undefined

undefined

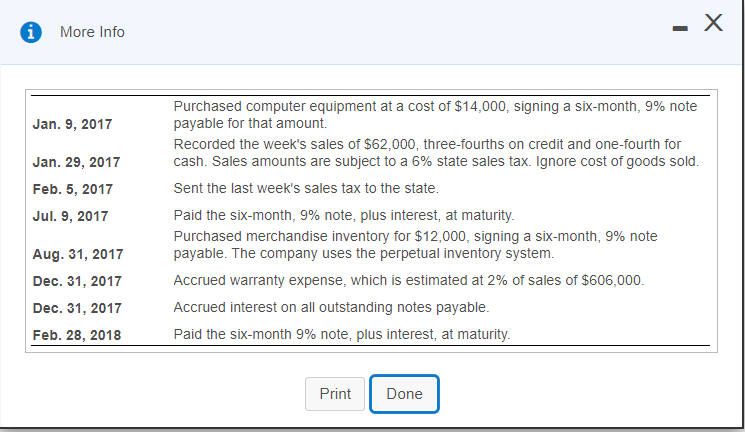

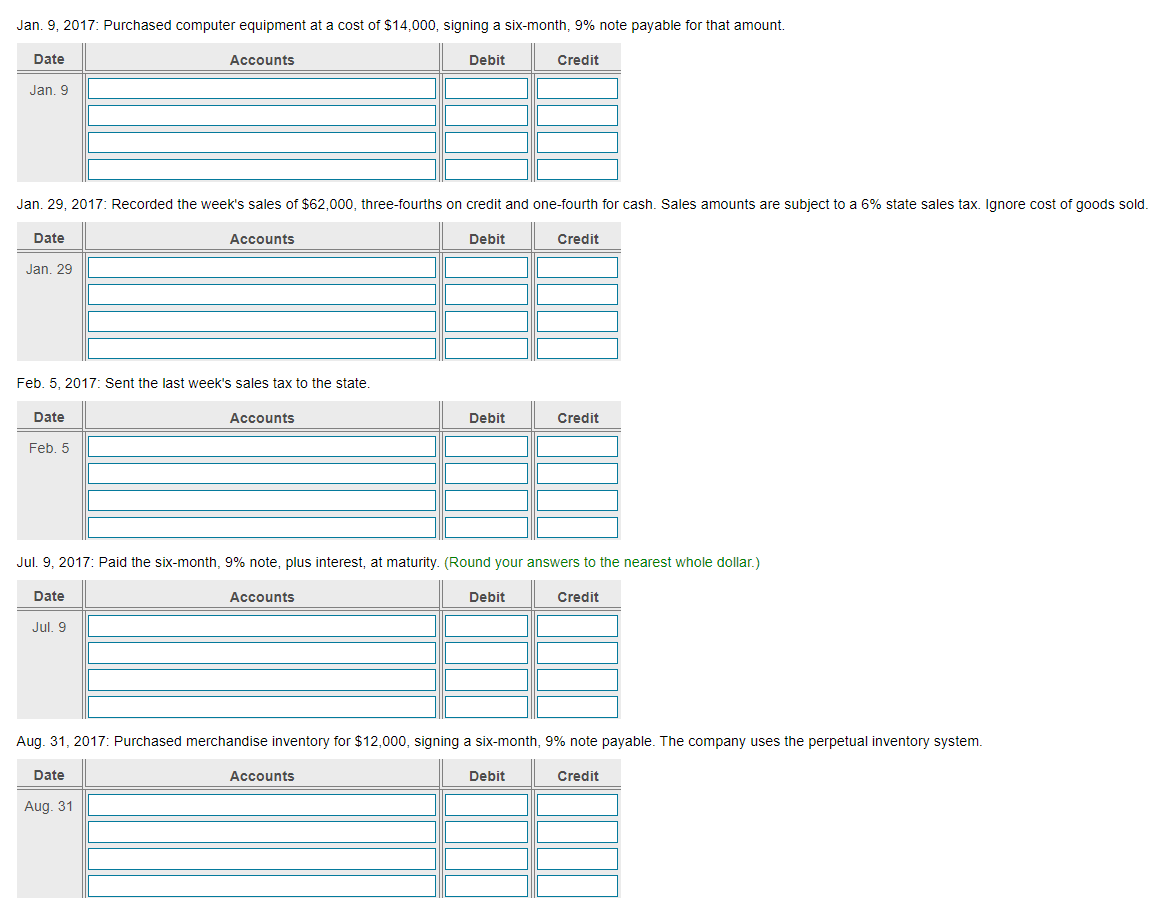

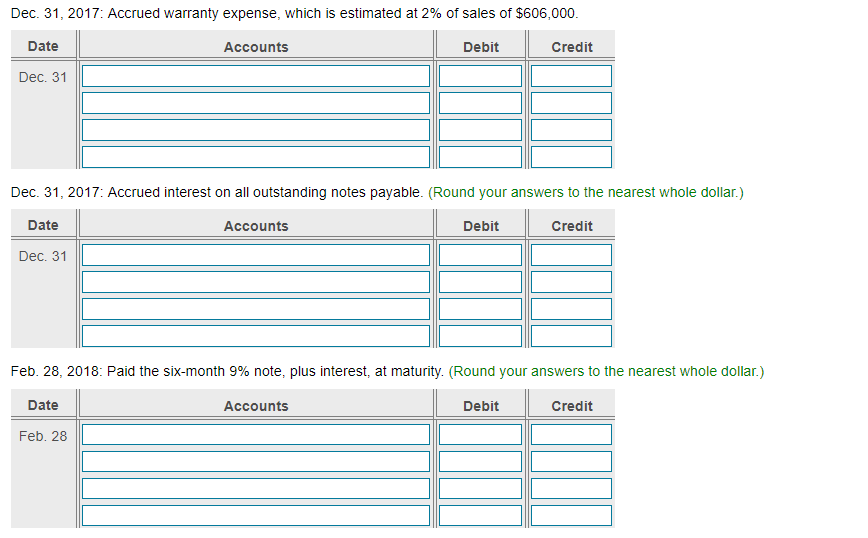

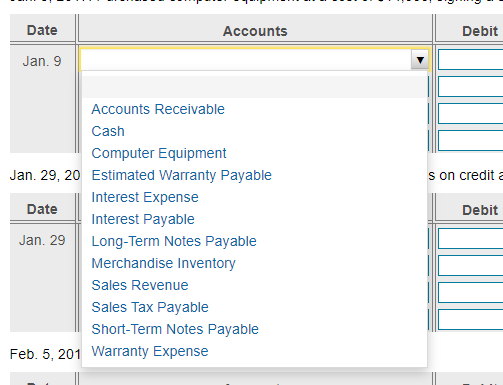

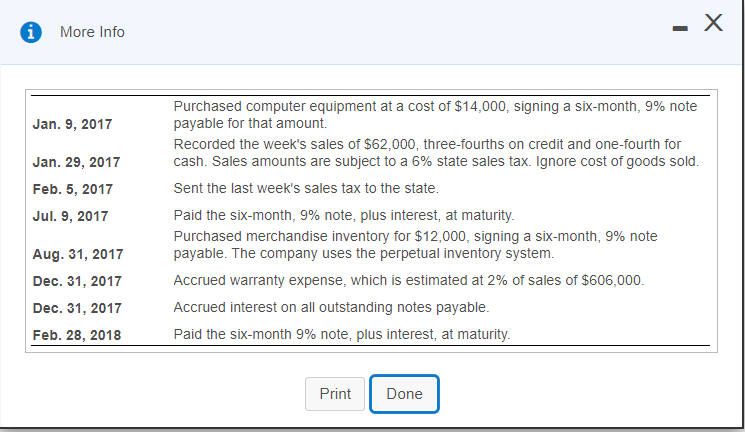

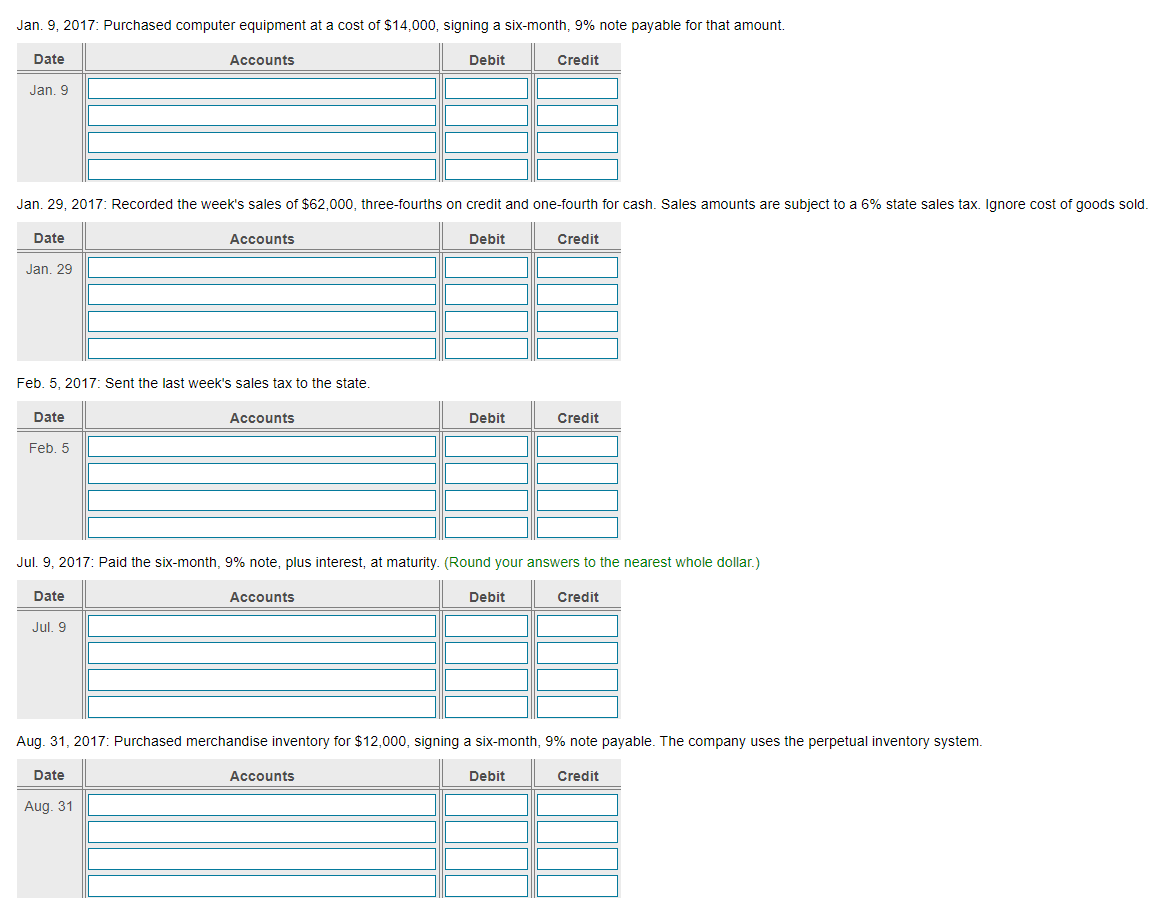

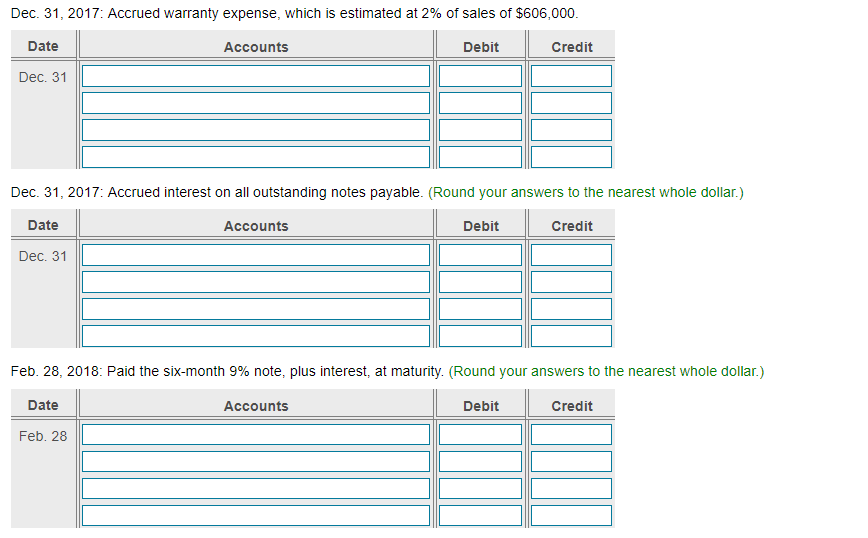

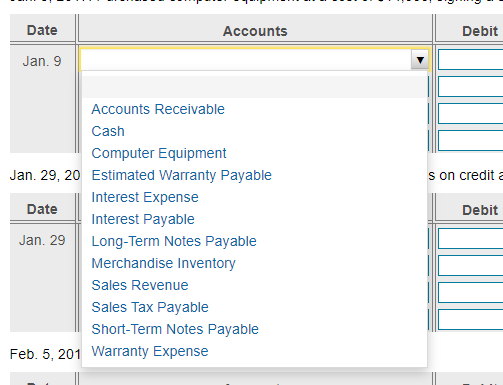

- X i More Info Jan. 9, 2017 Jan. 29, 2017 Feb. 5, 2017 Jul. 9, 2017 Purchased computer equipment at a cost of $14,000, signing a six-month, 9% note payable for that amount. Recorded the week's sales of $62,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Sent the last week's sales tax to the state. Paid the six-month, 9% note, plus interest, at maturity. Purchased merchandise inventory for $12,000, signing a six-month, 9% note payable. The company uses the perpetual inventory system. Accrued warranty expense, which is estimated at 2% of sales of $606,000. Accrued interest on all outstanding notes payable. Paid the six-month 9% note, plus interest, at maturity. Aug. 31, 2017 Dec. 31, 2017 Dec. 31, 2017 Feb. 28, 2018 Print Done Jan. 9, 2017: Purchased computer equipment at a cost of $14,000, signing a six-month, 9% note payable for that amount. Date Accounts Debit Credit Jan. 9 Jan. 29, 2017: Recorded the week's sales of $62,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Date Accounts Debit Credit Jan. 29 Feb. 5, 2017: Sent the last week's sales tax to the state. Date Accounts Debit Credit Feb. 5 Jul. 9, 2017: Paid the six-month, 9% note, plus interest, at maturity. (Round your answers to the nearest whole dollar.) Date Accounts Debit Credit Jul. 9 Aug. 31, 2017: Purchased merchandise inventory for $12,000, signing a six-month, 9% note payable. The company uses the perpetual inventory system. Date Accounts Debit Credit Aug. 31 Dec 31, 2017: Accrued warranty expense, which is estimated at 2% of sales of $606,000. Date Accounts Debit Credit Dec. 31 Dec 31, 2017: Accrued interest on all outstanding notes payable. (Round your answers to the nearest whole dollar.) Date Accounts Debit Credit Dec. 31 Feb. 28, 2018: Paid the six-month 9% note, plus interest, at maturity. (Round your answers to the nearest whole dollar.) Date Accounts Debit Credit Feb. 28 Date Accounts Debit Jan. 9 s on credit a Debit Accounts Receivable Cash Computer Equipment Jan. 29, 20 Estimated Warranty Payable Interest Expense Date Interest Payable Jan. 29 Long-Term Notes Payable Merchandise Inventory Sales Revenue Sales Tax Payable Short-Term Notes Payable Feb. 5, 201 Warranty Expense

undefined

undefined