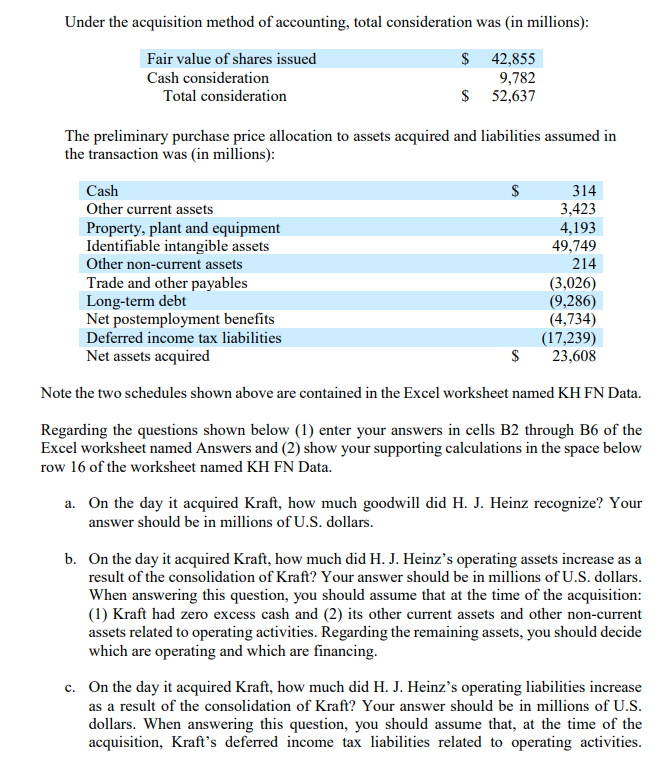

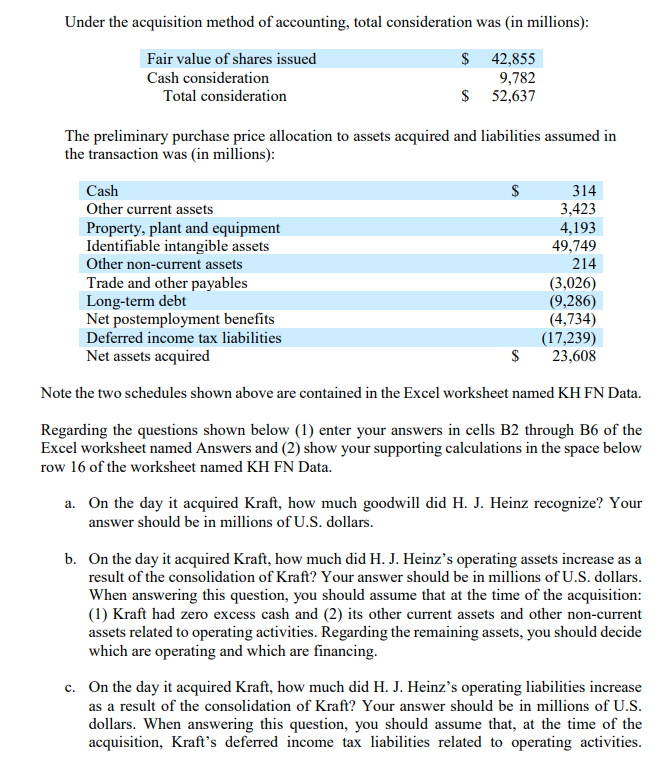

Under the acquisition method of accounting, total consideration was (in millions): Fair value of shares issued $ 42,855 Cash consideration 9,782 Total consideration $ 52,637 The preliminary purchase price allocation to assets acquired and liabilities assumed in the transaction was (in millions): Cash $ 314 Other current assets 3,423 Property, plant and equipment 4,193 Identifiable intangible assets 49,749 Other non-current assets 214 Trade and other payables (3,026) Long-term debt (9,286) Net postemployment benefits (4,734) Deferred income tax liabilities (17,239) Net assets acquired $ 23,608 Note the two schedules shown above are contained in the Excel worksheet named KH FN Data. Regarding the questions shown below (1) enter your answers in cells B2 through B6 of the Excel worksheet named Answers and (2) show your supporting calculations in the space below row 16 of the worksheet named KH FN Data. a. On the day it acquired Kraft, how much goodwill did H. J. Heinz recognize? Your answer should be in millions of U.S. dollars. b. On the day it acquired Kraft, how much did H. J. Heinz's operating assets increase as a result of the consolidation of Kraft? Your answer should be in millions of U.S. dollars. When answering this question, you should assume that at the time of the acquisition: (1) Kraft had zero excess cash and (2) its other current assets and other non-current assets related to operating activities. Regarding the remaining assets, you should decide which are operating and which are financing. c. On the day it acquired Kraft, how much did H. J. Heinz's operating liabilities increase as a result of the consolidation of Kraft? Your answer should be in millions of U.S. dollars. When answering this question, you should assume that, at the time of the acquisition, Kraft's deferred income tax liabilities related to operating activities. Under the acquisition method of accounting, total consideration was (in millions): Fair value of shares issued $ 42,855 Cash consideration 9,782 Total consideration $ 52,637 The preliminary purchase price allocation to assets acquired and liabilities assumed in the transaction was (in millions): Cash $ 314 Other current assets 3,423 Property, plant and equipment 4,193 Identifiable intangible assets 49,749 Other non-current assets 214 Trade and other payables (3,026) Long-term debt (9,286) Net postemployment benefits (4,734) Deferred income tax liabilities (17,239) Net assets acquired $ 23,608 Note the two schedules shown above are contained in the Excel worksheet named KH FN Data. Regarding the questions shown below (1) enter your answers in cells B2 through B6 of the Excel worksheet named Answers and (2) show your supporting calculations in the space below row 16 of the worksheet named KH FN Data. a. On the day it acquired Kraft, how much goodwill did H. J. Heinz recognize? Your answer should be in millions of U.S. dollars. b. On the day it acquired Kraft, how much did H. J. Heinz's operating assets increase as a result of the consolidation of Kraft? Your answer should be in millions of U.S. dollars. When answering this question, you should assume that at the time of the acquisition: (1) Kraft had zero excess cash and (2) its other current assets and other non-current assets related to operating activities. Regarding the remaining assets, you should decide which are operating and which are financing. c. On the day it acquired Kraft, how much did H. J. Heinz's operating liabilities increase as a result of the consolidation of Kraft? Your answer should be in millions of U.S. dollars. When answering this question, you should assume that, at the time of the acquisition, Kraft's deferred income tax liabilities related to operating activities