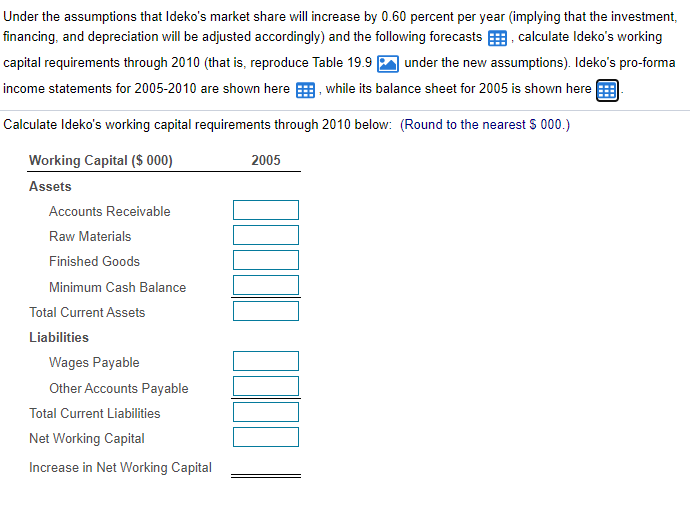

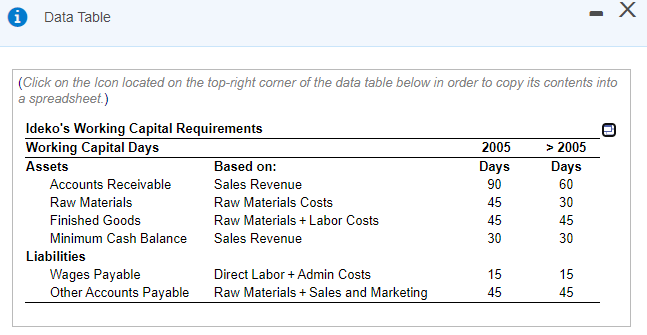

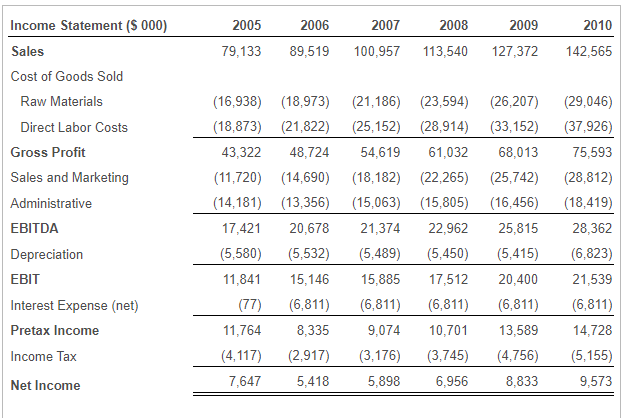

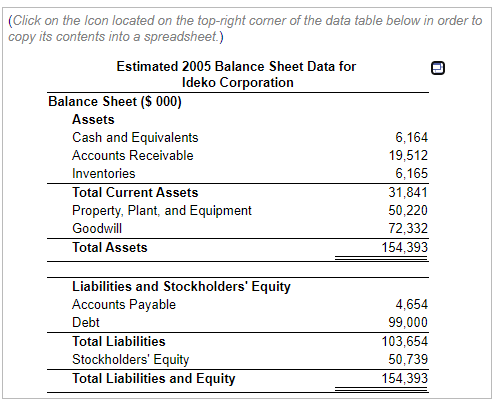

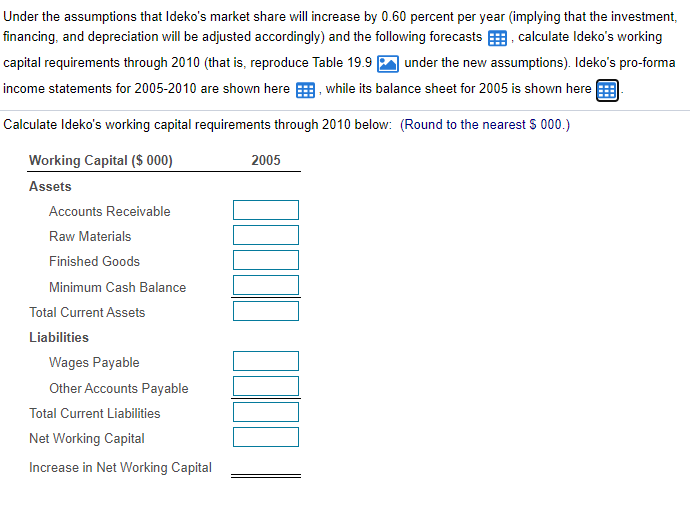

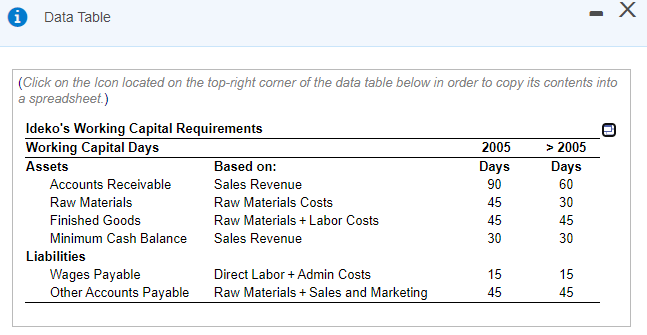

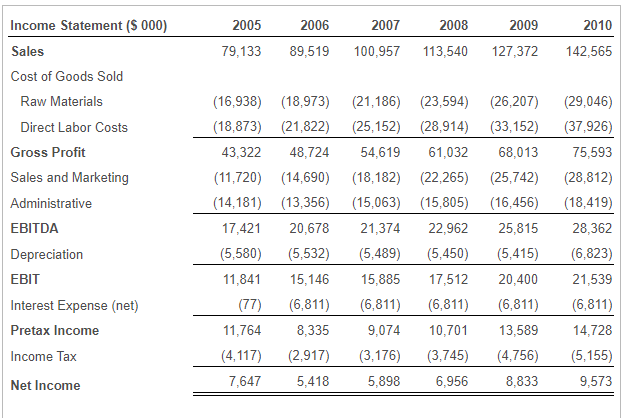

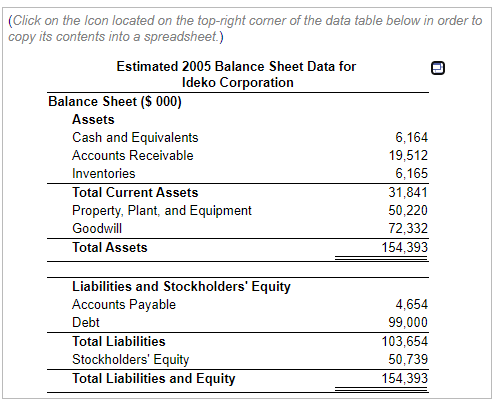

Under the assumptions that Ideko's market share will increase by 0.60 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest 5 000.) 2005 Working Capital ($ 000) Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets Liabilities Wages Payable Other Accounts Payable Total Current Liabilities Net Working Capital Increase in Net Working Capital lll lllll - i Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Ideko's Working Capital Requirements Working Capital Days 2005 > 2005 Assets Based on: Days Days Accounts Receivable Sales Revenue 90 60 Raw Materials Raw Materials Costs 45 30 Finished Goods Raw Materials +Labor Costs 45 45 Minimum Cash Balance Sales Revenue 30 30 Liabilities Wages Payable Direct Labor + Admin Costs 15 15 Other Accounts Payable Raw Materials + Sales and Marketing 45 45 2005 2006 2008 2009 2010 2007 100,957 79,133 89,519 113,540 127,372 142,565 Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,938) (18,973) (18,873) (21,822) 43,322 48,724 (11,720) (14,690) (14,181) (13,356) 17,421 20,678 (5,580) (5,532) 11,841 15,146 (77) (6,811) 11,764 8,335 (4,117) (2,917) 7,647 5,418 (21,186) (23,594) (26,207) (25,152) (28,914) (33,152) 54,619 61,032 68,013 (18,182) (22,265) (25,742) (15,063) (15,805) (16,456) 21,374 22,962 25,815 (5,489) (5,450) (5,415) 15,885 17,512 20,400 (6,811) (6,811) (6,811) 9,074 10,701 13,589 (3,176) (3,745) (4,756) 5,898 6,956 8,833 (29,046) (37,926) 75,593 (28,812) (18,419) 28,362 (6,823) 21,539 (6,811) 14,728 (5,155) 9,573 3 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,164 Accounts Receivable 19,512 Inventories 6,165 Total Current Assets 31,841 Property, Plant, and Equipment 50,220 Goodwill 72,332 Total Assets 154,393 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,654 99,000 103,654 50,739 154,393 Under the assumptions that Ideko's market share will increase by 0.60 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest 5 000.) 2005 Working Capital ($ 000) Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets Liabilities Wages Payable Other Accounts Payable Total Current Liabilities Net Working Capital Increase in Net Working Capital lll lllll - i Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Ideko's Working Capital Requirements Working Capital Days 2005 > 2005 Assets Based on: Days Days Accounts Receivable Sales Revenue 90 60 Raw Materials Raw Materials Costs 45 30 Finished Goods Raw Materials +Labor Costs 45 45 Minimum Cash Balance Sales Revenue 30 30 Liabilities Wages Payable Direct Labor + Admin Costs 15 15 Other Accounts Payable Raw Materials + Sales and Marketing 45 45 2005 2006 2008 2009 2010 2007 100,957 79,133 89,519 113,540 127,372 142,565 Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,938) (18,973) (18,873) (21,822) 43,322 48,724 (11,720) (14,690) (14,181) (13,356) 17,421 20,678 (5,580) (5,532) 11,841 15,146 (77) (6,811) 11,764 8,335 (4,117) (2,917) 7,647 5,418 (21,186) (23,594) (26,207) (25,152) (28,914) (33,152) 54,619 61,032 68,013 (18,182) (22,265) (25,742) (15,063) (15,805) (16,456) 21,374 22,962 25,815 (5,489) (5,450) (5,415) 15,885 17,512 20,400 (6,811) (6,811) (6,811) 9,074 10,701 13,589 (3,176) (3,745) (4,756) 5,898 6,956 8,833 (29,046) (37,926) 75,593 (28,812) (18,419) 28,362 (6,823) 21,539 (6,811) 14,728 (5,155) 9,573 3 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,164 Accounts Receivable 19,512 Inventories 6,165 Total Current Assets 31,841 Property, Plant, and Equipment 50,220 Goodwill 72,332 Total Assets 154,393 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,654 99,000 103,654 50,739 154,393