Question

Under the terms of the lease, SRTB must pay $55,000 on January 1 of each year, beginning on January 1, 2018, over a 4-year term.

Under the terms of the lease, SRTB must pay $55,000 on January 1 of each year, beginning on January 1, 2018, over a 4-year term. The delivery vehicles have a useful life of 4 years. SRTB depreciates similar vehicles that it owns using the straight-line method. SRTB's incremental borrowing rate is 14%, and the 5% implicit rate in the lease is known to the lessee. The vehicles cost Burch Motors $200,000 and have a fair value of $204,779. Burch has no uncertainties as to future costs and collection. The lease terms do not contain a transfer of ownership, and there is no purchase option. There is also no residual value specified in the contract because no residual value is expected at the end of the lease term by the lessor. Assume that there are neither initial direct costs nor nonlease components related to the lease agreement.

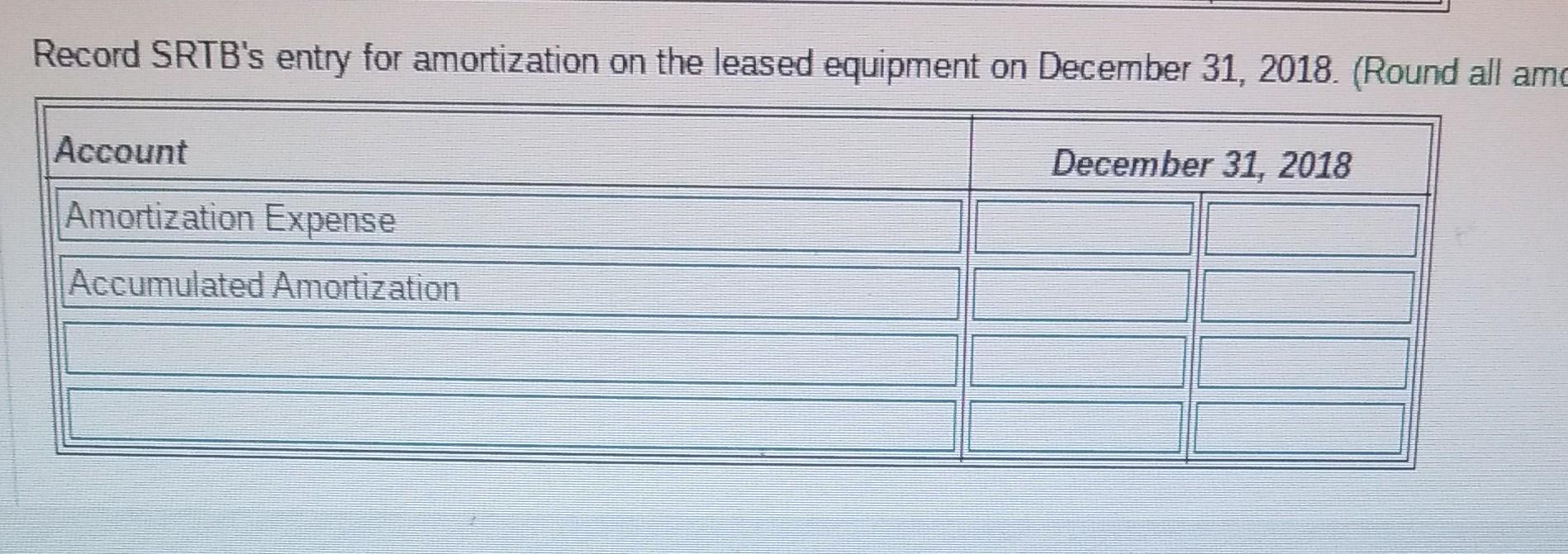

Record SRTB's entry for amortization on the leased equipment on December 31, 2018. (Round all anStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started