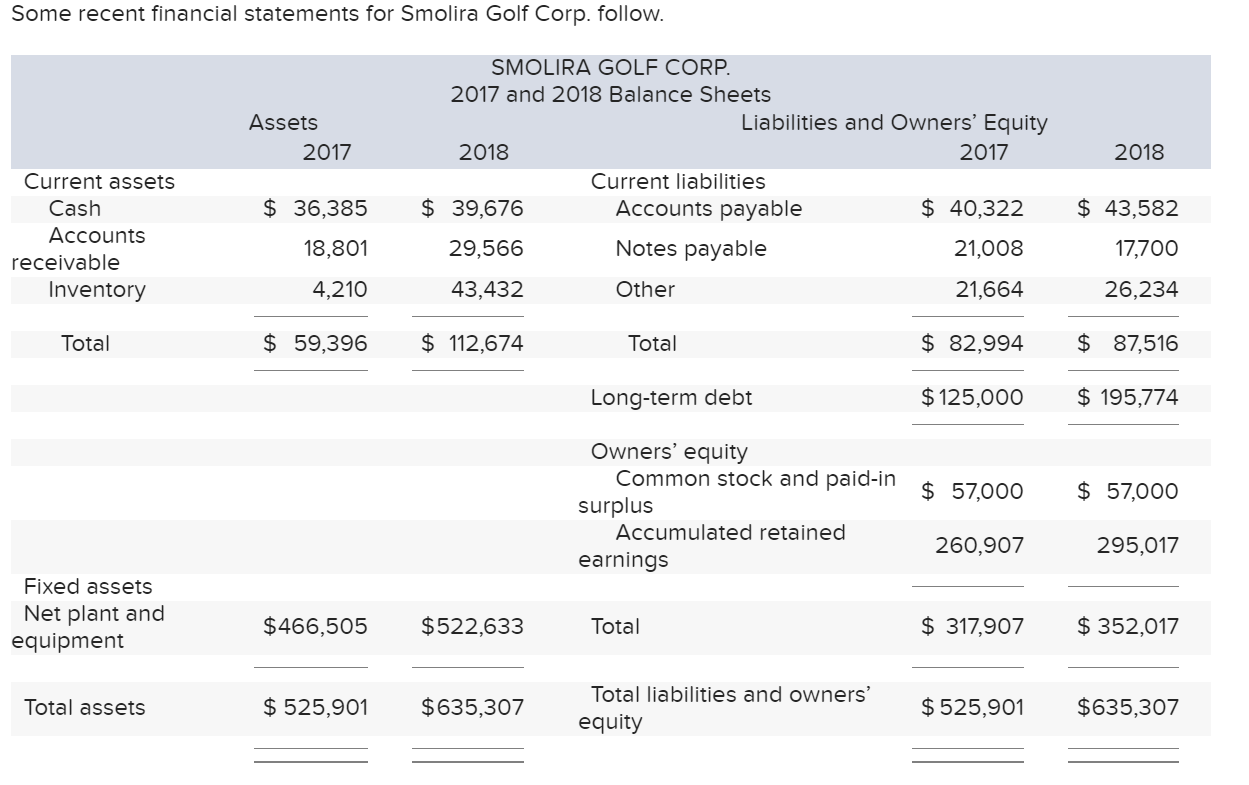

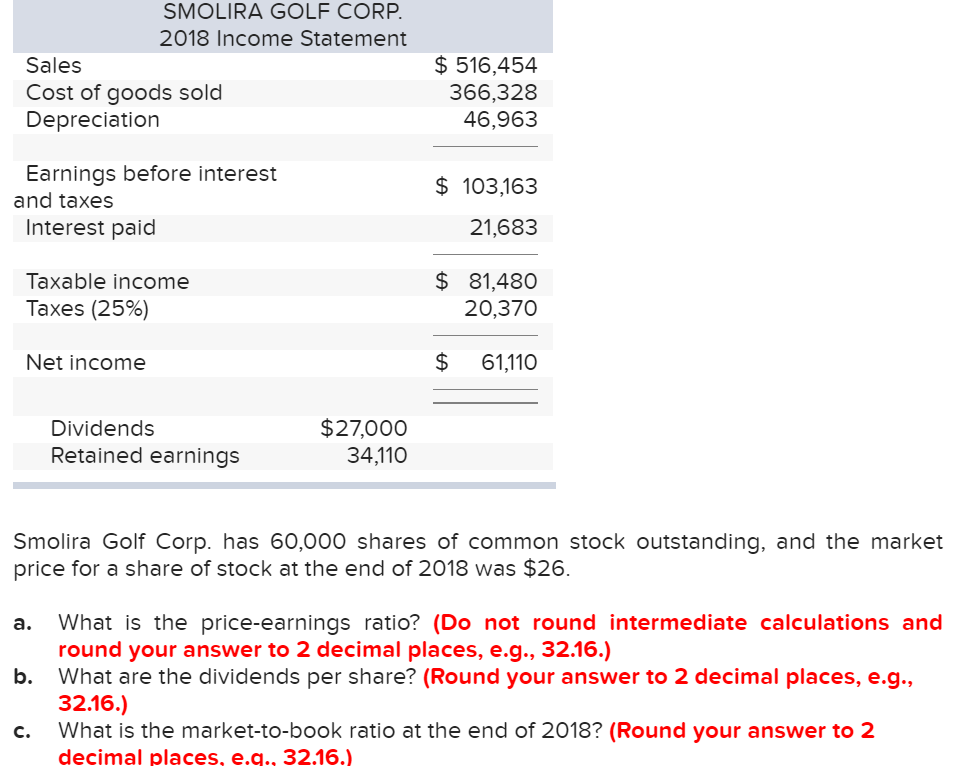

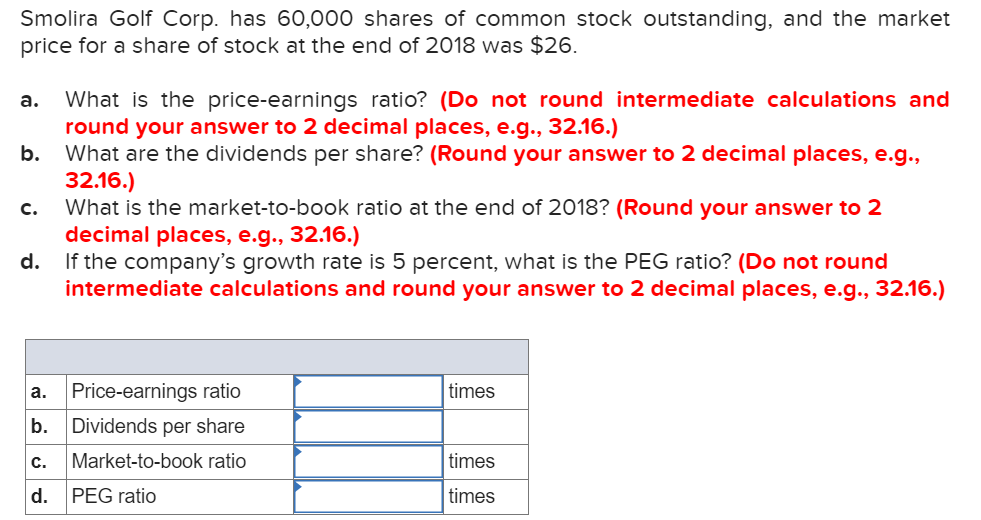

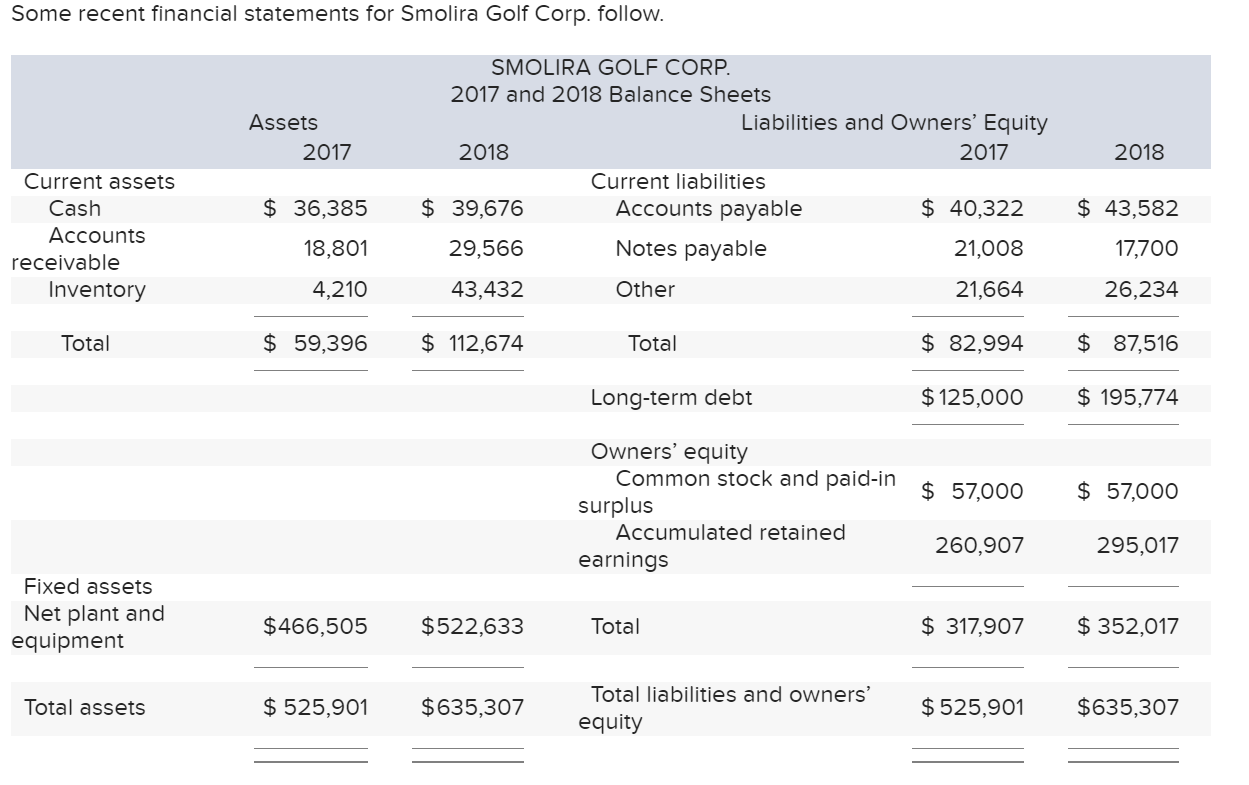

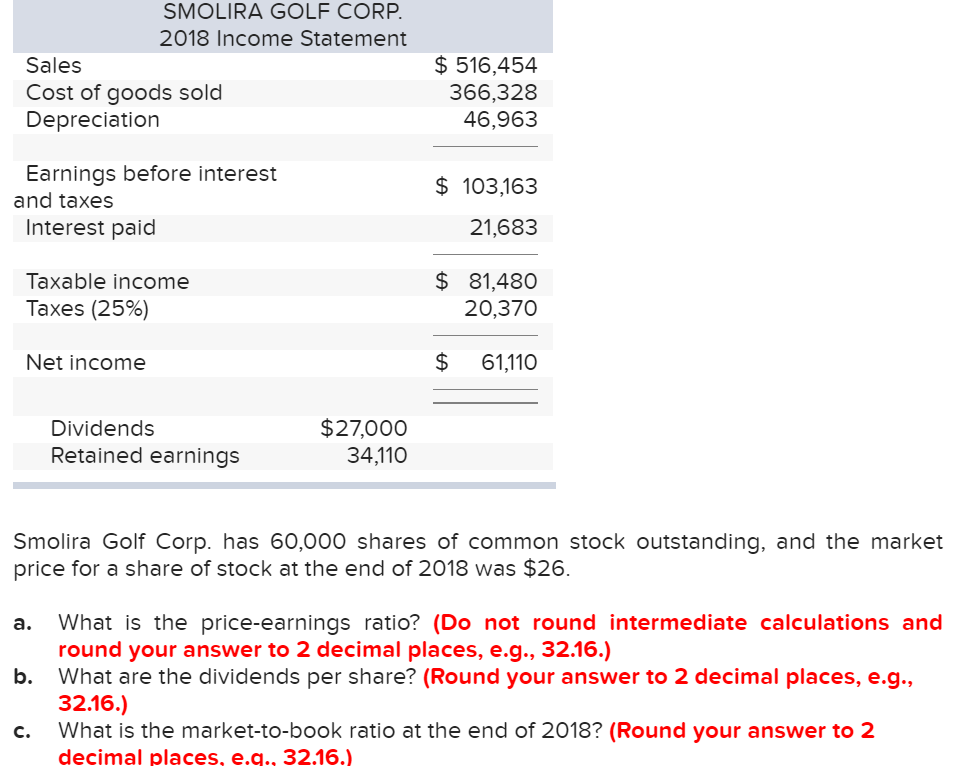

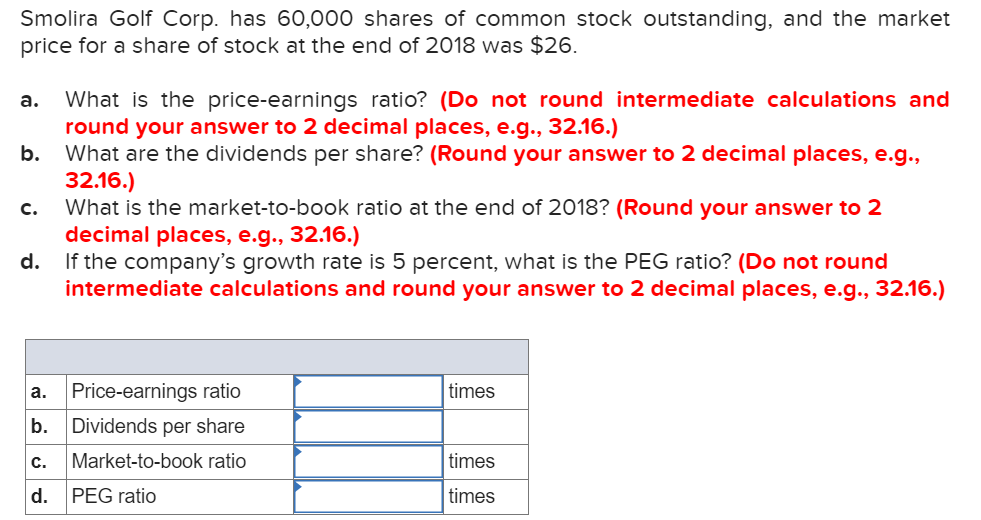

Some recent financial statements for Smolira Golf Corp. follow. Assets 2017 SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 39,676 Accounts payable $ 40,322 2018 $ 36,385 $ 43,582 Current assets Cash Accounts receivable Inventory 18,801 29,566 Notes payable 21,008 17,700 4,210 43,432 Other 21,664 26,234 Total $ 59,396 $ 112,674 Total $ 82,994 $ 87,516 Long-term debt $ 125,000 $ 195,774 $ 57,000 $ 57,000 Owners' equity Common stock and paid-in surplus Accumulated retained earnings 260,907 295,017 Fixed assets Net plant and equipment $466,505 $522,633 Total $ 317,907 $ 352,017 Total assets $ 525,901 $635,307 Total liabilities and owners' equity $ 525,901 $635,307 SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation $ 516,454 366,328 46,963 $ 103,163 Earnings before interest and taxes Interest paid 21,683 Taxable income Taxes (25%) $ 81,480 20,370 Net income 61,110 Dividends Retained earnings $27,000 34,110 Smolira Golf Corp. has 60,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was $26. a. b. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) What are the dividends per share? (Round your answer to 2 decimal places, e.g., 32.16.) What is the market-to-book ratio at the end of 2018? (Round your answer to 2 decimal places, e.g., 32.16.) C. Smolira Golf Corp. has 60,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2018 was $26. a. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are the dividends per share? (Round your answer to 2 decimal places, e.g., 32.16.) What is the market-to-book ratio at the end of 2018? (Round your answer to 2 decimal places, e.g., 32.16.) d. If the company's growth rate is 5 percent, what is the PEG ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) C. a. times b. Price-earnings ratio Dividends per share Market-to-book ratio times d. PEG ratio times

undefined

undefined