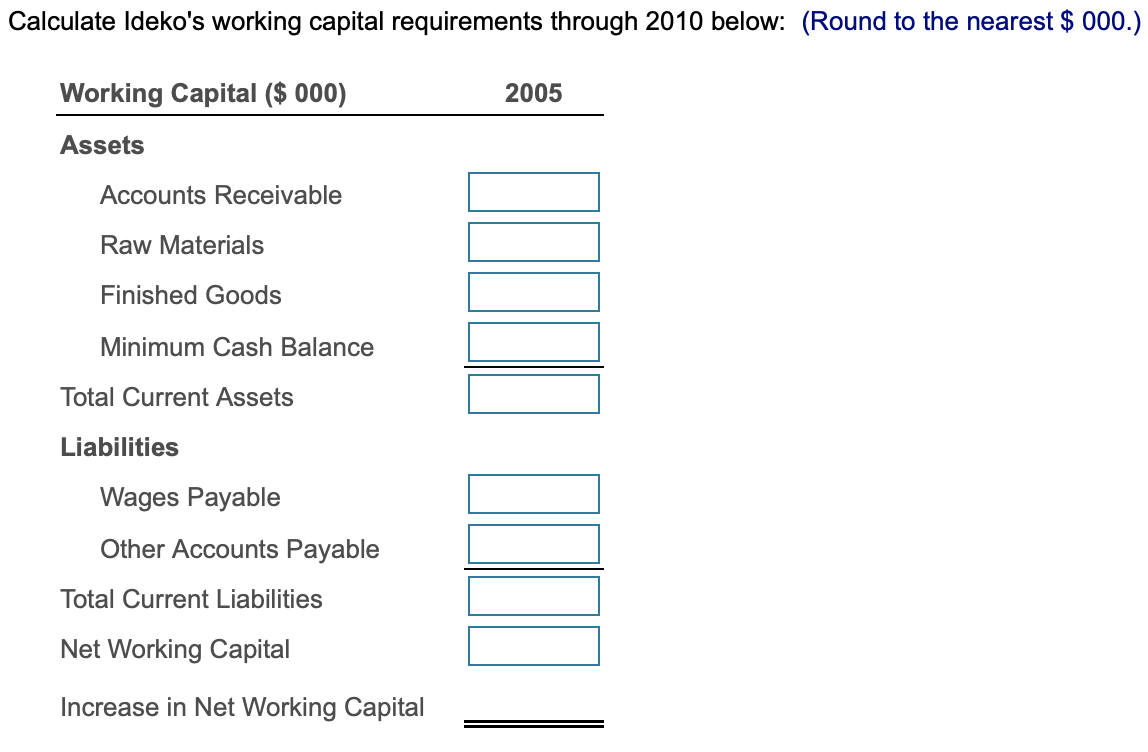

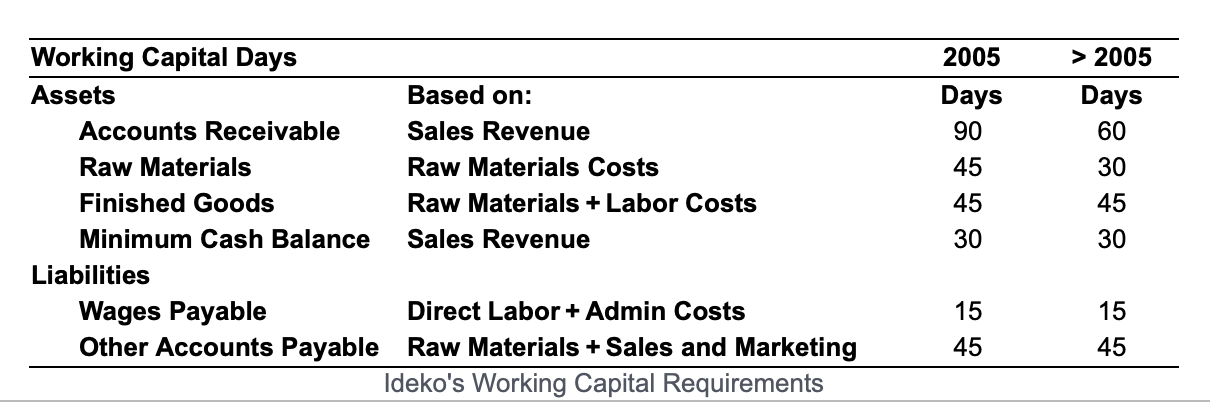

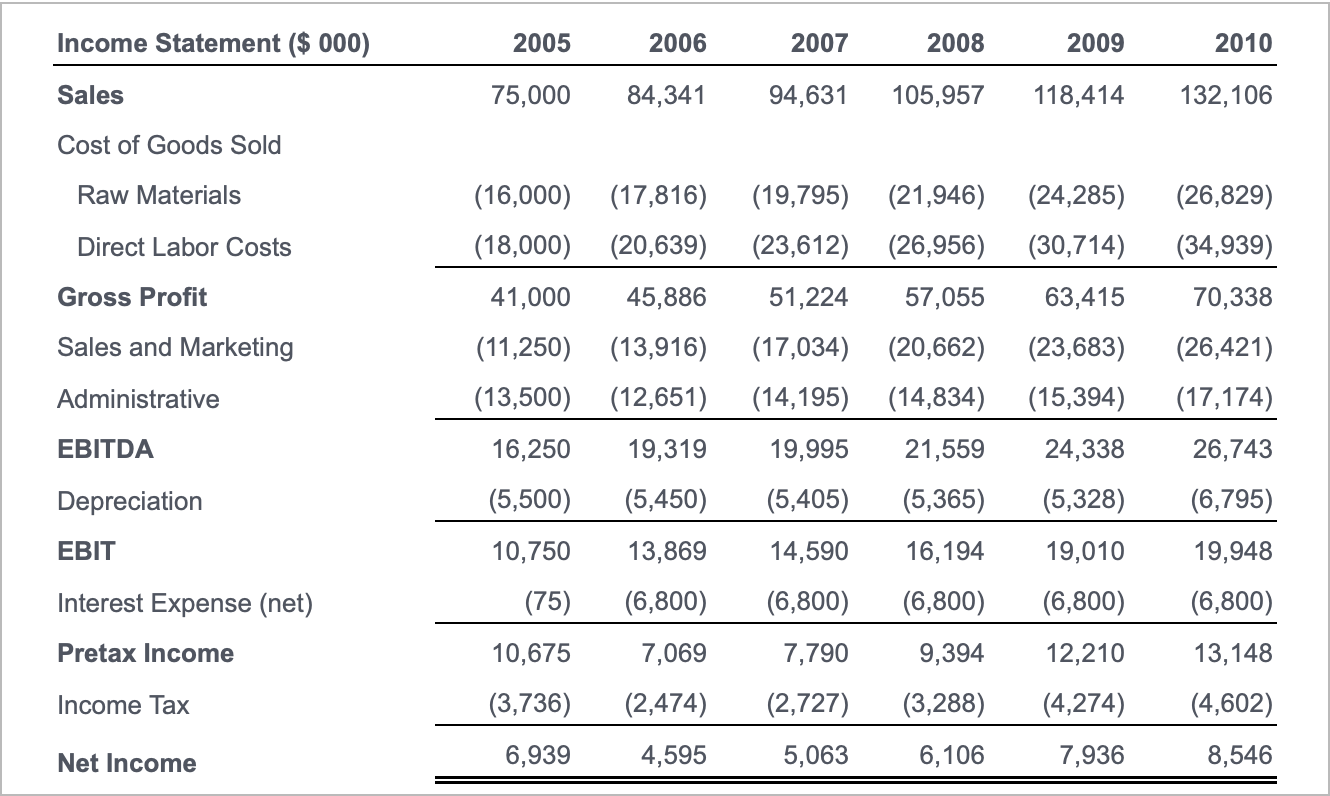

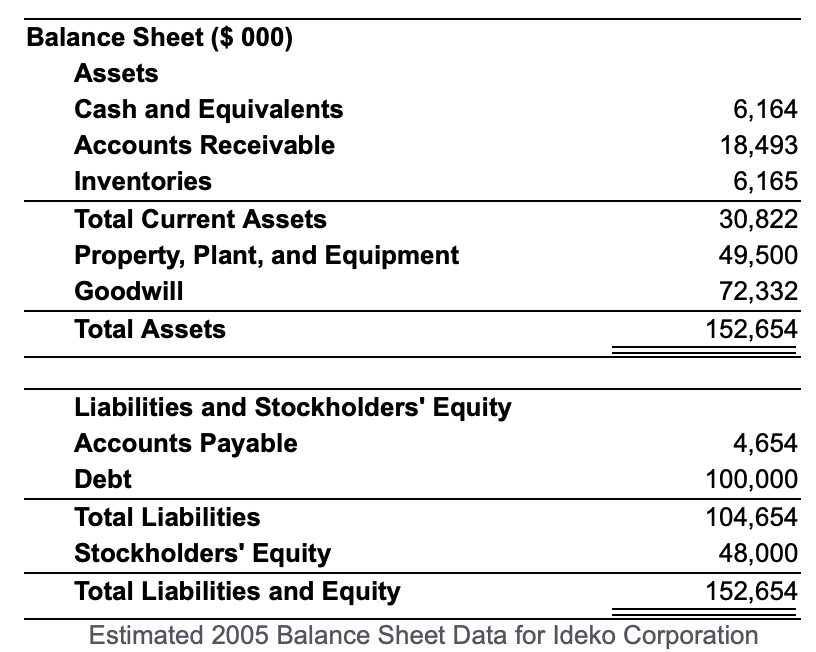

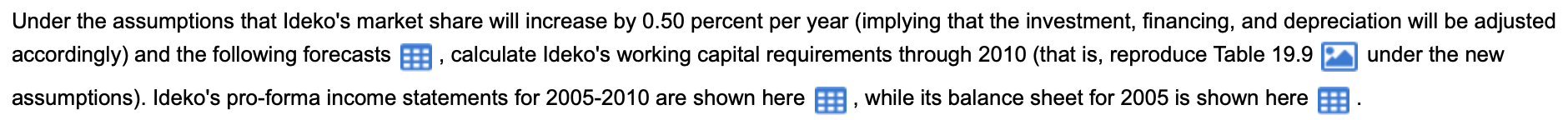

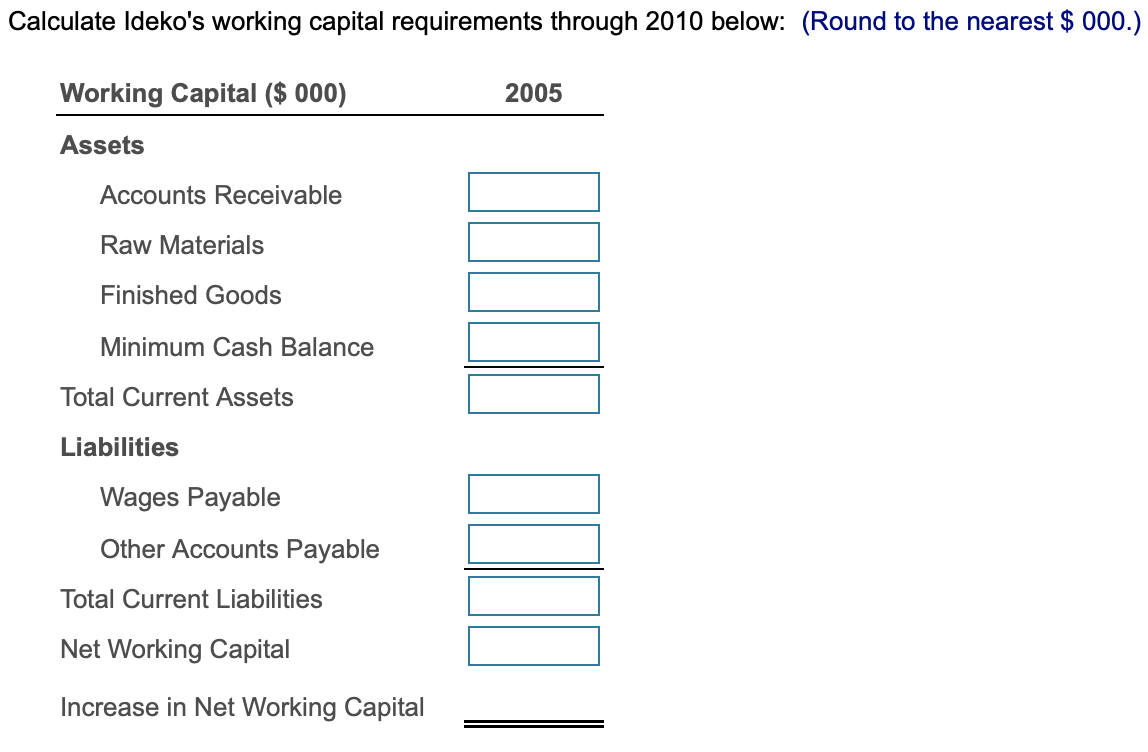

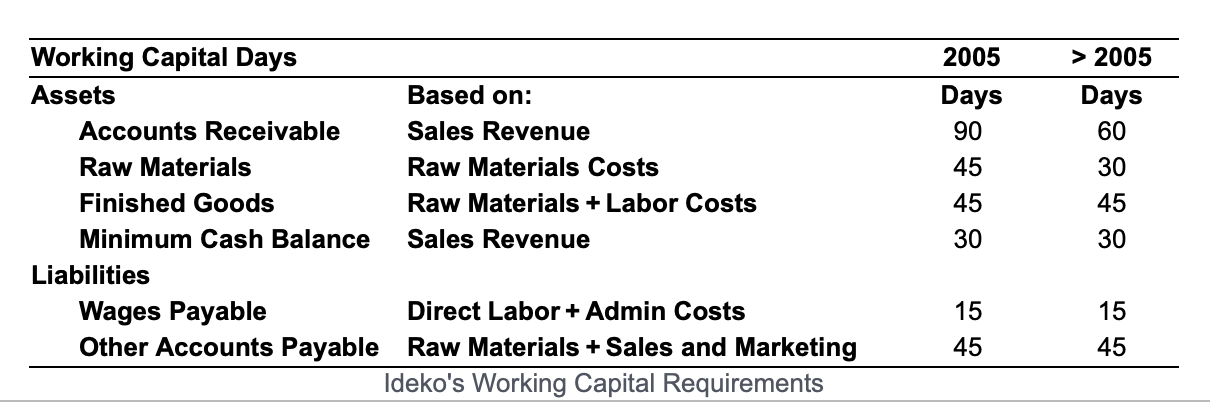

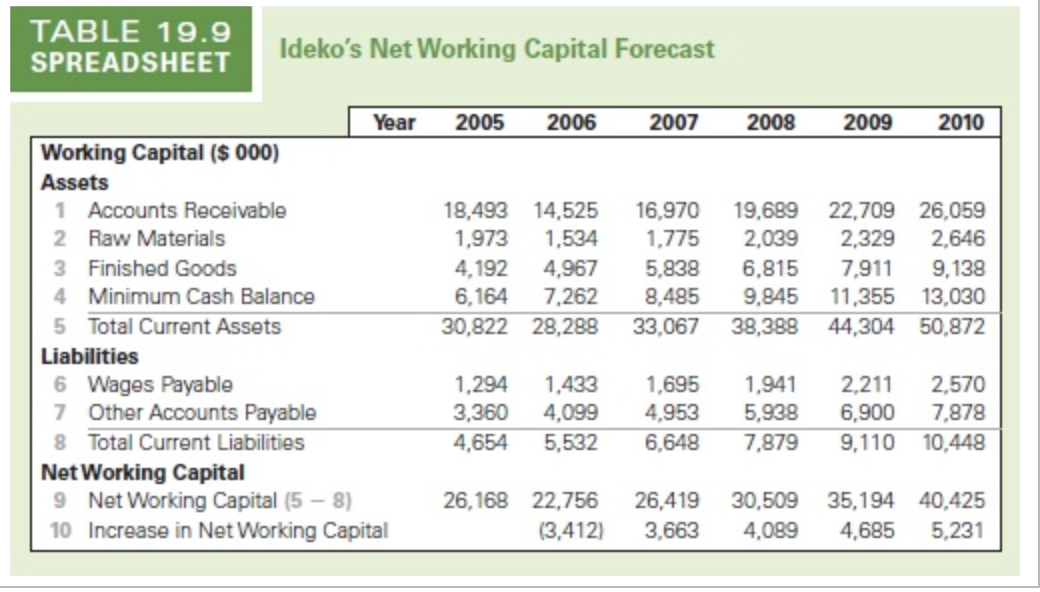

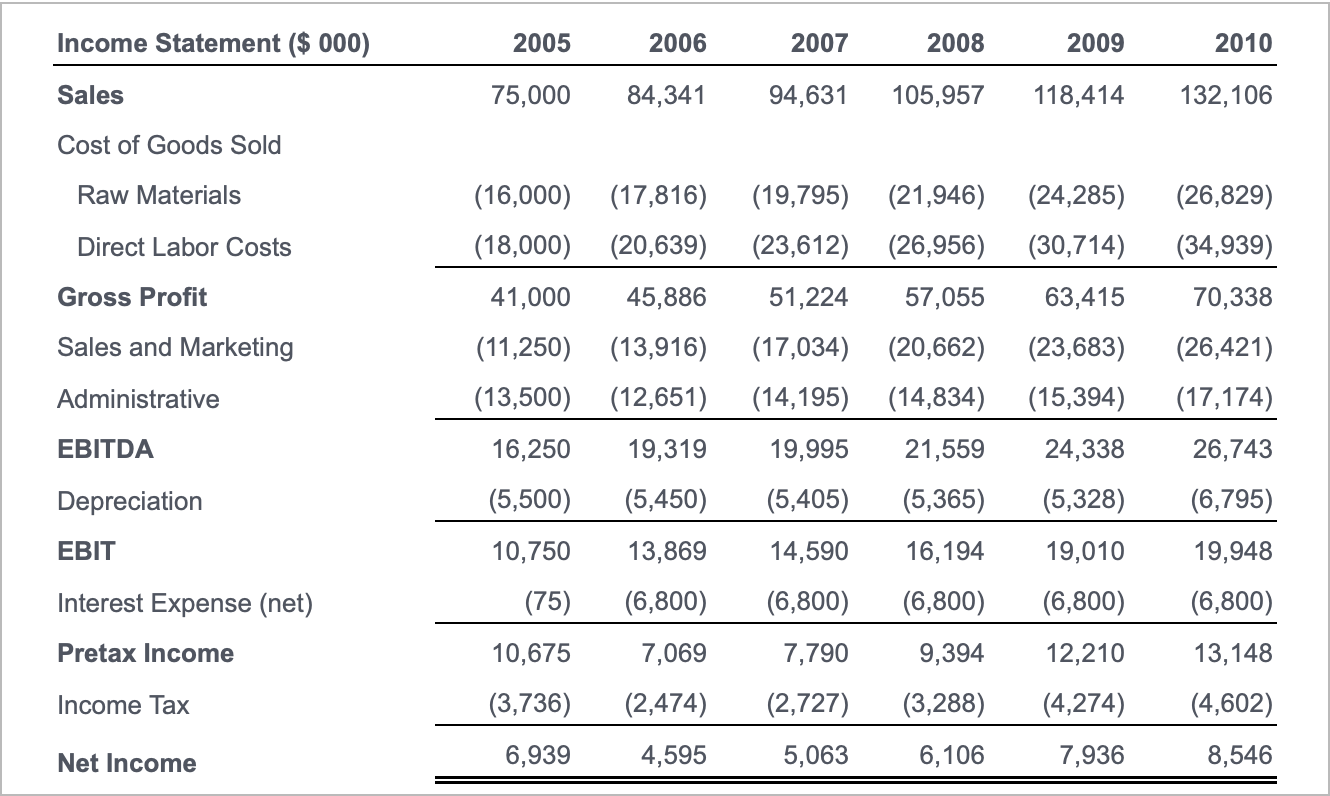

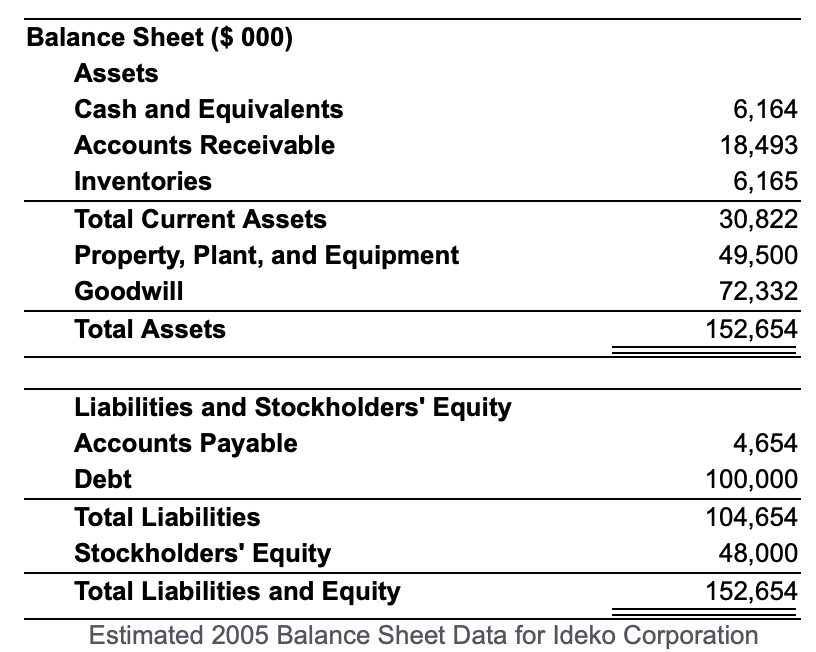

Under the assumptions that Ideko's market share will increase by 0.50 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts :: , calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here, while its balance sheet for 2005 is shown here Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest $ 000.) Working Capital ($ 000) 2005 Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets IIII IIIII Liabilities Wages Payable Other Accounts Payable Total Current Liabilities Net Working Capital Increase in Net Working Capital Working Capital Days Assets Based on: Accounts Receivable Sales Revenue Raw Materials Raw Materials Costs Finished Goods Raw Materials + Labor Costs Minimum Cash Balance Sales Revenue Liabilities Wages Payable Direct Labor + Admin Costs Other Accounts Payable Raw Materials + Sales and Marketing Ideko's Working Capital Requirements 2005 Days 90 45 45 30 > 2005 Days 60 30 45 30 i 15 15 45 45 2008 2009 2010 TABLE 19.9 SPREADSHEET Ideko's Net Working Capital Forecast Year 2005 2006 2007 Working Capital ($ 000) Assets 1 Accounts Receivable 18,493 14,525 16,970 2 Raw Materials 1,973 1,534 1,775 3 Finished Goods 4,192 4,967 5,838 4 Minimum Cash Balance 6,164 7,262 8,485 5 Total Current Assets 30,822 28,288 33,067 Liabilities 6 Wages Payable 1,294 1,433 1,695 7 Other Accounts Payable 3,360 4,099 4,953 8 Total Current Liabilities 4,654 5,532 6,648 Net Working Capital 9 Net Working Capital (5-8) 26,168 22.756 26,419 10 Increase in Net Working Capital (3,412) 3,663 19,689 2.039 6,815 9,845 38,388 22,709 26,059 2,329 2,646 7,911 9,138 11,355 13,030 44,304 50,872 1,941 5,938 7,879 2,211 2,570 6,900 7,878 9,110 10,448 30,509 4,089 35,194 40,425 4,685 5,231 Income Statement ($ 000) 2005 2006 2007 2008 2009 2010 Sales 75,000 84,341 94,631 105,957 118,414 132,106 Cost of Goods Sold Raw Materials (17,816) (16,000) (18,000) (19,795) (21,946) (23,612) (26,956) (24,285) (30,714) (26,829) (34,939) Direct Labor Costs (20,639) 41,000 45,886 51,224 57,055 63,415 70,338 Gross Profit Sales and Marketing (11,250) (13,500) (13,916) (12,651) (17,034) (20,662) (14,195) (14,834) (23,683) (15,394) (26,421) (17,174) Administrative EBITDA 16,250 19,319 19,995 21,559 24,338 26,743 Depreciation (5,500) (5,450) (5,405) (5,365) (5,328) (6,795) EBIT 10,750 13,869 14,590 16,194 19,010 19,948 (75) (6,800) (6,800) (6,800) (6,800) (6,800) Interest Expense (net) Pretax Income 10,675 7,069 7,790 9,394 12,210 13,148 Income Tax (3,736) (2,474) (2,727) (3,288) (4,274) (4,602) Net Income 6,939 4,595 5,063 6,106 7,936 8,546 Balance Sheet ($ 000) Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Goodwill Total Assets 6,164 18,493 6,165 30,822 49,500 72,332 152,654 Liabilities and Stockholders' Equity Accounts Payable 4,654 Debt 100,000 Total Liabilities 104,654 Stockholders' Equity 48,000 Total Liabilities and Equity 152,654 Estimated 2005 Balance Sheet Data for Ideko Corporation Under the assumptions that Ideko's market share will increase by 0.50 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts :: , calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here, while its balance sheet for 2005 is shown here Calculate Ideko's working capital requirements through 2010 below: (Round to the nearest $ 000.) Working Capital ($ 000) 2005 Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets IIII IIIII Liabilities Wages Payable Other Accounts Payable Total Current Liabilities Net Working Capital Increase in Net Working Capital Working Capital Days Assets Based on: Accounts Receivable Sales Revenue Raw Materials Raw Materials Costs Finished Goods Raw Materials + Labor Costs Minimum Cash Balance Sales Revenue Liabilities Wages Payable Direct Labor + Admin Costs Other Accounts Payable Raw Materials + Sales and Marketing Ideko's Working Capital Requirements 2005 Days 90 45 45 30 > 2005 Days 60 30 45 30 i 15 15 45 45 2008 2009 2010 TABLE 19.9 SPREADSHEET Ideko's Net Working Capital Forecast Year 2005 2006 2007 Working Capital ($ 000) Assets 1 Accounts Receivable 18,493 14,525 16,970 2 Raw Materials 1,973 1,534 1,775 3 Finished Goods 4,192 4,967 5,838 4 Minimum Cash Balance 6,164 7,262 8,485 5 Total Current Assets 30,822 28,288 33,067 Liabilities 6 Wages Payable 1,294 1,433 1,695 7 Other Accounts Payable 3,360 4,099 4,953 8 Total Current Liabilities 4,654 5,532 6,648 Net Working Capital 9 Net Working Capital (5-8) 26,168 22.756 26,419 10 Increase in Net Working Capital (3,412) 3,663 19,689 2.039 6,815 9,845 38,388 22,709 26,059 2,329 2,646 7,911 9,138 11,355 13,030 44,304 50,872 1,941 5,938 7,879 2,211 2,570 6,900 7,878 9,110 10,448 30,509 4,089 35,194 40,425 4,685 5,231 Income Statement ($ 000) 2005 2006 2007 2008 2009 2010 Sales 75,000 84,341 94,631 105,957 118,414 132,106 Cost of Goods Sold Raw Materials (17,816) (16,000) (18,000) (19,795) (21,946) (23,612) (26,956) (24,285) (30,714) (26,829) (34,939) Direct Labor Costs (20,639) 41,000 45,886 51,224 57,055 63,415 70,338 Gross Profit Sales and Marketing (11,250) (13,500) (13,916) (12,651) (17,034) (20,662) (14,195) (14,834) (23,683) (15,394) (26,421) (17,174) Administrative EBITDA 16,250 19,319 19,995 21,559 24,338 26,743 Depreciation (5,500) (5,450) (5,405) (5,365) (5,328) (6,795) EBIT 10,750 13,869 14,590 16,194 19,010 19,948 (75) (6,800) (6,800) (6,800) (6,800) (6,800) Interest Expense (net) Pretax Income 10,675 7,069 7,790 9,394 12,210 13,148 Income Tax (3,736) (2,474) (2,727) (3,288) (4,274) (4,602) Net Income 6,939 4,595 5,063 6,106 7,936 8,546 Balance Sheet ($ 000) Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Goodwill Total Assets 6,164 18,493 6,165 30,822 49,500 72,332 152,654 Liabilities and Stockholders' Equity Accounts Payable 4,654 Debt 100,000 Total Liabilities 104,654 Stockholders' Equity 48,000 Total Liabilities and Equity 152,654 Estimated 2005 Balance Sheet Data for Ideko Corporation