Answered step by step

Verified Expert Solution

Question

1 Approved Answer

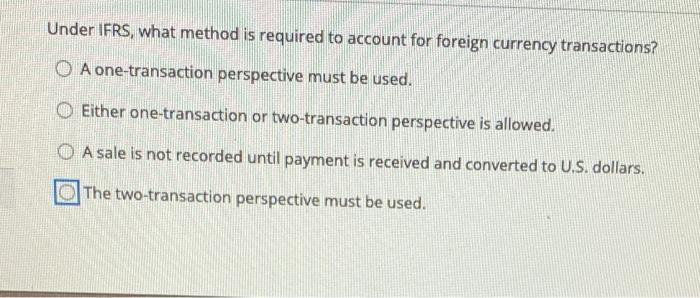

Under IFRS, what method is required to account for foreign currency transactions? OA one-transaction perspective must be used. Either one-transaction or two-transaction perspective is

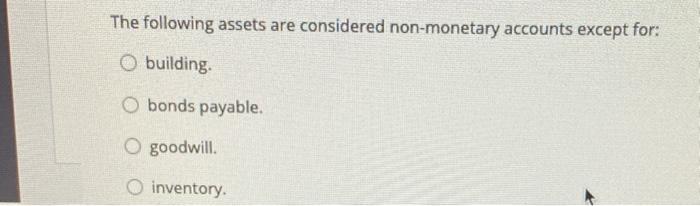

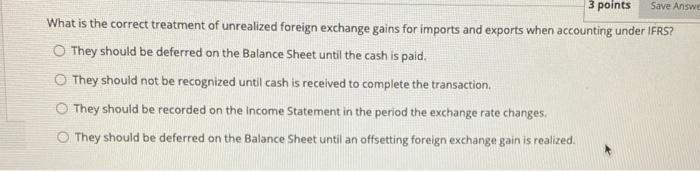

Under IFRS, what method is required to account for foreign currency transactions? OA one-transaction perspective must be used. Either one-transaction or two-transaction perspective is allowed. A sale is not recorded until payment is received and converted to U.S. dollars. The two-transaction perspective must be used. The following assets are considered non-monetary accounts except for: O building. O bonds payable. O goodwill. O inventory. 3 points Save Answe What is the correct treatment of unrealized foreign exchange gains for imports and exports when accounting under IFRS? O They should be deferred on the Balance Sheet until the cash is paid. O They should not be recognized until cash is received to complete the transaction. O They should be recorded on the Income Statement in the period the exchange rate changes. O They should be deferred on the Balance Sheet until an offsetting foreign exchange gain is realized.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer The two transaction perspective must be used Explanation Foreign exchange tra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started