Answered step by step

Verified Expert Solution

Question

1 Approved Answer

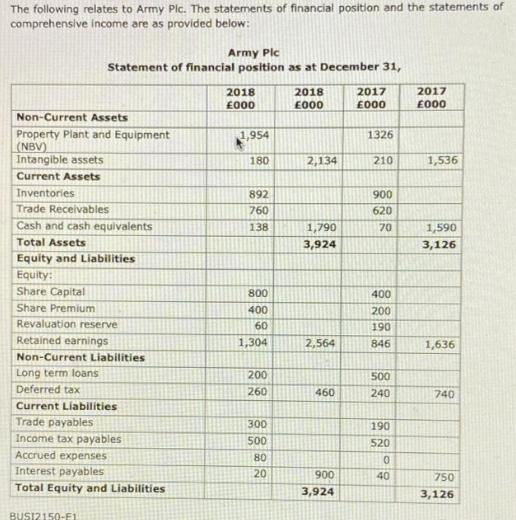

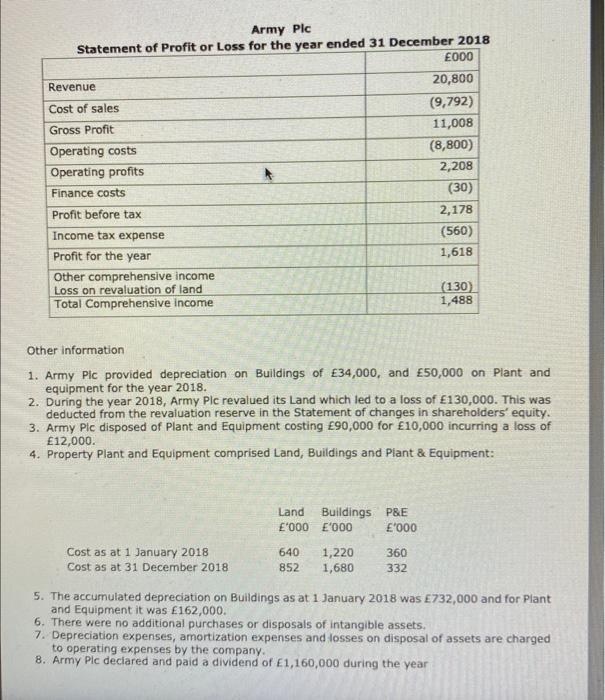

The following relates to Army Plc. The statements of financial position and the statements of comprehensive income are as provided below: Army Plc Statement

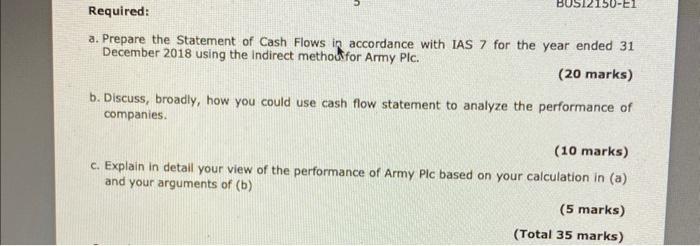

The following relates to Army Plc. The statements of financial position and the statements of comprehensive income are as provided below: Army Plc Statement of financial position as at December 31, 2018 2018 2017 2017 000 E000 000 000 Non-Current Assets Property Plant and Equipment (NBV) Intangible assets 1,954 1326 180 2,134 210 1,536 Current Assets Inventories 892 900 Trade Receivables 760 620 Cash and cash equivalents 138 1,790 70 1,590 Total Assets 3,924 3,126 Equity and Liabilities Equity: Share Capital 800 400 Share Premium 400 200 Revaluation reserve 60 190 Retained earnings 1,304 2,564 846 1,636 Non-Current Liabilities Long term loans Deferred tax 200 500 260 460 240 740 Current Liabilities Trade payables 300 190 Income tax payables 500 520 Accrued expenses 80 0 Interest payables 20 900 40 750 Total Equity and Liabilities 3,924 3,126 BUSI2150-E1 Army Plc Statement of Profit or Loss for the year ended 31 December 2018 000 Revenue 20,800 Cost of sales Gross Profit (9,792) 11,008 Operating costs (8,800) Operating profits A 2,208 Finance costs (30) Profit before tax 2,178 Income tax expense (560) Profit for the year Other comprehensive income Loss on revaluation of land Total Comprehensive income 1,618 (130) 1,488 Other information 1. Army Plc provided depreciation on Buildings of 34,000, and 50,000 on Plant and equipment for the year 2018. 2. During the year 2018, Army Plc revalued its Land which led to a loss of 130,000. This was deducted from the revaluation reserve in the Statement of changes in shareholders' equity. 3. Army Plc disposed of Plant and Equipment costing 90,000 for 10,000 incurring a loss of 12,000. 4. Property Plant and Equipment comprised Land, Buildings and Plant & Equipment: Land Buildings P&E '000 '000 '000 Cost as at 1 January 2018 Cost as at 31 December 2018 640 852 1,220 1,680 360 332 5. The accumulated depreciation on Buildings as at 1 January 2018 was 732,000 and for Plant and Equipment it was 162,000. 6. There were no additional purchases or disposals of intangible assets. 7. Depreciation expenses, amortization expenses and losses on disposal of assets are charged to operating expenses by the company. 8. Army Plc declared and paid a dividend of E1,160,000 during the year BUSI2150-E1 Required: a. Prepare the Statement of Cash Flows in accordance with IAS 7 for the year ended 31 December 2018 using the Indirect methou for Army Plc. (20 marks) b. Discuss, broadly, how you could use cash flow statement to analyze the performance of companies. (10 marks) c. Explain in detail your view of the performance of Army Plc based on your calculation in (a) and your arguments of (b) (5 marks) (Total 35 marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To prepare the Statement of Cash Flows using the indirect method we need to reconcile the changes in the companys cash and cash equivalents from the beginning to the end of the year Heres how the st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started