Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recall that Yield Curve is the graph of bond yields as a function of their maturity (2y, 3y, 5y, 10y, ...). Assume a 2-year

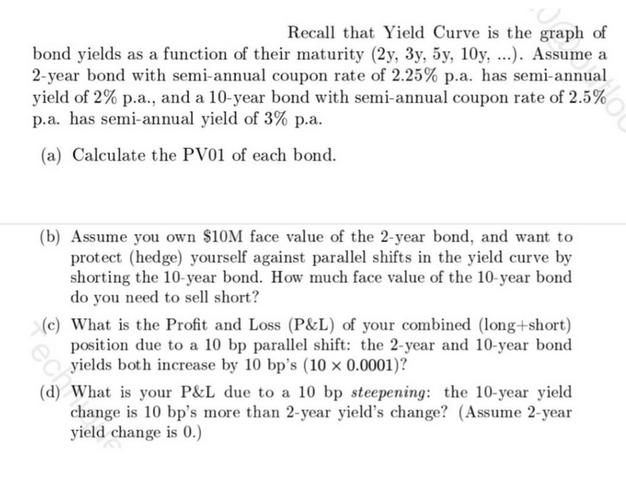

Recall that Yield Curve is the graph of bond yields as a function of their maturity (2y, 3y, 5y, 10y, ...). Assume a 2-year bond with semi-annual coupon rate of 2.25% p.a. has semi-annual yield of 2% p.a., and a 10-year bond with semi-annual coupon rate of 2.5% p.a. has semi-annual yield of 3% p.a. (a) Calculate the PV01 of each bond. (b) Assume you own $10M face value of the 2-year bond, and want to protect (hedge) yourself against parallel shifts in the yield curve by shorting the 10-year bond. How much face value of the 10-year bond do you need to sell short? (c) What is the Profit and Loss (P&L) of your combined (long+short) position due to a 10 bp parallel shift: the 2-year and 10-year bond yields both increase by 10 bp's (10 x 0.0001)? (d) What is your P&L due to a 10 bp steepening: the 10-year yield change is 10 bp's more than 2-year yield's change? (Assume 2-year yield change is 0.)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The weightedaverage cost of capital WACC is the average of the cost of equity and cost of debt weighted by their respective proportions in the capital structure The WACC of Alpha Best Corporation ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started