Answered step by step

Verified Expert Solution

Question

1 Approved Answer

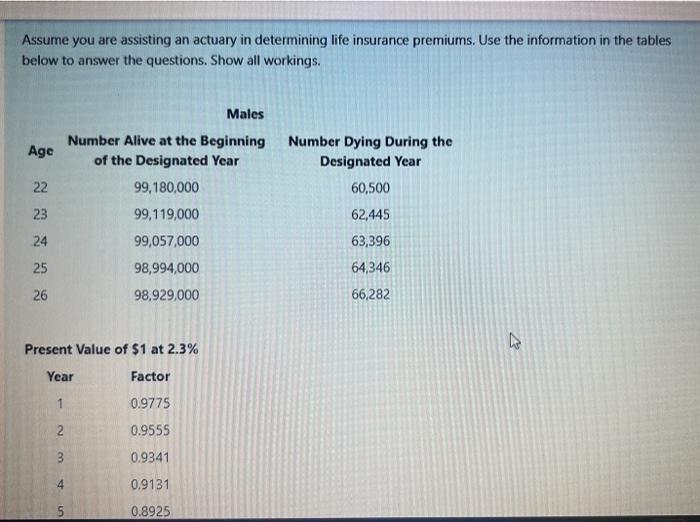

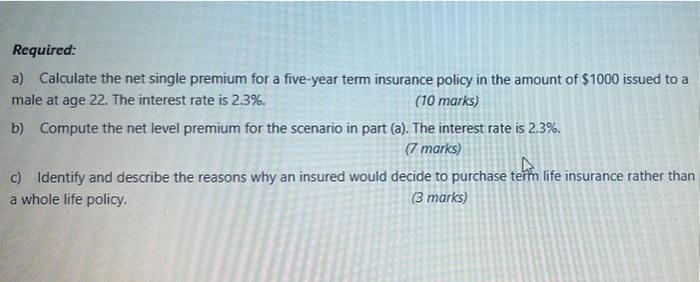

Assume you are assisting an actuary in determining life insurance premiums. Use the information in the tables below to answer the questions. Show all

Assume you are assisting an actuary in determining life insurance premiums. Use the information in the tables below to answer the questions. Show all workings. Age 22 23 24 25 26 Males Number Alive at the Beginning of the Designated Year 99,180,000 99,119,000 99,057,000 98,994,000 98,929,000 Present Value of $1 at 2.3% Year Factor 1 0.9775 2 0.9555 3 0.9341 4 0.9131 5 0.8925 Number Dying During the Designated Year 60,500 62,445 63,396 64,346 66,282 4 Required: a) Calculate the net single premium for a five-year term insurance policy in the amount of $1000 issued to a male at age 22. The interest rate is 2.3%. (10 marks) b) Compute the net level premium for the scenario in part (a). The interest rate is 2.3%. (7 marks) c) Identify and describe the reasons why an insured would decide to purchase term life insurance rather than a whole life policy. (3 marks)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A The net single premium for the fiveyear term insurance policy is calculated using the following formula Net Single Premium Death Benefit x Present V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started